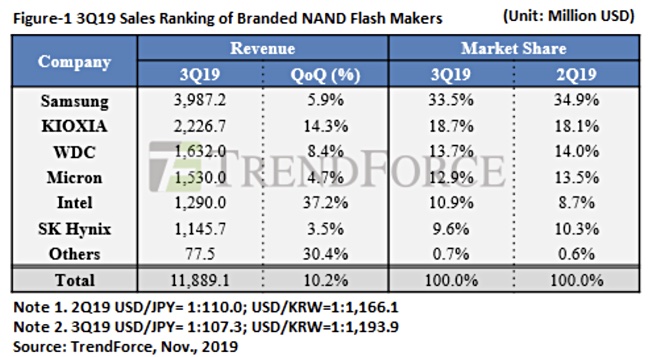

TrendForce data shows the flash market growing again, with the six suppliers reporting bit shipment growth and revenue increases in the third quarter. For most NAND suppliers, average selling prices (ASPs) continue to decline, a trend that started in Q3, 2018. But the benefit of lower prices means greater uptake for SSDs and other products that use NAND.

Here’s a quick rundown of changes in Q3 2019 compared with the previous quarter, recorded by Trendforce’s DRAMeXchange unit.

Samsung

- 5 per cent ASP (Average Selling Price) decline

- >10 per cent increase in bit shipments

- $3.987bn revenues (up 5.9 per cent)

Kioxia

- 5 per cent ASP decline

- 20 per cent bit shipment increase

- $2.227bn revenue (up 14.3 per cent)

Western Digital

- ASP flat

- 9 per cent rise on bit shipments

- $1.632bn revenue (up 8.4 per cent)

Micron

- 5 per cent ASP decline

- 10 per cent increase I bit shipments

- $1.53bn revenues (4.7 per cent growth)

SK hynix

- 4 per cent ASP growth

- 1 per cent bit shipment growth

- $1.146bn revenues (3.5 per cent growth)

Intel

- 10 per cent ASP fall

- >50 per cent bit shipment growth

- $1.29bn revenues (37.2 per cent rise)

Intel had the highest percentage increases in bit shipments and revenues but also the largest fall in ASPs.