High-bandwidth memory demand, fueled by AI-focused GPU servers, has propelled SK hynix revenues and net income to record highs for the fourth 2024 quarter and full year.

The company reported ₩19.76 trillion ($13.76 billion) in preliminary revenues for the quarter, 74.7 percent higher year-on-year, with a net profit of ₩8 trillion ($5.56 billion), markedly contrasting with the year-ago ₩1.38 trillion ($960 million) loss. The full 2024 year numbers were remarkable too, with revenues of ₩66.19 trillion ($45.97 billion), up 49.5 percent, and a vast turnaround from the year-ago ₩9.14 trillion ($6.36 billion) loss to a ₩19.8 trillion ($13.8 billion) net profit. The company’s financial situation has been transformed.

VP and CFO Kim Woohyun stated: “With significantly increased portion of high value-added products, SK hynix has built fundamental to achieve sustainable revenues and profits even in times of market correction.”

The Korean company fabricates both DRAM and NAND chips and produces SSDs using its own NAND chips. The high-bandwidth memory (HBM) side of its DRAM operation exhibited “high growth,” the company said, and now accounts for more than 40 percent of its total DRAM revenue. It’s reported that SK hynix’s HBM 2024 revenue increased by more than 4.5 times over 2023. The company pointed out that “the memory sector is being transformed into a high-performance, high-quality market with [the] growth of AI memory demand.”

It also saw a 300 percent increase in eSSD sales in 2024 due to strong demand from datacenters.

A look at SK hynix’s successive quarterly revenues shows five quarters of solidly increasing revenues up to record levels:

Profits have also risen strongly from the late 2023-2024 slump and there have been seven successive quarters of revenue rises:

The annual revenue picture shows that SK hynix is now almost four times larger in terms of revenue than it was in 2016, and it has rebounded from the 2023 memory trough with much increased revenues and profit.

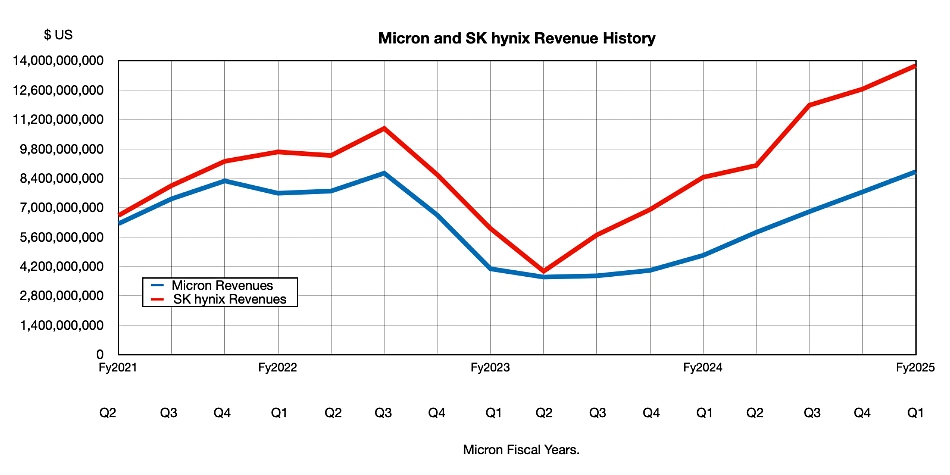

How does it compare to US competitor Micron, which also produces DRAM and NAND chips and SSDs?

The chart has been normalized to Micron fiscal years. It shows that SK hynix has grown faster than Micron after Q2 2023, most likely due to its dominance in the HBM market. Micron has revealed that it’s hoping to achieve an eventual 20 percent share of the HBM market, with CEO Sanjay Mehrotra saying: “Our HBM is sold out for calendar 2025, with pricing already determined for this time frame. In fiscal 2025, we expect to generate multiple billions of dollars of HBM revenue.”

We can conclude that Micron has a less than 20 percent share currently, meaning we might expect HBM revenues to be under half those of SK hynix, judging by publicly available information.

The Korean company “forecasts that the demand for HBM and high-density server DRAM, which is essential in high performance computing, will continue to increase as the global big tech companies’ investment in AI servers grows and AI inference technology gains importance.” The Korean Times reports that SK hynix expects its HBM sales to double in 2025.

It plans to expand current HBM3E production, with an earnings call comment saying: “Within the first half of this year, HBM3E will account for more than half of our HBM … And also, we believe 12-layer HBM4 will be our flagship product in 2026, and will finish developing and mass-producing 12-layer HBM4 this year, so that we can deliver it to customers on schedule … We aim to complete the development and preparation for mass production of HBM4 in the second half of this year and begin supplying them … The HBM4 supply will start with 12-layer chips and followed by 16-layer. The 16-layer chips are expected to be delivered in line with customer demands, likely in the second half of 2026.”

The company sees that sales of AI-equipped smartphones and PCs should expand, driving its sales into the consumer market higher in the second half of 2025.

SK hynix is so profitable that it has lowered its debt by ₩ 6.8 trillion ($4.73 billion) to ₩22.7 trillion ($15.8 billion) compared to the end of 2023, “leading to a significant improvement in the debt ratio and net debt ratio to 31 percent and 12 percent respectively.” The company has also raised the annual fixed dividend by 25 percent to ₩1,500 ($1.04) per share share and has decided to put aside 5 percent of its free cash flow, which was formerly included in the dividend payouts, to enhance its financial structure.

Unless the AI boom stops soon, SK hynix appears set for continued quarterly revenue rises throughout 2025.