NetApp is laying off staff as it reorganizes to cope with a changed commercial environment.

A company statement said: “NetApp is implementing a strategic organizational realignment to better position the company for long-term growth and operational efficiency. The company is optimizing cost structures, streamlining work processes, and cultivating critical capabilities across the organization.

“These efforts are designed to strengthen NetApp’s ability to serve customers, innovate at scale, and respond to fast-moving industry dynamics, including the rapid rise of AI, and reflect the evolving needs of the business. NetApp remains committed to supporting its employees, customers, and stakeholders during this transition and is taking thoughtful steps to ensure the company is positioned to meet future demands and deliver sustainable value.”

We have been told of a 6 percent workforce cut, which would equate to around 700 people.

NetApp already warned of layoffs of at least 4 percent in its financial report for the nine months ended January 2025, stating: “In the first nine months of fiscal 2025, management approved restructuring plans to redirect resources to highest return activities and reduce costs, which included a reduction of our global workforce by approximately 4 percent. … The activities under the plans are expected to be substantially complete by the end of fiscal 2025.”

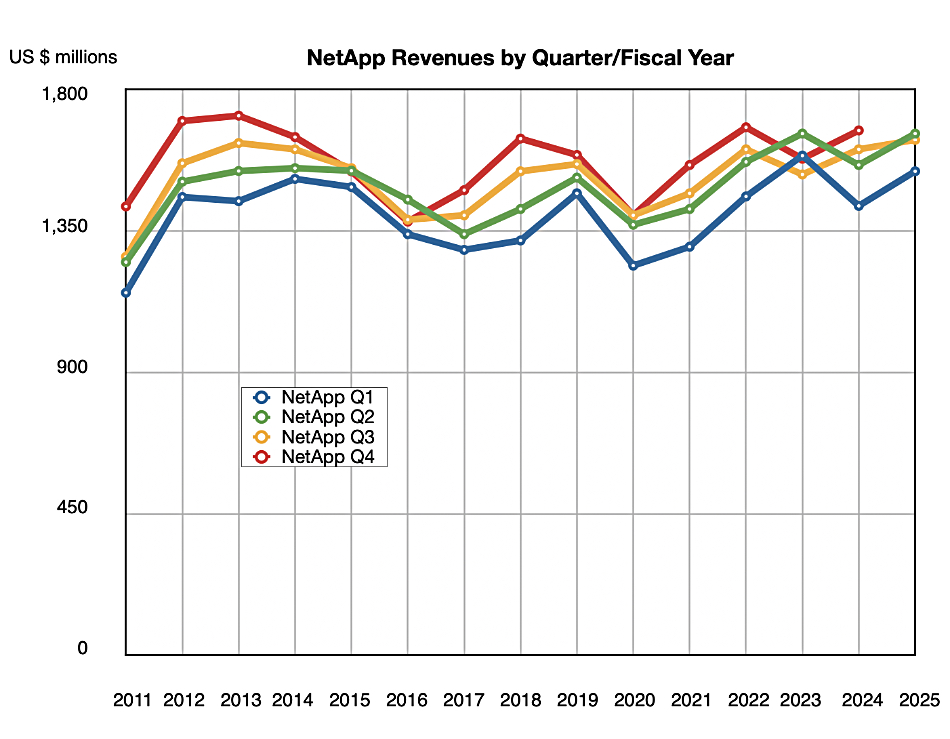

The company found itself facing sales deal slippage in its Q3 of fiscal 2025, which ended January 24, 2025. It had hoped to pull in $1.68 billion ± $75 million in revenues, a 4 percent year-over-year rise at the midpoint, and NetApp was inside that range with $1.64 billion, a 2 percent year-on-year rise.

The fourth quarter outlook is for revenues of $1.725 billion ± $75 million, a 3.3 percent increase on a year ago at the midpoint. NetApp is taking action to lower its costs early, before the quarter ends, in order to boost profitability or reduce its losses.

Server maker Supermicro has just warned it will miss estimated revenues for its Q3 of fiscal 2025, citing deal slippage and higher inventory costs after older generation product sales missed expectations.

Supermicro has had its own accounting problems, but its issues could reflect a cooling AI server market. That, if true, could also be affecting NetApp. It may equally be affected by President Trump’s tariff changes.

In the storage field, Lightbits and ExaGrid have both recently posted good growth stories. However, SSD and DRAM maker Micron reported a sales downturn outside its core datacenter market. Micron’s revenues in the quarter ended December 31, 2024, were $8.05 billion, up 38 percent year-on-year, but down 8 percent from the previous quarter, ending a run of seven consecutive growth quarters. Ultimately, it’s a mixed picture full of “could bes” and “maybes” with no single factor yet apparent.

Back in February, Wedbush analyst Mat Bryson suggested that NetApp’s growth was unlikely to be to above 2 percent in its Q4 and “it’s difficult to view NetApp’s outlook without a modicum of skepticism.”

NetApp is due to announce Q4 results on May 29. Analysts will then be poring over NetApp’s comments to find out what has happened and how it might affect other suppliers.