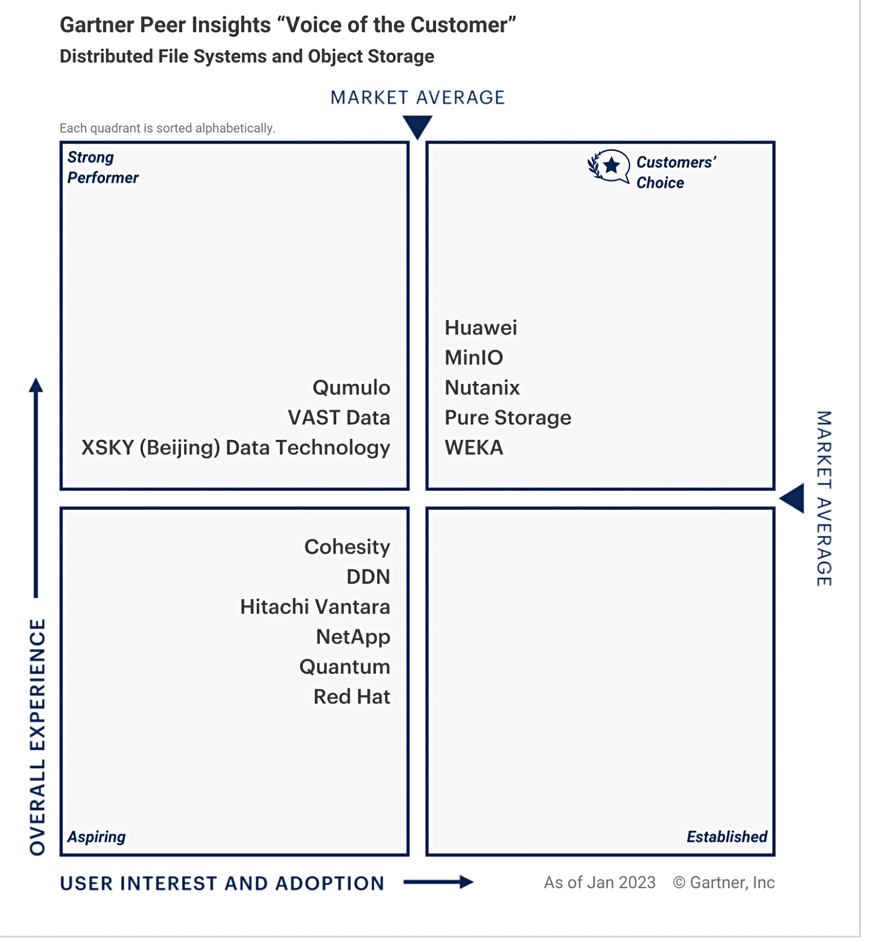

Analyst house Gartner says its customers have listed the companies they think are above average distributed file systems and/or object storage suppliers. Topping the list was Huawei, MinIO, Nutanix, Pure and WEKA.

A Peer Insights document from Gartner has a table showing this, and explains what is going on:

Like the Magic Quadrant (MQ) this is a 4-box diagram but the suppliers are listed alphabetically within a box, not with precise positioning inside a 2D space defined by their scores on the two axes. Gartner’s Voice of the Customer (VoC) box diagram has much lower granularity than the MQ.

The two VoC axes are the horizontal user interest and adoption and vertical overall experience. Suppliers must exceed the average market customer ratings per axis to be anywhere but in the lower left box. The averages are based on 741 Gartner customer reviews and ratings in the 18-month period ending 31 January 2023.

Only vendors with 20 or more eligible published reviews (and 15 or more ratings for “Capabilities” and “Support/Delivery”) during the specified 18-month submission period are included, while reviews from vendor partners or end users of companies with less than $50 million in revenue are excluded.

Let’s check the excluded roster for any surprises. No HPE, but Antonio Neri’s company might get in indirectly via its deal with VAST Data. Dell is also absent. That’s an unusual absence for the overall storage market leader with its PowerScale filer and object storage offerings, though we don’t know what gartner’s metrics were.

The roster of included vendors includes XSKY (Beijing) Data Technology. It’s a China-based software-defined storage company that is prominent in the Ceph world, ranking 3rd globally and 1st in China for Ceph community code contributions.

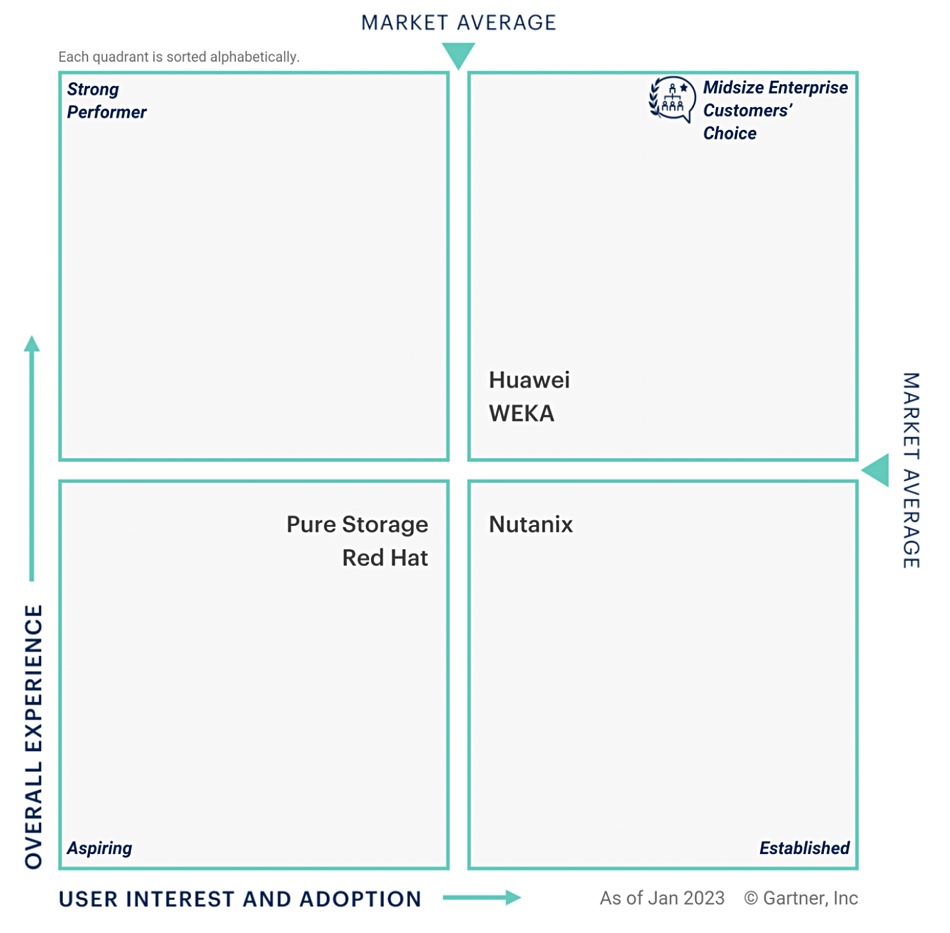

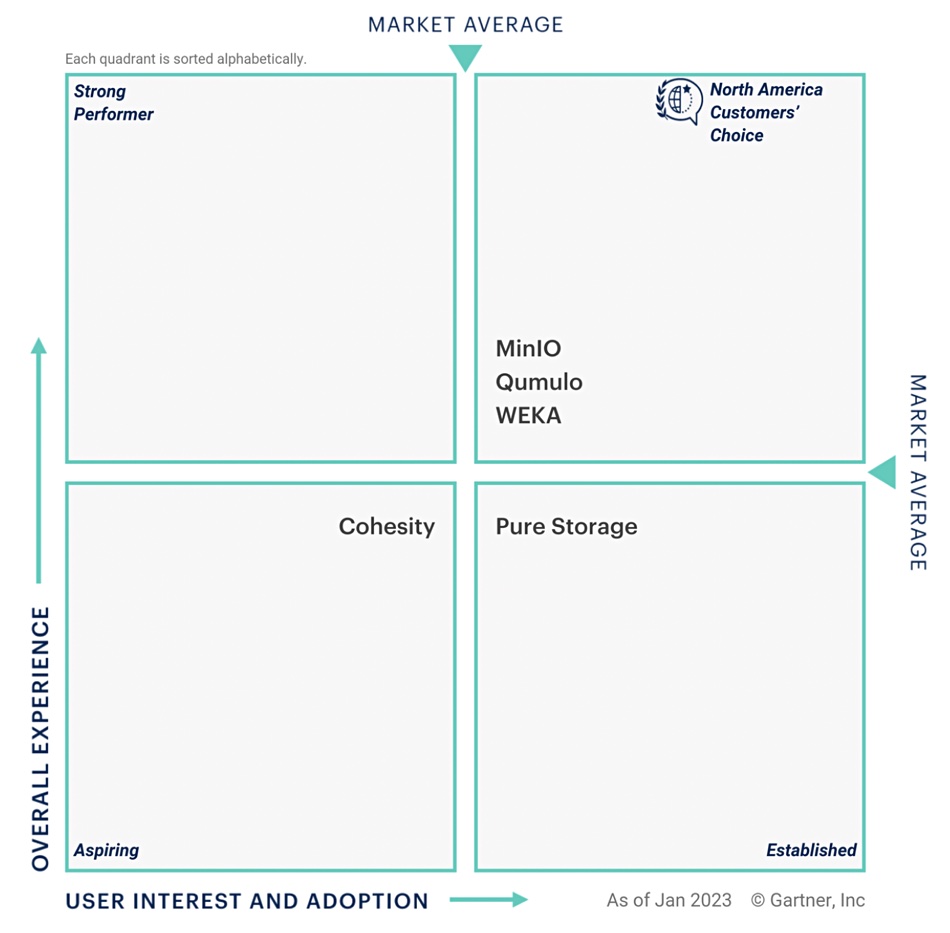

The Gartner report authors slice and dice the data to show mid-size customer views and also N America customer views, with both charts showing interesting differences from the main chart:

Large enterprise-focused suppliers drop out with the mid-size customer chart, with MinIO (surprisingly) included amongst the dropouts, but not WEKA. Nutanix drops down a box, while Pure goes down and left to the Aspiring box.

The N America customer choice sees Huawei and XSKY go away, but so too do Nutanix, VAST Data, DDN, Hitachi Vantara, NetApp, and Red Hat. That’s unexpected as is Pure’s decline in its overall experience rating. Qumulo moves rightwards to become a Customer’s Choice along with MinIO and WEKA.

You can get a copy of this Gartner report from WEKA here if you fancy, although registration is required. Check out individual customer reviews here.