Commvault has stemmed its recent revenue decline in Q2, a useful first step in its quest for top-line growth. The data protection vendor anticipates revenue growth in the next two quarters.

Revenue for the second fiscal 2020 quarter ended September 30, 2019 were $167.6m, down 1 per cent. Net loss was $7.1m.

in the earnings call CFO Brian Carolan confirmed Q3 ’20 consensus forecasts for approximately $73m of software and products revenue are “within our expected range.”

He said revenue in the third fiscal 2020 quarter should be higher than Q2, and the company anticipates more growth in the fourth quarter.

Carolan said the company thinks Q1 ’20 “marked a baseline quarter” – a revenue trough, in other words. “In Q2 we actually saw the best quarter ever in terms of our appliance sales for HyperScale.” The CEO said: “We closed our single largest appliance deal in the US this last quarter.”

The CFO said fy2021 will be the first year that the company will “see some meaningful… renewals of the original subscription contracts that we sold in FY ’18. It’s going to create an opportunity for some upsell and cross-sell as well as some of our new technologies [Hedvig] that we recently acquired.”

Q2 2020 by the numbers

Software and products revenue was $68.6m, down one per cent y-o-y. Services revenue was $99.m, also down one per cent. Subscription and utility annual contract value (ACV) grew 59 per cent to $121m. Total repeatable revenue (subscription software and maintenance services) was $121.8m, up one per cent. These repeatable revenue streams outperform Commvault’s non-repeatable revenue.

Operating cash flow was $24m compared to $17.8m a year ago. Free cash flow increased 35 per cent to $23.4m. Total cash and short-term investments were $475.2m at quarter end. Total operating expenses fell five per cent to about $110m.

Sanjay Mirchandani, Commvault CEO, who joined the company from Puppet Labs in February 2019, said in the earnings call: “We delivered results above expectations for both revenue and operating margins [14.8 per cent.] This performance as well as our positive outlook reflects the good headway we are making on the simplification innovation and execution priorities we established at the start of the fiscal year. We have work to do but we are making real measurable progress and we remain focused on setting achievable goals in meeting them.”

Return to growth?

The Q2 revenue number is an improvement on recent quarterlies as this list of revenue changes and profits/losses shows;

- Q2 fy19 +0.7 per cent and profit of $0.9m

- Q3 fy19 +2 per cent and profit of $13.4m

- Q4 fy19 -2 per cent and loss of $2.2m

- Q1 fy20 -8 per cent and loss of $6.8m

- Q2 fy20 -1 per cent and loss of $7.1m <— revenue decline rate slowed

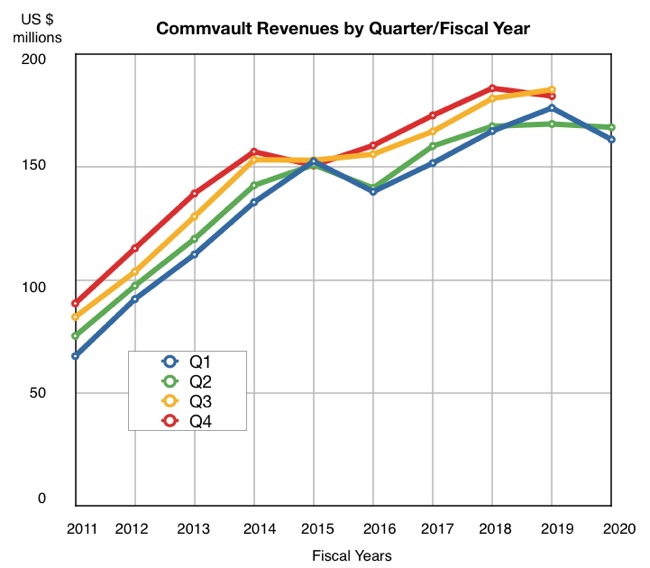

A chart of quarterly revenues by fiscal year shows the revenue flow changes.