ExaGrid recruited more than 120 new customers in the first 2021 quarter and has become cash-flow positive. The data backup startup said it also posted record sales in EMEA. “We have actually had three really strong quarters in a row. The company continues to grow,” ExaGrid president and CEO Bill Andrews told us.

The quarter saw ExaGrid bookings grew over 40 per cent and revenue 24 per cent as the total customer count moved past 3,000. Blocks & Files calculates that, since the third 2018 quarter ExaGrid has won an average of 60 new customers each quarter. “Remember, we go after the upper mid-market to the enterprise so these are not smaller customers,” Andrew said.

ExaGrid supplies a scale-out, globally deduplicating backup appliance with a so-called disk cache Landing Zone for fast restores of the most recent backups. There are two backup tiers; the Performance Tier for the next-fastest restores and the virtual air-gap Retention Tier for slower restores from deduplicated backup files.

The company in January announced v6.0 of its software, which contained the ransomware-combatting ExaGrid Retention Time-Lock feature with immutable backups that could not be deleted. Andrews said at the time: “ExaGrid has the only backup storage solution with a non-network-facing tier, delayed deletes, and immutable data objects.”’

Today, Andrews said: “ExaGrid has upgraded over 1,000 customers to Version 6.0 and all of those customers have the Retention Time-Lock for Ransomware Recovery feature turned on.”

The company claims a 75 per cent competitive win rate against suppliers such as Dell EMC (PowerProtect), HPE (StoreOnce), Quantum (DXi), and Veritas.

Comment

Data protection startups are pushing the idea of backup-as-a-service for on-premises and in-cloud applications, provided by software running in the public cloud. The fastest restore for in-cloud apps will be from in-cloud backup stores, while the fastest on-premises restores will be from on-premises backup appliances.

That is ExaGrid’s market. It is a big market.

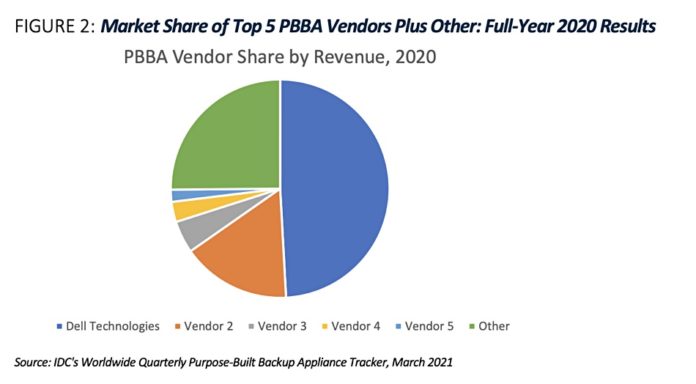

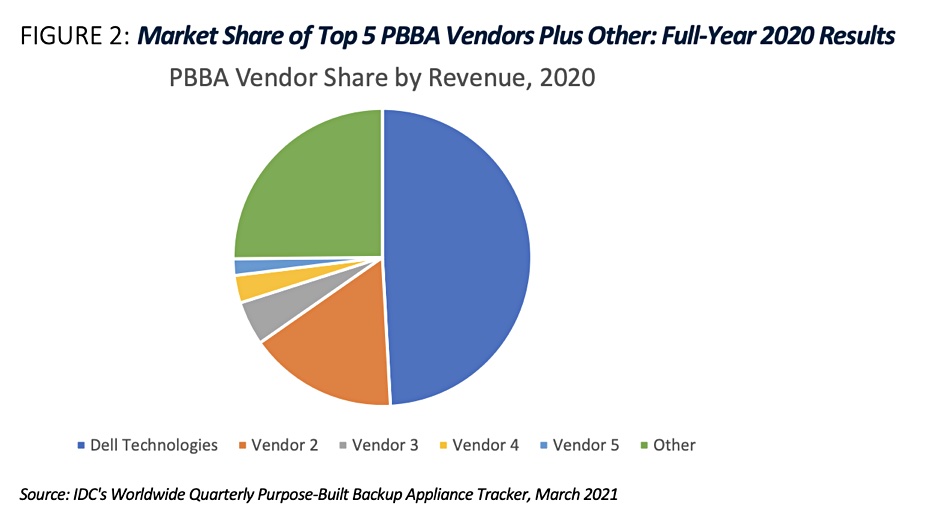

An IDC chart published this month by Dell EMC shows that the purpose-built backup appliance market generated $4.33bn revenues in 2020. Dell EMC soaked up 47 per cent share – to take approximately $2.035bn. With nothing else to go on but a rough visuals from the pie chart above, we think the unnamed second- and third-placed vendors look to have over 20 per cent market share. Who could they be? Our entirely unscientific hunches are that HPE StoreOnce is in second place. Is Exagrid the third-placed vendor?