Seagate’s first fiscal 2021 quarter revenues were depressed by the pandemic but the disk drive maker thinks things will start to pick up. In the earnings call, CEO Dave Mosley said: “We now believe the September quarter marks the bottom of the COVID-related demand disruptions. And we expect [a] gradual recovery from this point forward.

“Demand for data continues to explode, even through this current period of market uncertainty,” Mosley said in a prepared statement.

“We see indications for enterprise demand to improve and we expect this to continue as the broader markets gradually recover, supporting our positive December quarter outlook and reinforcing our revenue expectations for the fiscal year.”

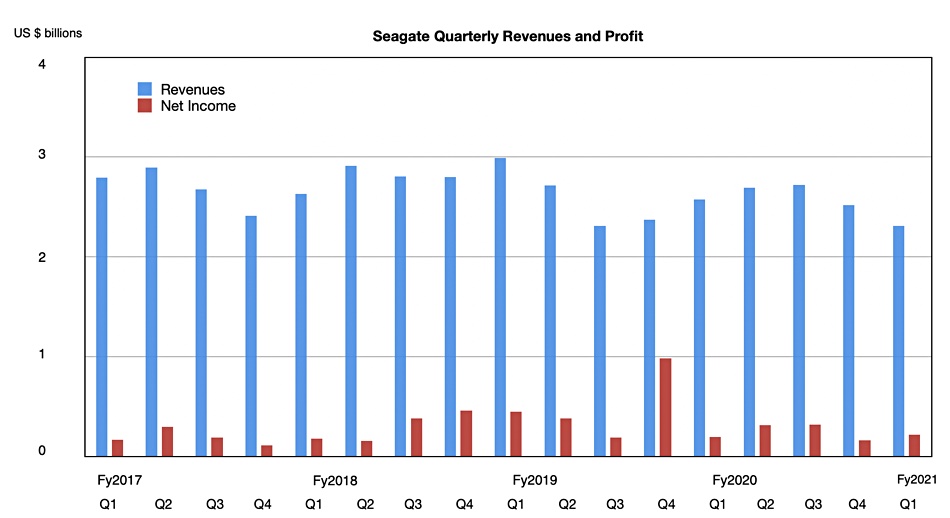

Revenues of $2.31bn in the quarter ended October 2, declined 10.4 per cent Y/Y, while net income climbed 11.4 per cent to $223m net income. That was helped by a year-on-year reduction in total operating expenses from $2.31bn to $2.1bn. The outlook for the next quarter is $2.55bn at the mid-point. That’s down from the year-ago quarter’s $2.7bn.

“Seagate delivered solid September quarter results,” Mosley said, “supported by strong recovery in the video and image applications market and healthy cloud data centre demand, which drove double digit year-over-year revenue growth for our mass capacity storage solutions.”

Quick summary

- Gross margin of 25.8 per cent, down from the year-ago 26 per cent,

- Diluted EPS of $0.86, up from year-ago’s $0.74,

- Operating cash flow of $297m and free cash flow of $186m,

- Cash and cash equivalents of $1.7bn at quarter-end.

Seagate earned $2.39bn from selling disk drives, the same as a year ago. Its other businesses; Enterprise Systems, Flash and Others, generated $188m revenues, also flat Y/Y. The average capacity per disk drive was 4.4TB, well up from the year-ago 2.9TB.

CFO Gianluca Romano said enterprise (high-capacity nearline drives represented 58 per cent of Seagate revenues, compared to the year-ago 47 per cent, and 63 per cent of disk drive revenues. They represented 51 per cent a year ago.

Outside the nearline market there were Y/Y declines in enterprise mission-critical and PC drives although consumer drives sales increased Q/Q.

Romano said sales of SSD products “trended lower due to challenging pricing environment.”

No HAMR blow, more of a gentle tap

Mosley confirmed Seagate is on track to ship its first 20TB HAMR drives for revenue in December, “with a path to deliver 50-terabyte HAMR drives forecast in 2026″.

However, Romano tempered any expectations of a swift transition to 20TB HAMR drives by saying: “Until we get to 24-terabyte there’s not really a compelling transition and so we have to keep continue working that drive and we will work that over the course of the next calendar year.”

Object storage

Seagate last month announced it was entering the object storage business with brand new CORTX software (see our story). An analyst on yesterday’s earning call asked the company if this would compete with – and alienate – existing storage vendors.

“I don’t look at it as alienating,” Mosley replied, “simply, because there really isn’t an object store that’s designed specifically for mass capacity.”

Mass capacity object storage is Seagate’s aim, he said. Seagate is “opening up the community, so other people can help us… we want partnerships… we’re open to any partnership with anyone, I don’t think it’s going to be a threat.”