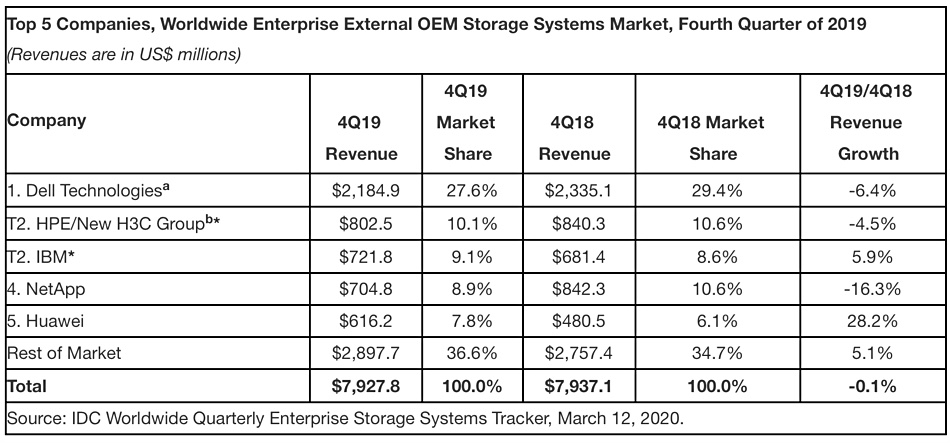

Dell continues to dominate IDC’s external OEM storage market numbers for 2019’s fourth quarter. But the company experienced a 6.4 per cent fall in revenue in a flat market in which hyperscale buyers gave Original Design Manufacturers (ODMs) their strongest growth in five quarters.

Paul Maguranis, senior research analyst at IDC, provided the announcement quote: “ODMs witnessed double-digit year-over-year growth this quarter for revenue, units, and capacity shipped and accounted for 58.9 per cent of capacity shipped for the entire storage market, up from 46.8 per cent this time last year.”

IDC notes the all-flash array market grew 13.1 per cent to $3.23bn in revenues. It didn’t provide numbers for disk drive storage, but noted that hybrid (flash + disk) arrays took in $3.04bn, declining 2.8 per cent annually.

IDC’s number crunchers reckon the overall external storage market was flat at $7.927.8bn in Q4. Huawei, in fifth place, was the main gainer, recording a 28.2 per cent rise in revenues to $616.2m. IBM also did well, tying with HPE for second place, while NetApp fell to fourth.

Hitachi was in IDC’s external storage table last quarter, but has dropped the latest top five supplier rankings. Pure Storage failed to make top five for the second consecutive quarter.

Pure told us that, looking at the 5 year (2014 – 2019) compound annual growth rate of Pure versus its major competitors, Pure grew 55.7 per cent, and HPE grew less than 2 per cent. Dell EMC, IBM and NetApp are all negative.

In the WW external storage market, Pure grew 18.8 per cent YoY from CY2019 to CY2020. HPE and Hitachi also grew, but Dell, IBM and NetApp all shrank, with NetApp dropping 13 per cent. Pure did not provide growth numbers for Q4 2019 so we can’t make a comparison between it and the suppliers which IDC lists.

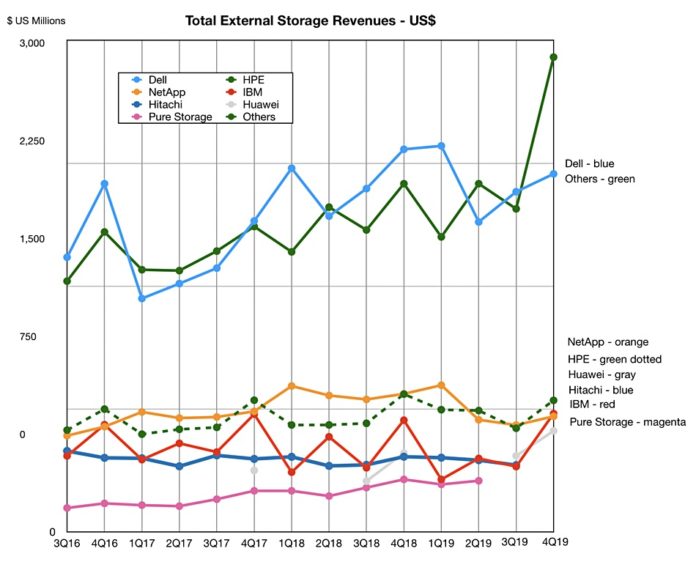

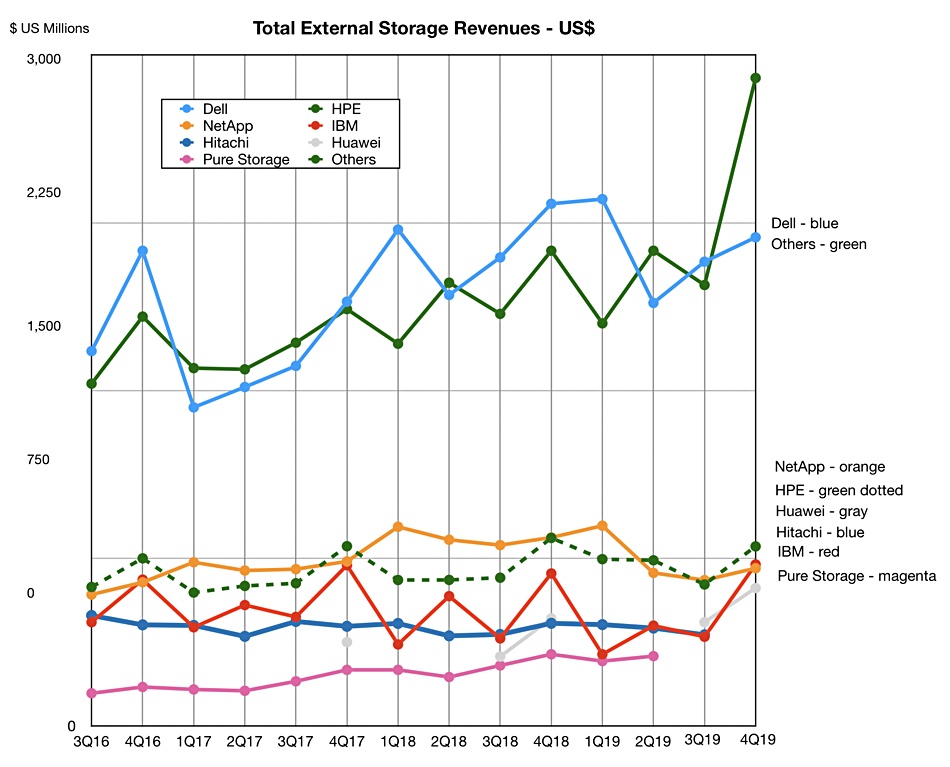

Here is a chart showing the trends since Q3 2016;

Revenues of ODMs, Pure and Hitachi are in the Others Category in Q4 2019, which accounts for the sharp rise in Others revenues for this quarter.

We can see that Huawei and IBM have both overtaken Hitachi recently and Pure is growing steadily closer to Hitachi.