The EDSFF organisation has standardised short and long and 3-inch ruler form factors for SSDs, with specs available from the Storage Networking Industry Alliance.

EDSFF stands for Enterprise and Data centre SSD Form Factor and there is an EDSFF working group. The idea is to move away from 2.5-inch and 3.5-inch disk-bay sizes for SSDs, which now come in these sizes as well as M.2 gumstick cards and PCIe add-in card (AIC) formats. There will be instead longer and thinner devices, the so-called rulers, which can provide 1PB of capacity in a 1U server, using 64-layer, TLC 3D NAND.

This mean more capacity in less space, leading to denser storage and server systems and less wasted space.

Suppliers involved in the EDSFF initiative include SSD makers Intel, Micron, Samsung, Toshiba and Western Digital, and server suppliers Dell EMC, HPE and Lenovo, which augurs well for wide industry adoption and the unification of the differing Intel and Samsung ruler formats.

There are short and long ruler standards with 9.5mm and 18mm widths. The short ruler is 5.9mm thick, 111.49mm long and 31.5mm wide. The long ruler can be 9.5mm or 18mm thick, 318.75mm long and 38.4mm wide.

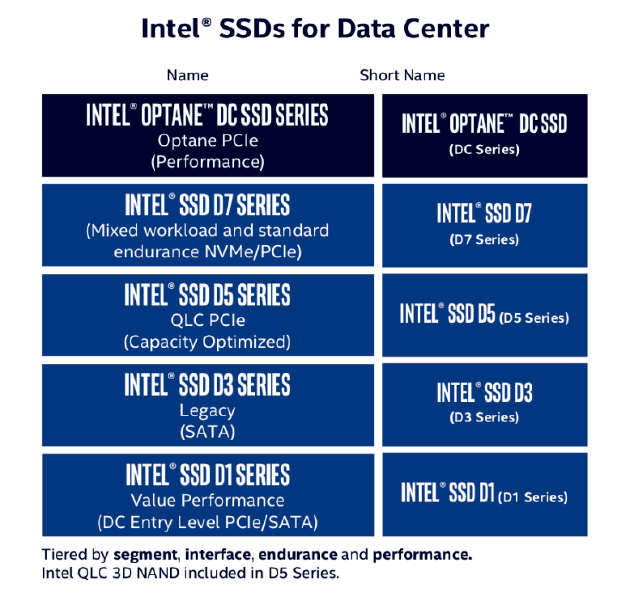

An Intel slide shows its EDSFF plans:

The EDSFF is also working on a 3-inch form factor that is 76mm (3 inches) wide. This format has two thicknesses and two lengths: 7.5mm or 16.8mm thick and either 104.9mm or 142.2mm long.

Download the format specs here.