The long hoped-for upturn at data protector Commvault has been delayed again, as CEO Sanjay Mirchandani announces another loss-making quarter, due to Hedvig acquisition costs.

Revenues for its third fiscal 2020 quarter were $176.4m, 4.3 per cent lower than last year’s $184.3m. There was a loss of $650k, which compares – badly – to a $13.4m profit a year ago.

Mirchandani said: “I am pleased to report that we again delivered results above expectations and that we did it while refreshing our data management portfolio, launching our new SaaS offering, Metallic, and integrating Hedvig, our first major acquisition.”

Three months CFO Brian Carolan anticipated that this third fiscal 2020 quarter would show a revenue upturn. It has on a sequential basis, 5 per cent, but not on an annual basis. As its third quarter is seasonally higher than its second, the sequential increase is no surprise.

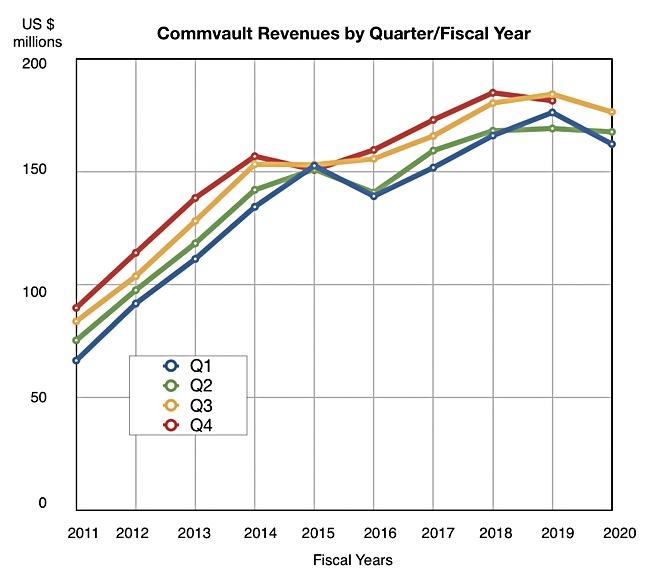

A chart shows this is the fourth successive quarter of revenue decline;

Mirchandani is still anticipating a recovery: “Our ability to achieve these results is a direct reflection of the progress we are making on the simplification, innovation and execution priorities we established at the start of the fiscal year. These priorities will be the foundation for our return to growth.”

In the quarter:

- Total repeatable revenue was $123.4m, an increase of 2 per cent y/y,

- Subscription and utility annual contract value (ACV) grew 56 per cent y/y to approximately $140.0m,

- Software and products revenue was $76.6m, a decrease of 9 per cent y/y,

- Services revenue was $99.7m, flat year over year,

- Operating cash flow totalled $0.9m compared to $31.1m a year ago.

- Total cash, restricted cash, and short-term investments were $345.0m at quarter-end, compared to $458.3m as of March 31, 2019,

- Operating margin was negative 0.3 per cent.

- Diluted earnings/share – $0.47.

- Diluted loss/share was $(0.01).

Operating cash flow in quarter included approximately $5.0m of payments related to Hedvig transaction costs and approximately $8.0m of severance payments related to recent restructuring actions.

The transition to subscriptions is affecting the revenue number and the Hedvig acquisition affected the profit line. There were $4.4m of transactions expenses, $2.8m of amortization and some additional compensation expenses related to the retained employees of Hedvig. These are not reflected in Commvault’s non-GAAP results which look consequently healthier.

Subscription income grew markedly and appears to have damaged perpetual licence sales, sending overall revenue down. Next quarter the Hedvig costs should be over and done with.