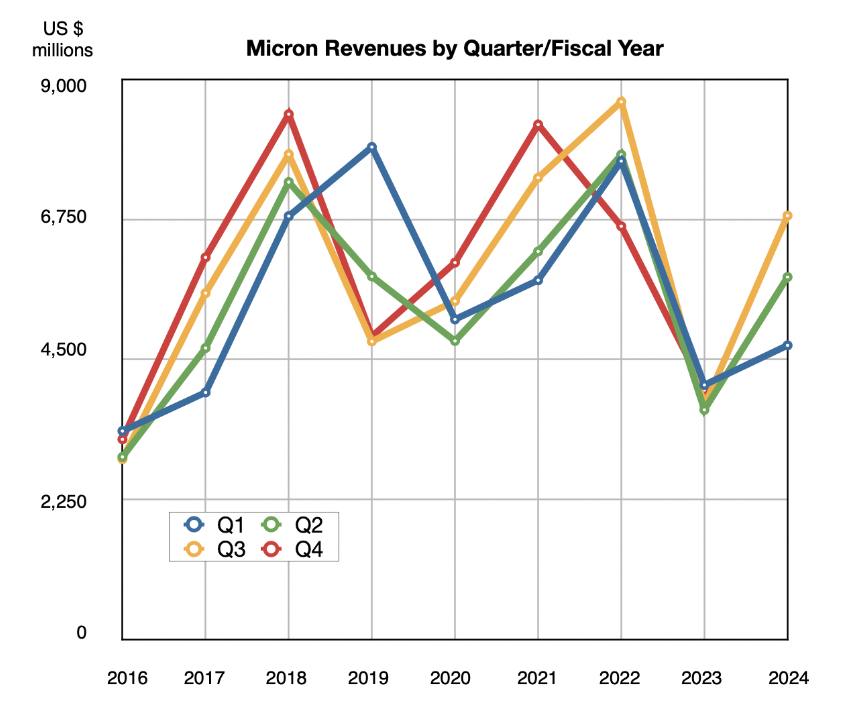

Micron revenues rose 81.5 percent year-on-year in its latest quarter as demand for AI server memory rocketed skywards.

Revenue for Q3 of Micron’s fiscal 2024 ended May 30 was $6.8 billion, beating its guidance and contrasting with the year-ago $3.8 billion when the memory market was bottoming out. It made a net profit of $332 million, much better than the $1.9 billion net loss last year.

President and CEO Sanjay Mehrotra said: “Robust AI demand and strong execution enabled Micron to drive 17 percent sequential revenue growth, exceeding our guidance range in fiscal Q3. We are gaining share in high-margin products like High Bandwidth Memory (HBM), and our datacenter SSD revenue hit a record high.”

Micron said it made robust price increases as industry supply-demand conditions continued to improve. This pricing, combined with a strengthened product mix, resulted in increased profitability across all its end markets.

Financial summary

- Gross margin: 26.9 percent vs -17.8 percent a year ago

- Operating cash flow: $2.48 billion vs $1.22 billion for the prior quarter and $24 million for the same period last year

- Free cash flow: $425 million vs -$1.355 billion last year

- Cash, marketable investments, and restricted cash: $9.22 billion

- Diluted EPS: $0.30 vs -$1.73 a year ago.

DRAM revenue for the quarter was $4.7 billion, up 76 percent year-on-year. NAND revenues grew 107 percent year-on-year to $2.1 billion. NOR and other revenue of $54 million was down 19.4 percent.

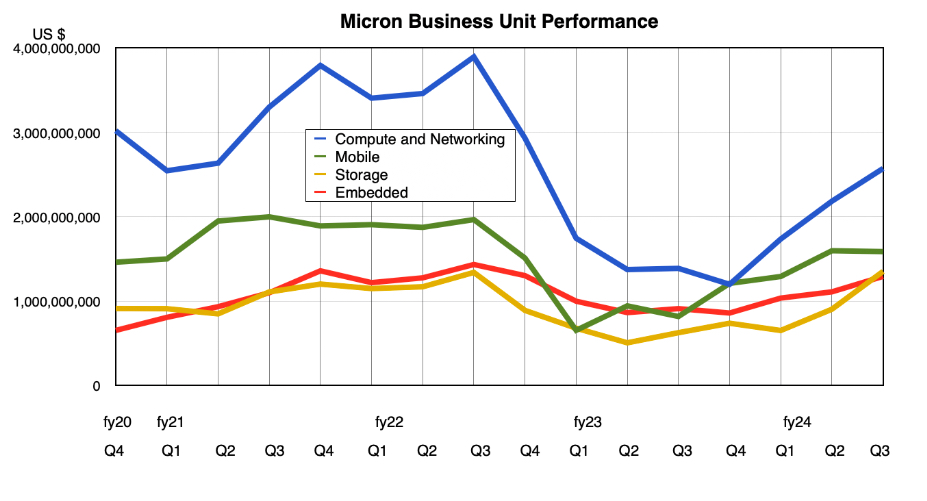

Business unit revenue performance:

- Compute & Networking: $2.57 billion, up 85 percent year-over-year

- Mobile: $1.59 billion, up 94 percent

- Storage: $1.35 billion, up 116 percent

- Embedded: $1.29 billion, up 42 percent, with record demand in the automotive sector

Outlook

Next quarter’s $7.6 billion midpoint outlook would signify revenue growth of 89.5 percent year-on-year. That’s a big ask but then revenues grew 82 percent annually in Q3 and demand is accelerating as GPU server growth continues at its high rate.

Micron said it expects continued price increases throughout calendar 2024 as AI-driven demand for datacenter products may lead to shortages.

The company said its next generation, 300-plus-layer NAND technology is “on track, with high volume production planned for calendar 2025.” Mehrotra echoed views previously expressed by Western Digital EVP Rob Soderbery about slowing NAND node (layer count) transitions, saying: “I think it is certainly helpful given the bit growth that you get from those transitions to slow down the timing of the cadence of those node transitions so that your bit growth CAGR versus the gain of bits that you get from the wafers can be managed well.”

Turning back to AI, Mehrotra said: “We are excited about the expanding AI-driven opportunities ahead, and are well positioned to deliver a substantial revenue record in fiscal 2025.”

“We are in the early innings of a multi-year race to enable artificial general intelligence, or AGI, which will revolutionize all aspects of life,” he said in prepared remarks. “Enabling AGI will require training ever-increasing model sizes with trillions of parameters and sophisticated servers for inferencing. AI will also permeate to the edge via AI PCs and AI smartphones, as well as smart automobiles and intelligent industrial systems. These trends will drive significant growth in the demand for DRAM and NAND, and we believe that Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.”

Let us hope that this multi-year AI race isn’t just a dot-com bubble with disastrous results for businesses going all in on the tech.

A Micron presentation slide said: “As we look ahead to 2025, demand for AI PCs and AI smartphones, and continued growth of AI in the datacenter, create a favorable setup that gives us confidence that we can deliver a substantial revenue record in FY 25.

“Due to expectations for continued leading-edge node tightness, we are seeing increased interest from many customers across market segments to secure 2025 long-term agreements ahead of their typical schedule.” That will increase Micron’s confidence in its FY 2025 revenue expectations.

High Bandwidth Memory (HBM) demand is a vital part of this, and Micron expects “to generate several hundred million dollars of revenue from HBM in FY 24, and multiple billions in revenue from HBM in FY 25 … Our HBM is sold out for 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 supply.”

Another benefit to Micron of strong HBM demand is likely to be general DRAM price rises. “Industry wide, HBM3E consumes approximately three times the wafer supply as DDR5 to produce a given number of bits in the same technology node. We anticipate strong HBM demand due to AI, combined with increasing silicon intensity of the HBM roadmap, to contribute to tight supply conditions for DRAM across all end markets.”

A “substantial revenue record” suggests Micron is hoping to sail past its FY 2022 $30.8 billion number. Its nine-month total for the current FY 2024 year is $17.36 billion, which will provide a $25 billion full year if its outlook of $7.6 billion for the next quarter (+/-$200 million) is met. Beating $30.8 billion in revenues would require a minimum 19 percent revenue growth rate from FY 2024 to 2025. Mehrotra must be feeling confident to make such a suggestion.

However, all this good news failed to please the stock market, which saw Micron’s share price decrease 7 percent in trading after the results were published from $142.50 to $131.66 – due to some analysts’ disappointment with the outlook for the final quarter of fiscal 2024.