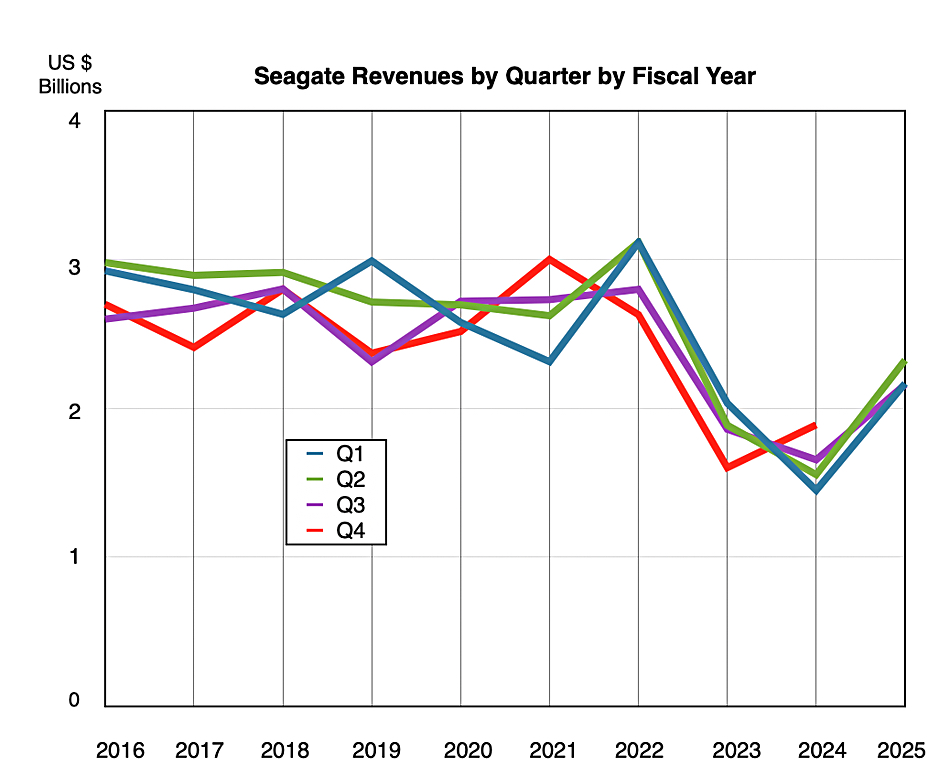

Although Seagate’s third fiscal 2025 quarter revenues rose almost a third year-on-year, they declined sequentially as supply constraints sent shipments down.

Revenues in the quarter ended March 28 were 30.5 percent higher than a year ago at $2.16 billion, near the middle of its outlook range, with a GAAP profit of $340 million versus last year’s small $25 million profit.

CEO David Mosley stated: “Seagate delivered another solid quarter of profitable year-on-year growth and margin expansion … our performance underscores the structural enhancements we’ve made to our business model and healthy supply/demand environment for mass capacity storage.”

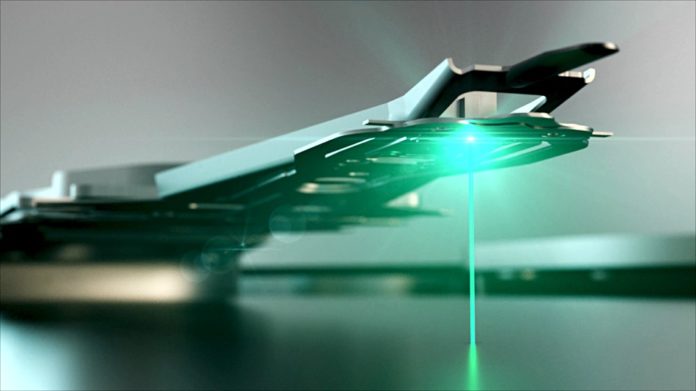

“We remain focused on executing our HAMR product ramp to support ongoing cloud customer demand. While we navigate the current dynamic macroeconomic environment, we are confident that our technology leadership, resilient financial model and solid industry fundamentals will drive profitable growth through 2025 and beyond.”

Financial summary

- Gross margin: 35.2 percent vs 25.7 percent last year

- Operating cash flow: $259 million vsyear-ago $188 million

- Free cash flow: $216 million vs $128 million a year ago

- Diluted EPS: $1.57 vs $0.12 a year ago

- Dividend: $0.72/share

- Cash & cash equivalents: $814 million vs $705 million a year ago

Seagate reduced its outstanding debt by $536 million, exiting the fiscal third quarter with total debt of $5.1 billion.

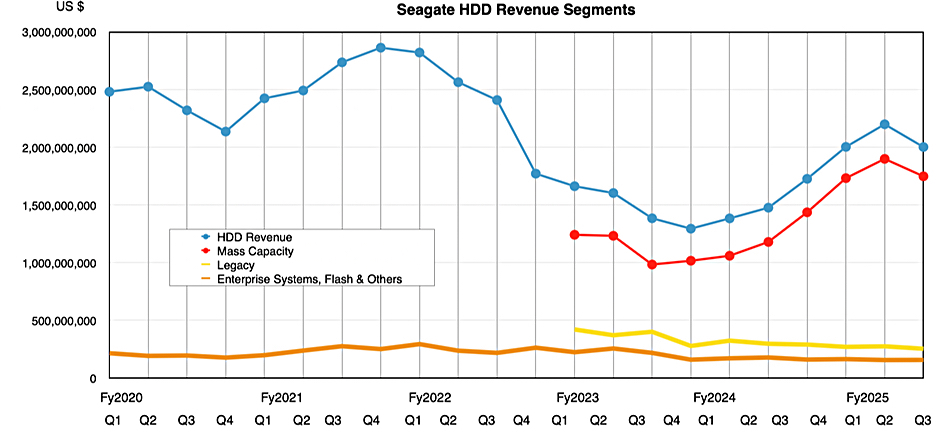

There was a shipment downturn in the quarter with the 132.9 EB capacity shipped total down 5 percent quarter-on-quarter although still up 50 percent Y/Y. This affected mainly its nearline drives, as legacy drive capacity shipped has been trending down for many quarters;

Even so the average capacity per nearline drive rose 8 percent Q/Q to16.2 TB. It was just 8.7 TB a year ago.

According to CFO Gianluca Romano’s comments in the earnings call this was due to “the temporary supply constraints we discussed last quarter.” It affected non-HAMR drive production with inadequate production capacity put in place. That was rectified last quarter but it meant Seagate under-served its market in the quarter just ended.

Seagate said that it is ramping 3TB/platter HAMR shipment volume at its lead [only] cloud customer, approaching qualification conclusion at a 2nd major cloud customer, and has additional customers in track with shipments starting in the second half of calendar 2025. Mosley said: “We expect an appreciable increase in HAMR product shipments over the coming quarters as these future qualifications conclude.”

Its outlook for its fourth fiscal 2025 quarter is for revenues of $2.4 billion give or take $150 million, and a 27 percent Y/Y rise at the midpoint. This is based on tariff policies as of April 29 and reflects a minimal direct impact to its outlook. Wedbush analyst Matt Bryson said Seagate expects to either mitigate or pass through any cost increases tied to tariffs, while gross margins (and revenues) are still expected to continue an upward trajectory through the course of this calendar year.