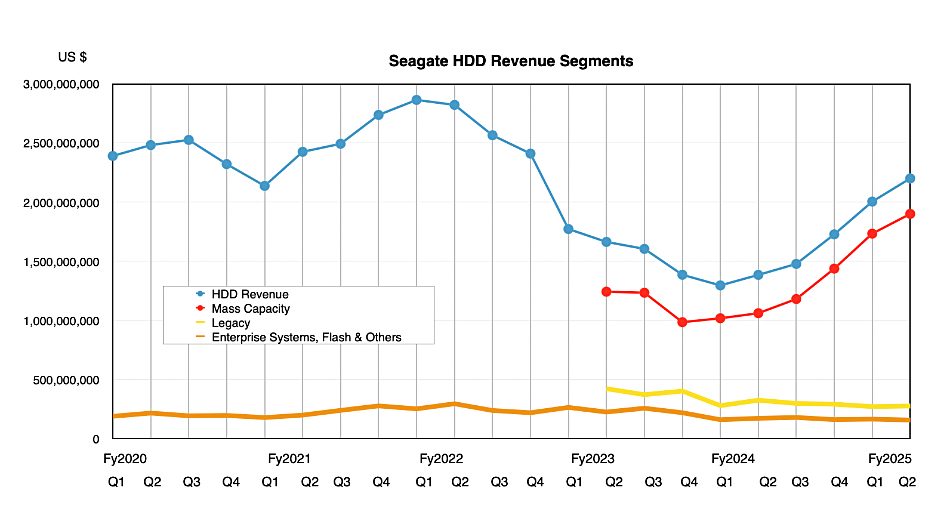

Cloud providers purchased more high-capacity disk drives in Q4 2024, pushing Seagate revenues up nearly 50 percent.

Seagate revenues rose to $2.33 billion in its second fiscal 2025 quarter, which ended December 27, from $1.55 billion a year ago. The company reported a $336 million GAAP profit, marking a significant turnaround from a $19 million loss in the prior year. Investors were less than pleased with its forecasts for the upcoming third quarter, however. The drive maker says that it expects around $2.10 billion for Q3, compared with analysts’ average estimates of $2.19 billion, according to Reuters.

CEO Dave Mosley stated: “Seagate ended calendar 2024 on a strong note as we grew revenue, gross margin, and non-GAAP EPS successively in each quarter of the year. Our results demonstrate structural improvements in the business and our focus on value capture in an improving demand environment, highlighted by decade-high gross margin performance exiting the December quarter.”

“Our performance was supported by increased demand across nearly all markets we serve with the most significant growth in the cloud sector. This broad-based demand from global cloud customers led to an almost doubling of nearline product revenue in the December quarter on a year-on-year basis and close to 60 percent nearline revenue growth for the entire calendar year.”

“Overall, Seagate is in an outstanding competitive and technology position in a strengthening demand environment.”

Production of the company’s 24 TB CMR and 28 TB SMR drives is ramping quickly and the duo represent Seagate’s highest revenue and exabyte production platform.

Financial summary

- Gross margin: 34.9 percent vs 23.3 percent last year

- Operating cash flow: $221 million

- Free cash flow: $150 million vs $27 million in previous quarter

- Diluted EPS: $2.03 vs $0.12 a year ago

- Dividend: $0.72/share

- Cash & cash equivalents: $1.23 billion vs $787 million a year ago

However, it faced a production issue affecting non-HAMR drives, which has now been resolved. This led to supply constraints for the upcoming March quarter. CFO Gianluca Romano said in the earnings call: “We did not start enough material in a certain period of time because we didn’t put back the equipment that [was] necessary to produce that materials. So we don’t have that level of supply that could have been necessary to match demand in the March quarter (Q3 2025).”

The proportion of mass-capacity nearline drives continues to rise as other market segments languish:

Mosley highlighted an AI-led future, stating: “We expect GenAI to drive future mass capacity storage growth. This is particularly true of data-rich imagery and video content created by GenAI models, which is projected to expand nearly 170 times from 2024 through 2028.”

Disk drives will be needed because “HDDs play a crucial role in housing the massive data sets required for training AI models, serving as central repositories when these data sets are not actively being processed by GPUs. These mass storage data lakes form the backbone of trustworthy AI by storing checkpoints or snapshots of AI model data sets, ensuring that data is both retained and available in the future for continuous model refinement.”

“We expect enterprises to replicate and store more data locally at the edge as AI computing and inferencing moves closer to the source of data generation. VIA is another opportunity-rich market at the edge. For some time now, we’ve spoken about the increased adoption of AI analytics within the VIA markets, which help form actionable insights from data for applications such as smart cities and smart factories.”

HAMR technology drive qualifications are progressing, with Mosley saying: “There are now multiple customers qualified on this platform across each of the mass capacity end markets. Currently, we are ramping volume to our lead CSP customer while progressing on qualifications at additional cloud and hyperscale customers. These qualifications will set the foundation for the next phase of our Mosaic volume ramp starting in the second half of calendar 2025.”

Seagate plans to rely on HAMR technology’s areal density improvements to increase capacity, without needing to add an extra platter to its ten-platter products. Rival Western Digital now has 11-platter drives.

SSDs and HDDs will coexist. “Datacenter architects will continue to adopt both hard disk drive storage and compute-oriented memory technologies such as NAND flash to support the breadth of their workloads. NAND is best suited for high throughput, low latency tasks, while hard disk drives remain the preferred storage solution for the bulk of data storage needed in the cloud.”

Mosley asserted: “HDDs offer customers at least 6x lower cost per terabyte of storage capacity. They possess a significantly smaller embodied carbon footprint and provide manufacturing scale that is highly capital-efficient.”

The outlook for next quarter projects a sequential revenue decline to $2.1 billion +/- $150 million, representing a 26.9 percent increase compared to the year-ago Q3 at the midpoint.