Quantum has finally filed corrected financial statements along with its latest quarterly results, and is set to focus on the video and image storage market.

This has cost $33m and taken more than 18 months but the work is now done and the financial restatements filed. They show a business in decline as its attempts to grow the business in the face of declining tape system-related revenues, such as DXi deduplication, failed.

The troubled tape systems and file management supplier experienced financial mis-management from 2015 to 2017, caused by premature revenue recognition.

Once discovered this led to being booted off the New York Stock Exchange and a board-level accounting examination to recalculate the wrong results and file corrected ones with the SEC.

Latest and restated results

Revenues in its first fiscal 2020 quarter, ended June 20, were $105.6m, down 1.75 per cent annually, with a loss of $3.8m, better than the $7.5m recorded a year ago.

Signs of progress included;

- After excluding non-recurring charges, adjusted net income was $4.4m compared to $2.3m a year ago,

- Total operating expenses in the quarter were $43.1m, compared to $50.7m a year ago,

- SG&A expenses declined 11 per cent to $34.4m compared to $38.5m in the year-ago quarter,

- R&D expenses were $8.4m, up one per cent compared to $8.3m a year ago.

Gross margins were flat year over year despite lower royalty revenue in the first fiscal quarter of 2020 that was negatively impacted by LTO media supply issues. This was resolved in early August and the tape market should return to growth, Quantum said.

Quantum filed amended results for its 2015, 2016, 2017, 2018 and 2019 fiscal years. It said the revenue restatement re-casted the timing of revenue, not the quality or accuracy of the revenue itself.

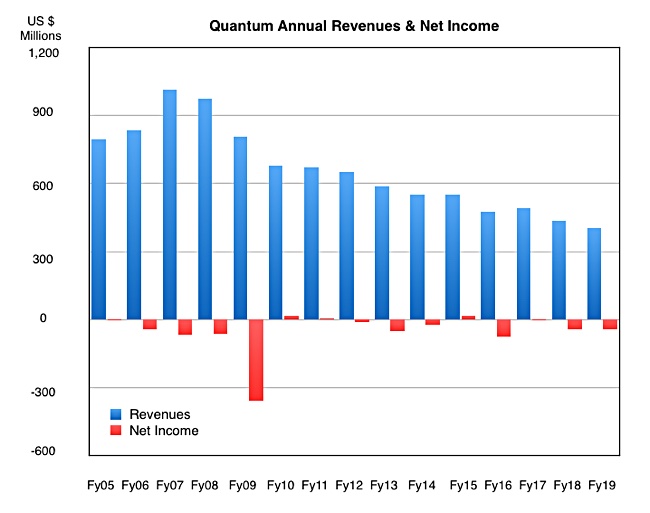

We can now see how the business has performed historically. Our chart showing revenues and profits since fiscal 2005:

Clearly it is a business in decline. Why should the declining stop?

Chairman and CEO Jamie Lerner said in a canned quote; “Today, Quantum is a leaner, more efficient company poised for growth based on a series of transformative steps we have taken.”

That means new execs, eliminated expenses and participation in growing markets.

New management

Almost three quarters of the senior management prior to January 2018 has been replaced. Quantum said it has adopted new business priorities, standards and governance practices focused on product innovation and profitable sales.

Costs have been cut, as Quantum has chopped nine facilities and offices worldwide, and eliminated $60m in annualised operating expenses that included a reduction of about 30 per cent of its employees.

Looking for a revenue upturn

Lerner said: “With the restatement behind us, we are focused on growing our business profitably and creating sustainable value for our shareholders.” Quantum wants to get its shares re-listed on a national stock exchange hopes to accomplish that by the end of 2019.

It aims to grow revenues based on its lower expense base, a stronger tape market, and the growing video and image market.

The product line that has growth potential is its StorNext file lifecycle management system which has been successful in the entertainment and media industries with an integrated set of fast file, long-term object, cloud and tape storage capabilities integrated with application workflows.

Quantum thinks t80 per cent of the world’s data by 2025 will be video or video-like data, across industries – and not just in the entertainment and media world. It is specifically looking at the high-speed processing of video and long-term archiving of video and unstructured data.

The company forecasts revenues between $99m and $105m next quarter (Q2 fy20). That’s $102m at the mid-point which will almost exactly equal the $101.98m reported last year. It hopes for six to 10 per cent revenue growth for the remaining three quarters of its fiscal 2020, compared to the prior year.

That, and getting relisted, would be a good result.