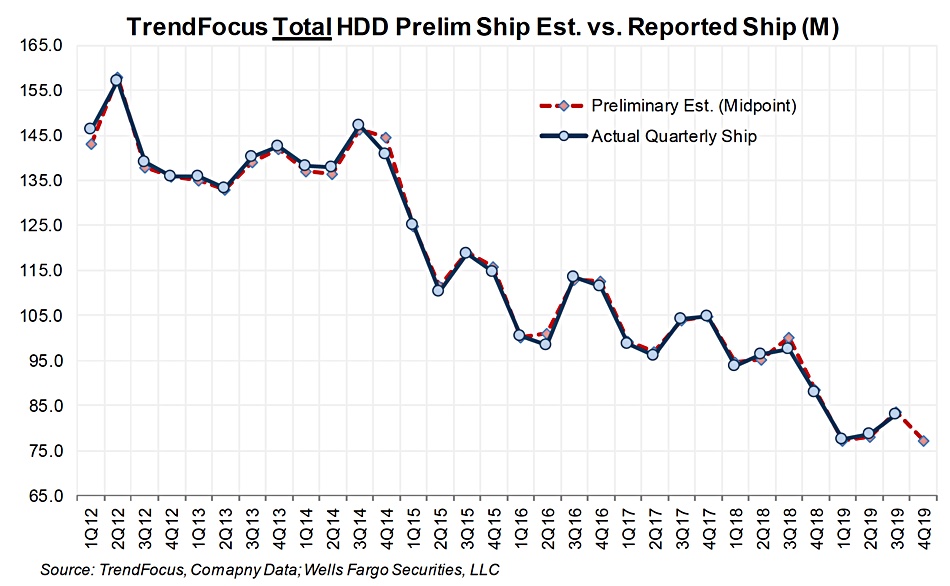

Disk drive shipments fell by half in the seven years to the end of 2019 according to TrendForce, a market research firm.

Enterprise nearline drives is the only category showing good growth in the last year. As reported by Wells Fargo senior analyst Aaron Rakers, TrendForce’s estimated numbers for the fourth 2019 quarter show the other categories mostly declined.

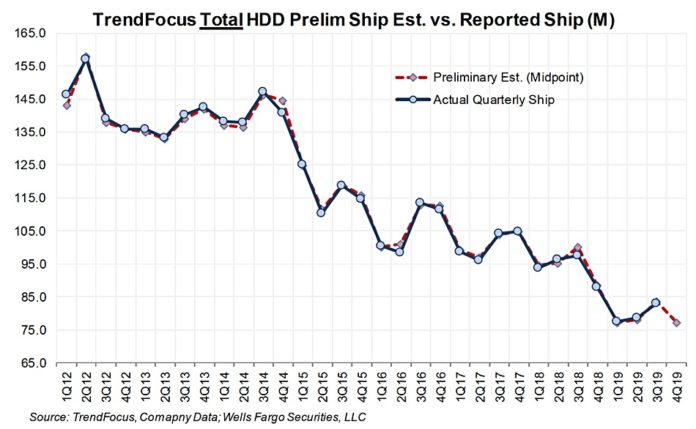

Rakers notes that TrendForce estimates have a good historical match with actual shipments, using the chart we publish below to make his point.

The HDD market segment data shows nearline’s dominance as SSDs eat away all other categories except desktop PCs, where capacity is prized over access speed.

- Total HDDs – c77.2 million drives, down 12.3 per cent y-o-y,

- 2.5-inch mobile/CE – c30 million units, down 31 per cent y-o-y

- 3.5-inch Desktop/CE – c27.5 million units, up 5 per cent y-o-y

- Nearline capacity – c15 million units, up 41 per cent y-o-y,

- Mission-critical – c4.6 million units, down 15 per cent y-o-y.

There are just three disk drive suppliers, and TrendForce awards Seagate the lead in shipped units in the fourth quarter:

- Seagate – c31.5 million drives, down 14 per cent y-o-y and 40.8 per cent market share. It was 41.7 per cent a year ago.

- Western Digital – c29.35 million drives, down three per cent y-o-y and around c.38 per cent share; up from 34.3 per cent a year ago.

- Toshiba – c16.35 million units, down 20 per cent y-o-y, with a21.2 per cent hare; down from 24 per cent last year.

Extrapolate the trends and we might see one manufacturer exiting the market in the next decade. Equally we might see the third-placed vendor clawing back lost ground. But don’t hold your breath; this is an ultra-marathon, as exciting as watching oil tankers race.