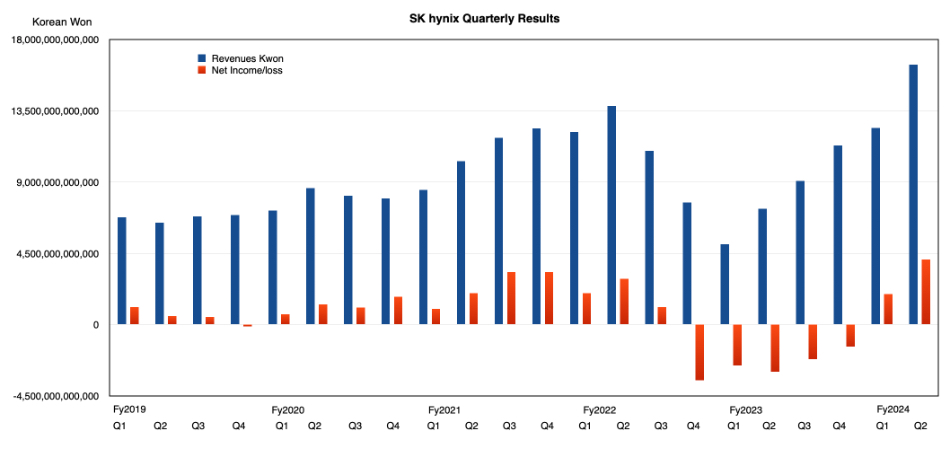

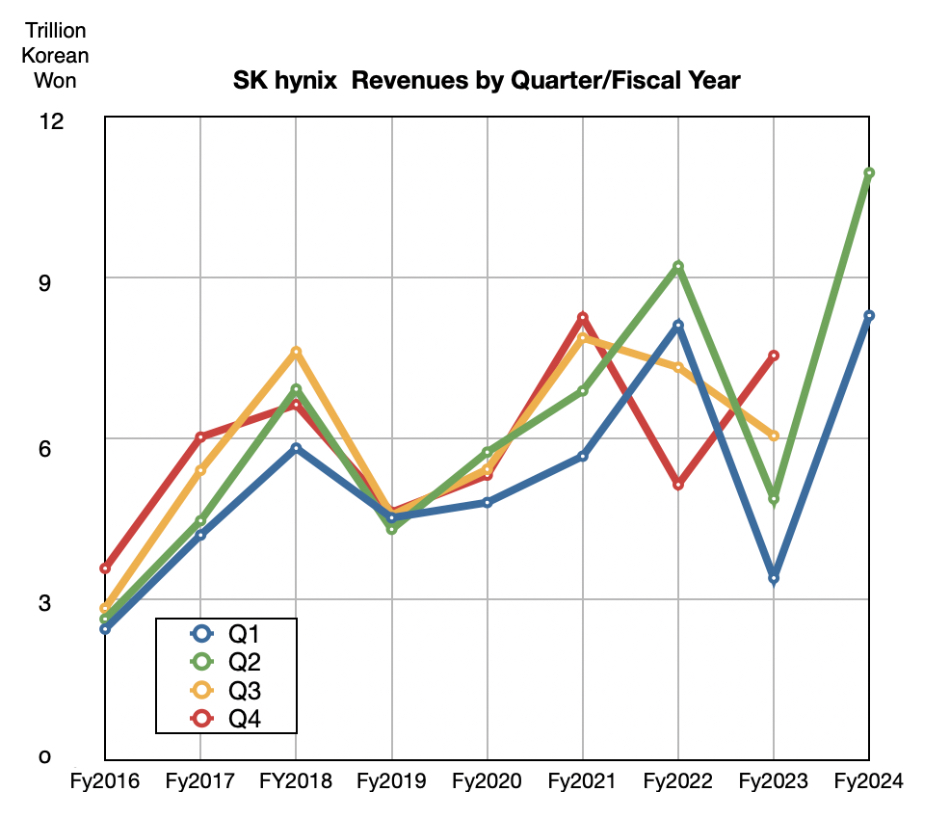

Sk hynix revenues for Q2 soared as demand for high-bandwidth GPU memory went up in lockstep with AI application use.

The Korean NAND and DRAM fabrication outfit reported revenue of ₩16.4 trillion ($11.8 billion) in the quarter ending June 30, up 125 percent annually and 32 percent sequentially, with a profit of ₩4.1 trillion ($2.97 billion) contrasting with the ₩3 trillion ($2.17 billion) loss a year ago.

The company makes both DRAM and NAND, with its DRAM manufacturing lines making either HBM or lower-price ordinary DRAM. It said HBM sales went up by more than 80 percent compared to the previous quarter and more than 250 percent compared to the same period last year.

Enterprise SSD sales rose 50 percent sequentially while mobile NAND sales were less impressive. We don’t know the split between DRAM and NAND revenues, but understand DRAM revenues are significantly higher. Wedbush analyst Matt Bryson told subscribers that SK hynix’ “NAND bit growth decreased in the low single digit percentage range Q/Q while ASPs were up in the mid to high teen percentage range.”

Generally, Bryson said: “Hynix generally talked to strength in enterprise applications more than offsetting modest recovery in handsets and weaker than expected conditions in PCs.”

A statement from SK hynix CFO Kim Woohyun about the results said: “The company will further solidify the position as a leader in AI memory products by focusing on developing the best process technology and high-performance products based on a stable financial structure.”

In the NAND area, it says it will “lead the market in the second half with 60 TB products, expecting eSSD sales to be more than quadrupled compared to last year.” Results for its Solidigm subsidiary were not revealed. In May, an SK hynix statement said: “We are preparing an eSSD product that combines SK hynix’s unique NAND technology with Solidigm’s eSSD solution capabilities.”

The company aims to capitalize on HBM demand by mass-producing 12-layer HBM3e products, which are being sampled by customers now. It will launch 32 Gb DDR5 DRAM for servers and MCRDIMM (Multiplexer Combined Ranks Dual In-line Memory Module) for high-performance computing in the next two quarters.

It is increasing its HBM production capacity with its new Cheongju M15X fab, due to start mass production in the second half of 2025. It will also start construction of the first fab of the Yongin semiconductor cluster in March 2025, and complete it in May 2027.

SK hynix is being chased by Samsung and Micron in the HBM area, with Nvidia certifying Samsung’s HBM3e chips for use in its H20 GPUs sold in China. Nvidia has not yet certified Samsung’s HBM3e chips more generally, which are currently supplied by SK hynix.

Micron has said it expects “to generate several hundred million dollars of revenue from HBM in FY2024, and multiple billions in revenue from HBM in FY2025.”

The next and faster HBM4 generation is coming and all three suppliers – Sk hynix, Samsung, and Micron – will want to participate in the anticipated HBM4 AI server gold rush in the 2026-2027 period. If this gold rush takes place, with SSD demand rising as well, then SK hynix revenues could grow to the ₩50 trillion level and beyond. We could be looking at a DRAM supercycle, and not just a normal and traditional recovery in the memory boom and bust cycle – if the surge in server AI workloads continues (a big “if”).

A financially stronger SK hynix could then play an influential role in consolidating the NAND supplier market, with dominant Samsung facing four weaker players – Kioxia, its joint-venture partner Western Digital, SK hynix with subsidiary Solidigm, and Micron. SK hynix, which part-owns Kioxia, has already blocked a Kioxia-Western Digital merger.