Three startups aim to revolutionise and rescue the on-premises storage array from the twin assaults of hyperconverged infrastructure (HCI) and the public clouds.

They are Infinidat, StorONE and VAST Data and each company is gaining enterprise customers who agree that their technology supersedes all-flash arrays in marrying capacity scaling and performance.

All three claim the classic all-flash array, even when extended with NVMe-over-Fabrics speed, is a dead-end. Ground-up re-written storage software is needed to reinvigorate shared storage array technology.

Each company is a technology outlier and has responded differently to the twin needs of storing large and growing volumes of primary data cost-effectively while providing fast, flash-level access.

Infinidat

According to Infinidat, all-flash arrays are prohibitively expensive at petabyte scale and its DRAM caching makes its disk-based arrays faster than all-flash arrays, even when they are boosted with Optane 3D XPoint drives.

Infinidat eschews a flash capacity store, relying instead on nearline disk drives with data prefetched into a memory cache using a Neural Cache engine with predictive algorithms. A thin SSD layer acts as an intervening store between disk and the DRAM. There are three controllers per array, which enables parallel access to the data.

Infinidat’s monolithic InfiniBox array provides block and file access to the data and there is technical background information in a Register article. The Neural Cache engine monitors which data blocks have been accessed and prefetches adjacent blocks into DRAM.

According to a Silverton Consulting report, the cache metadata uses LUN block addresses as an index and “can maintain information on billions of objects, accessing and updating that metadata in microseconds”. It enables more than 90 per cent of reads to be satisfied from memory.

Infinidat said it had deployed more than 6EB of storage to its customers in February – an exabyte greater than six months previously. It also said this 6EB was more than the top eight all-flash array (AFA) vendors had shipped in 2019.

Competitors include Dell EMC’s PowerMax, IBM with its DS8800 product, and Hitachi Vantara’s VSP. Blocks & Files expects Infinidat growth to continue.

StorONE

StorOne, Israeli startup came out of stealth in 2017, after spending six years developing its own storage software stack.

The basic idea about marrying capacity and performance is expressed through the company’s TRU (total resource utilisation) software. This can deliver the rated throughput of a storage drive, whether it is a disk drive, a SAS or SATA SSD or an NVMe SSD. StorONE said its storage software stores data as blocks which could be accessed either as blocks, files or objects in a universal store.

StorONE’s basic pitch is that its software make all types of storage hardware go faster. For example, StorONE delivered 1.7 million IOPS in a 2-node ESXi server system using 24 x 3.84TB WD SSDS in a JBOD as the data store. The company claims a typical all-flash array would need four times as much controller and storage hardware to deliver that performance.

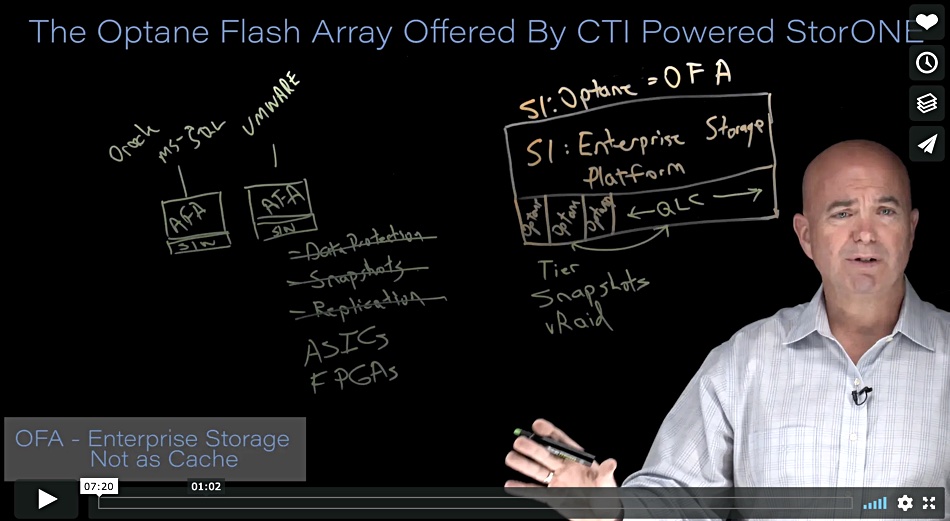

More Optane Flash Array background can be gleaned from a video on Vimeo.

At launch, the TRU system scaled up to 18GB/sec of throughput and 15PB of capacity, making this enterprise-class in scalability. StorONE is now developing S1: Optane Flash Arrays, using Optane SSDs as a performance tier and Intel QLC flash as the capacity store. It says the combination with its own S1:Tier software “delivers over one million read IOPS, and over 1 million write IOPS”.

StorONE has not revealed much customer information, at time of writing. However, the company has made its pricing transparent and markets its technology as significantly cheaper than the competition. CEO and founder Gal Naor wrote in April 2020: “It is not unusual for us to provide a five-year total cost of ownership price to a customer that is less than what they are paying for 18 months of maintenance.”

The company is also developing an all-Optane array for extreme performance workloads. This is described in an unpublished StorONE Lab report which we have seen. In testing a three-drive system the S1 Enterprise Storage Platform delivered between 85 per cent to 100 per cent of the raw performance of the physical Optane drives:

- 1.15 million random read IOPS at 0.035ms latency

- 480,000 random read IOPS at 0.55ms

- 6.8GB/sec sequential read bandwidth at 0.3ms

- 3.1GB/sec sequential write bandwidth at 0.5ms

Our sense is that StorONE is making steady progress, while trying to demonstrate it can accelerate any storage hardware configuration without focusing on any particular market.

VAST Data

VAST Data already had some customers for its enterprise storage arrays when it came out of stealth in February 2019. Initially, the arrays used TLC (3bits/cell) flash and then transitioned to denser and lower cost QLC NAND.

VAST Data’s basic pitch revolves around extra efficient data reduction and erasure coding. The way it reduces the number of times it writes to its flash drives means the array cost and endurance are better than ordinary all-flash arrays. Customers can store all their data on flash, access it via file and object protocols, and get flash speed at disk array prices, the company claims.

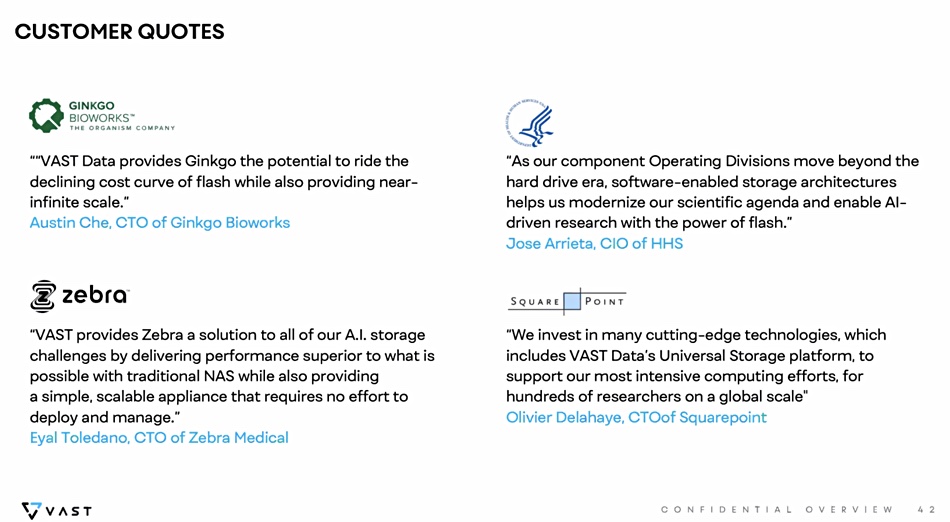

Customer progress has been rapid, according to Jeff Denworth, co-founder and VP for products. He told a press briefing this week that year one sales, starting February 2019, eclipsed first year sales of Data Domain, Isilon, Pure Storage and Nutanix. The average customer spend was $1.02m and VAST claimed dozens of customers across four continents. Denworth said the company has $140m cash in the bank and sees a “clear path to breakeven”.

VAST focuses on the enterprise flash capacity market, which means it spreads less thinly across its potential customer base than StorONE. It has also produced customer references, unlike StorONE.

Comment

Denworth told the press briefing that the NVMe-over-Fabrics array startups had failed to live up to expectations. But how will VAST, Infinidat and StorONE prosper?

Blocks & Files notes that no mainstream storage array vendor has so far made moves to extend or adapt their technology in response to Infinidat, StorONE or VAST Data. That is unsurprising, as each startup has developed its software stack from the ground up. Adding similar caching or erasure coding or data reduction technologies by the mainstreamers with their different software stacks would be difficult.

That implies that, if one or more of the three are successful enough, then an acquisition might be on the cards.