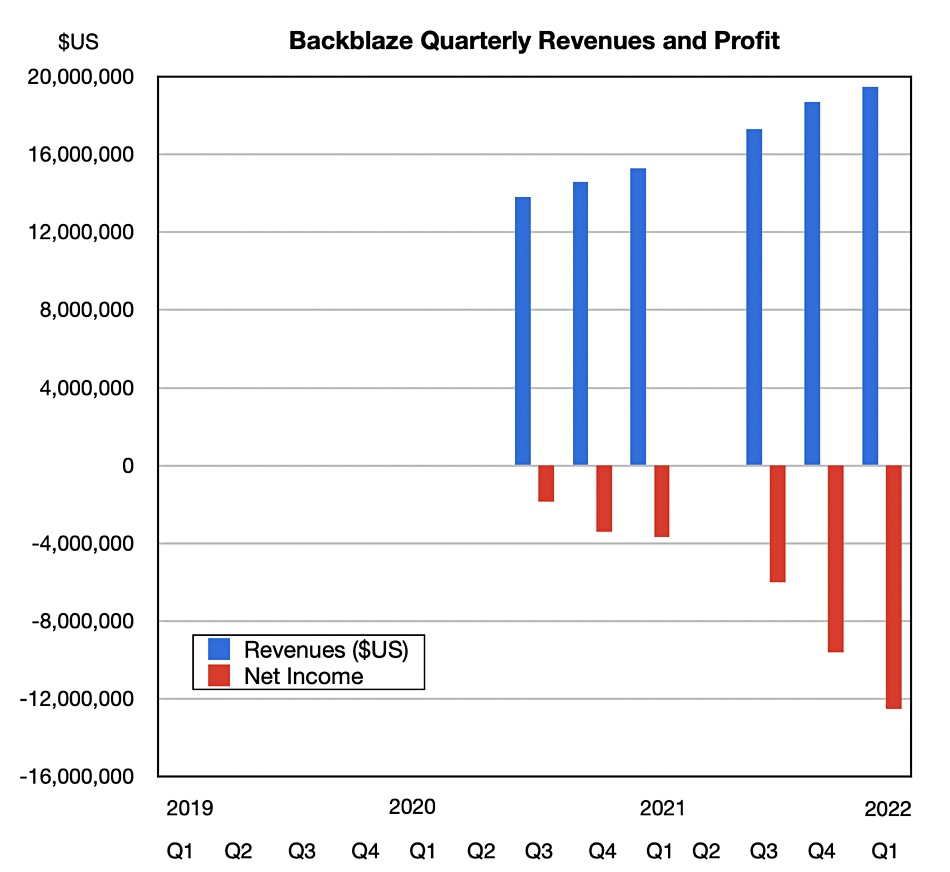

Cloud backup and storage provider Backblaze reported a 27 percent revenue bounce in calendar Q1 to $19.5 million, with losses deepening to $12.5 million versus the year-ago loss of $3.7 million.

B2 cloud storage revenues were up 48 per cent year-on-year to $7 million, 36 percent of total revenue, while computer backup, the other segment, reached $12.3 million, up 18 percent. It represents 52 percent of Backblaze’s revenues.

The loss can be contrasted with Backblaze’s cash, cash equivalents and short-term investments which totaled $99.1 million at quarter-end. The company positions itself as a less expensive cloud storage alternative to AWS, Azure and GCP that is also simpler to use.

It concentrates on data storage and movement, having no higher-level services such as data protection, unlike CSPs such as Datto, for example.

CEO Gleb Budman’s said: “In Q1, our business hit $79 million in annual recurring revenue and grew 27 percent, an acceleration versus 24 percent growth in the same period a year ago. We also recently announced numerous product and platform enhancements, including our Universal Data Migration, B2 Reserve, Partner API, and the beta launch of Cloud Replication. These advances make it even easier, more strategic, and more cost-effective to store more data with Backblaze.”

B2 Cloud Storage ARR is now over $28 million with Computer Backup ARR being approximately $55 million.

Backblaze is a steadily growing business with distinctive “neighbour next door” marketing attributes, like its blog which publishes periodical disk drive and SSD failure statistics, identifying drive models and manufacturers. Its customer focus is on the 50 percent of the market that it refers to as the underserved mid-market.

Backblaze: We ‘expect B2 to eventually overtake backup’

In the earnings call Budman said: “While the Computer Backup business remains the larger of our two cloud service offerings at the moment, our strategy and increasing investments center around capitalizing on the roughly $100 billion total combined 2025 addressable markets for B2 Cloud Storage as projected by IDC.”

He added: “We do expect B2 to grow faster than Computer Backup. And remember that most of our investments are going to B2. So given that B2 has a very high revenue per user, very high revenue retention rate and the overall growth rate is very high, we do expect B2 to eventually overtake Backup as the larger business in the coming years.”

A Cloud Replication service is coming in June. This “makes it easy for customers to keep a copy of their data geographically distributed to support disaster recovery, compliance objectives or to help move the data closer to end users for faster access.”

A Backblaze partner program counts Catalogic and CTERA as members. Catalogic integrates Backblaze’s B2 to provide customers, such as developers, with backups designed to be impervious to cybercriminals. CTERA offers cloud-based Network Attached Storage (NAS) and uses Backblaze’s B2 as the storage cloud underlying the offering. Commvault and Veeam are also partnering Backblaze, using it as a backup target.

The Q2 outlook is for revenues between $20.2 million and $20.6 million. CFO Frank Patchel did say Backblaze was seeing some softness in data growth and that is factored into the outlook.