NetApp and Cloudian were promoted, IBM demoted, Cohesity ejected and OpenIO brought indoors from the cold in IDC’s 2019 Object Marketscape report.

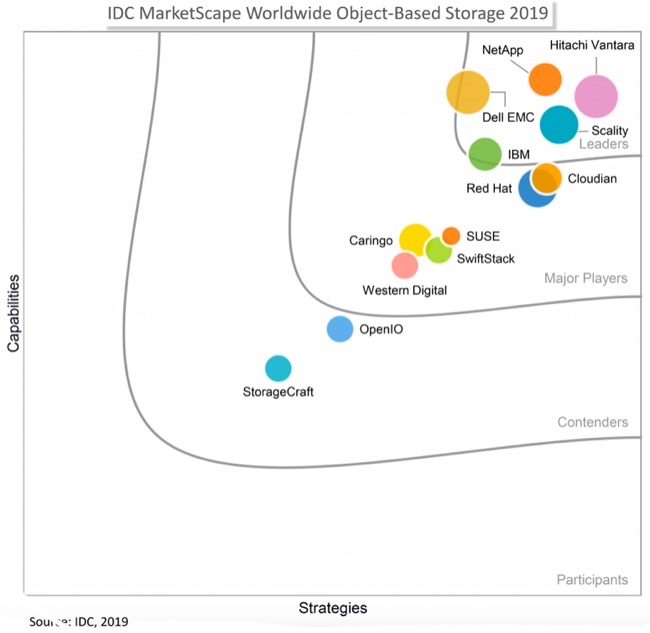

NetApp has published an extract that contains the 2019 Marketscape diagram and we can compare this to 2018. Here is the 2019 version:

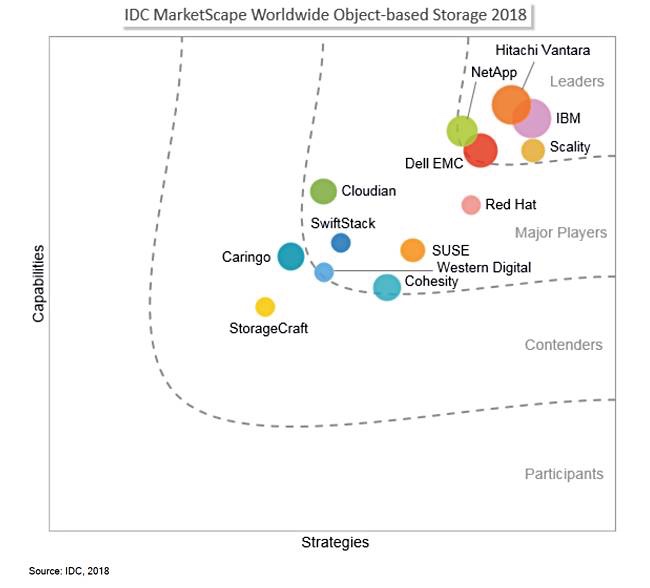

Here is the 2018 diagram:

In the Leaders section, NetApp was promoted to second place with higher capabilities and lower strategies ratings than top-ranked Hitachi Vantara.

IBM fell back to fifth place in the Leaders ranks, behind Scality and Dell EMC. Dell EMC improved its capabilities but deteriorated a little in the strategies area.

Cloudian improved its strategies rating in the Major Players’ section, as did SwiftStack to a lesser degree. Caringo entered this section, improving on last year’s placement in the Contenders’ area.

Last year Cohesity was present in the Major Players area. This year it does not feature in MarketScape. We have asked Cohesity and IDC for clarification.

A Cohesity spokesperson said: “Based on our conversation with IDC, they changed the criteria this year to only include traditional Object Storage products that did just object storage natively and required a gateway to deliver any file services on top of it.

“[With] the Smart Files release a few months ago, Cohesity has a unique ability to natively deliver file and object not just on the same cluster but also on the same Bucket/Volume/View. IDC assumed that this didn’t meet their criteria for traditional object storage appliances and decided not to send the survey to us.”

OpenIO enters the Object Storage Marketscape for the first time, in the Contenders area.

MinIO, the supplier of the world’s fastest object storage system, is not placed in the chart. Earlier this month IDC published an Innovators report profiling three companies that offer open source object storage for high performance workloads. They are MinIO, OpenIO, and SoftIron. IDC noted: “MinIO has seen over 268 million docker pulls and over 480 contributors.”

IDC said suppliers had generate more than $10m object storage revenue for inclusion in the Marketscape report. So that probably ruled out MinIO.

But IDC adds: “If revenue requirements were not met, the participant must have proven customer deployments of 4PB or greater.” That would rule MinIO in. We have asked IDC why Minio is not present in the report.

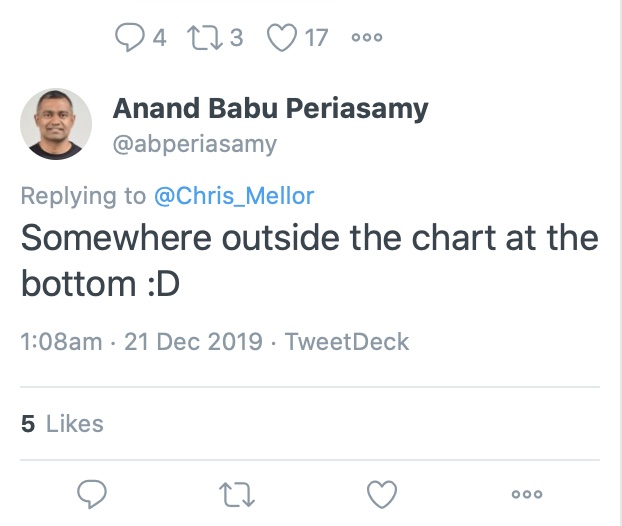

Minio CEO AB Periasamy said in a tweet that MinIO would be positioned “Somewhere outside the chart at the bottom.”

Marketscape explainer: IDC’s Marketscape is a 2D square chart with two axes; Capabilities from low to high on the vertical axis and Strategies (low to high) on the horizontal axis. Suppliers are placed in sections called Leaders, with the highest ratings in capabilities and strategies, Major Players with the next-highest ratings, Contenders with the next highest, and Participants which has the lowest ratings. A supplier’s spot or bubble on the chart increases in size with their object-based revenue.