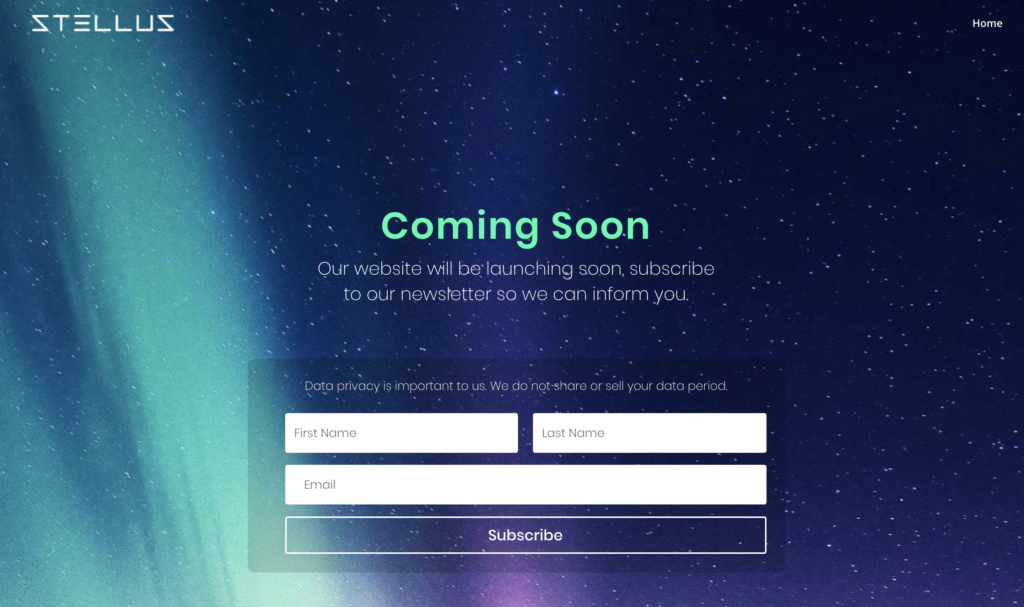

Google has delivered on its intent, revealed last April, to deliver an AWS Glacier-like Cloud Archive storage service.

This is pitched as a tape replacement, holding data that is kept for a minimum of one year without access. There is no delay on data retrieval, unlike direct rival AWS Glacier Deep Archive (GDA), which quotes up to 48 hours.

Comparing costs between AWS Glacier Deep Archive and Google’s Cloud Archive will require a lot of work. You will need to define an archive workload, including the various types of operations on the data within it, and run a calculation process. There are worked out examples on Google’s website. No doubt AWS and Google sales resources will be happy to help here.

Geoffrey Noer, Google’s cloud storage product manager, blogs: “At Google Cloud, we think that you should have a range of straightforward storage options that allow you to more securely and reliably access your data when and where you need it, without performance bottlenecks or delays to your users.”

Archive storage prices

AWS’s GDA costs $0.0099 per GB per month whereas Google’s Cloud archive is more expensive at $0.0012/GiB per month. (A GiB by the way is a Gibibyte; 1GiB is 2 to the power 30 bytes; 1,024MiB, whereas 1GB is 10 to the power 30; 1,000MB.)

Google’s Cloud Archive retrieves data in less than a second, the same as Google’s Nearline and Coldline storage.

AWS and Google charge for data retrieval but on a different basis. Amazon has a three-tier price scheme based on retrieval time; standard ($0.02/GB) is within one hour, expedited ($0.03/GB) is within 5 minutes and bulk ($0.0025/GB) is within 48 hours.

Google Cloud Archive tiers retrieval, known as egress, based on the data amount. Zero to 1TiB/month costs $0.12 (egress worldwide bar China) or $0.23 (China). One to 10TiB costs $0.11 or $0.022/TiB (China again) and more than 10TiB costs $0.08 or $0.20/TiB for China.

Additional charges

Network usage when reading data in the archive within the same region carries no cost. But network usage on access between regions in a continent is $0.01/GiB. General egress charges apply on read access between continents.

There are also operation costs, set in three tiers. Data retrieval costs $0.01/GiB (Nearline), $0.02/GiB (Coldline) and $0.05/GiB (Archive). Class B operations cost $0.01, $.05 and $0.50 per 10,000 for Nearline, Coldline and Archive respectively. Class A operations cost $0.10, $0.10 and $0.50 per 10,000 operations for the three storage classes.

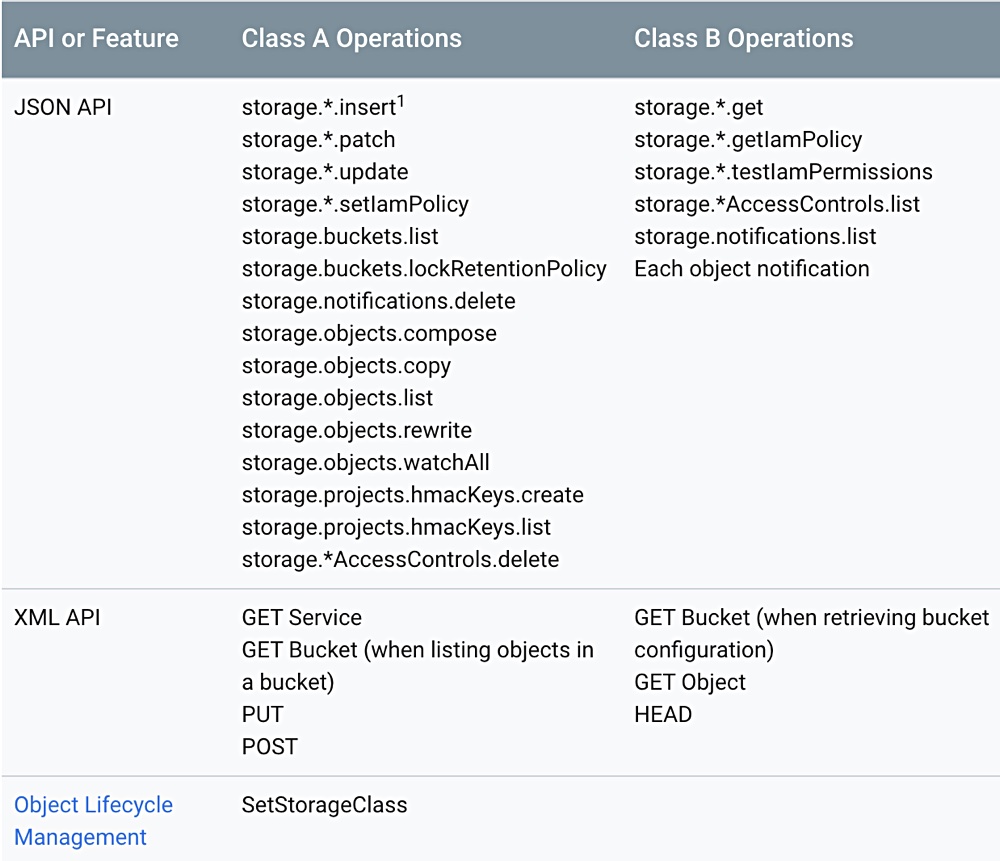

Google has defined Class A and B operations in a table.

Certain operations are free:

- JSON API storage.channels.stop

- JSON API storage.buckets.delete

- JSON API storage.objects.delete

- JSON API storage.projects.hmacKeys.delete.

- DELETE with XML API

- Delete with Object Lifecycle Management