China’s Yangtze Memory Technology Corp is reportedly developing 196 and 232 layer NAND, building a second fab and talking to Apple as it devises a way to increase its NAND market share past 5 percent.

YMTC is part of China’s initiative to become self-sufficient in technology and is currently selling 64-layer 3D NAND and a 128-layer product made by stacking two 64-layer dies together. It has a separate logic controller die, electrically connected through metal VIAs (Vertical Interconnect Accesses), and bonded to the top of its NAND cell dies. This is branded as Xtacking technology. The NAND is formatted as TLC (3bits/cell) or QLC (4 bits/cell).

DigiTimes has reported on YMTC’s fab plan, along with slides sourced from the NAND-fabber, along with the progress of its 196 and 232-layer ambitions: YMTC’s second fab in Wuhan is scheduled to be producing 128-layer chips by the end of the year, at the rate of 200,000 wafer starts per month, double that of its current (and first fab) which has a 100,000 wspm capacity. DigiTimes said YMTC had sent 196L NAND samples to prospective customers and indicated production could start this year.

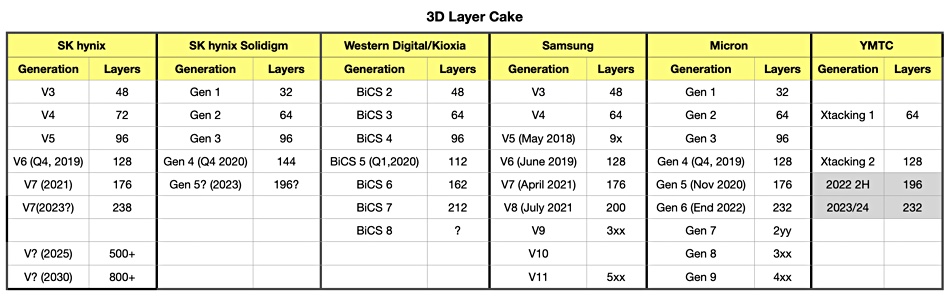

SK hynix’s Solidigm subsidiary is at the 144-layer level. Western Digital and Kioxia’s most advanced production NAND has 162 layers. Samsung, Sk hynix and Micron are producing 176-layer chips and all have 200+ layer technology in development.

YMTC is also developing its next generation NAND, with 232 layers, the same as Micron’s most advanced technology. The YMTC 232L NAND has a potential ship date in the 2023/2024 timeframe.

We can now update our table of NAND suppliers and their 3D NAND layer counts:

NAND supplier market shares in the fourth 2021 quarter according to Statista were:

- Samsung: 35.3 percent

- Kioxia: 18.9 percent

- SK hynix and Solidigm: 18 percent

- Western Digital: 12.5 percent

- Micron: 10.9 percent

- Others (YMTC): 4.4 percent

We may see YMTC’s share rise further once the new fab comes on stream and if its 196L technology proves to be successful.

Apple has reportedly been testing YMTC NAND, and the supplier’s credibility would certainly rise if it won Apple as a customer.