Analyst house Gartner has named Veeam number one for market share in the global enterprise backup and recovery software market for the first time, displacing Veritas from the top position.

Veeam achieved this ranking as part of the Gartner Market Share Analysis: Enterprise Backup and Recovery Software, Worldwide, 2023 report, based on a market share of 15.1 percent, revenues of $1.5 billion and 11.8 percent year-over-year growth in 2022-2023.

Blocks & Files has obtained a summary of the paid report from Gartner to examine the performance of other major vendors in the backup and recovery market. But first the puff from Veeam in response to its new Gartner ranking.

“Today, every organization relies on the availability of data no matter what happens. When the worst happens – whether due to ransomware or a natural disaster or an inadvertent security update – data resilience is critical,” said Anand Eswaran, CEO at Veeam, in a statement. “At Veeam, we are powering data resilience from backup and recovery to end-to-end ransomware protection for over 550,000 organizations in over 150 countries.”

The report provides an analysis of vendor market share, vendor performance, key trends affecting the market, and significant mergers and acquisitions for the calendar year.

Gartner states: “The enterprise backup and recovery software market grew at 5.1 percent in 2023, ending the year at nearly $10 billion in total revenue.

“Veeam returned to double-digit growth after experiencing revenue growth of 9.4 percent in 2022. In 2023, it expanded its revenue by 11.8 percent, and became number one in revenue and market share.”

However, it was a mixed bag for the other players in the market. “While the vendor showing the fastest revenue growth grew at close to 19 percent, revenue growth was slower for most market leaders, with an average under 3 percent,” said the analyst.

Cohesity and Acronis actually grew the most in terms of revenue, by 18.9 percent and 16 percent, respectively.

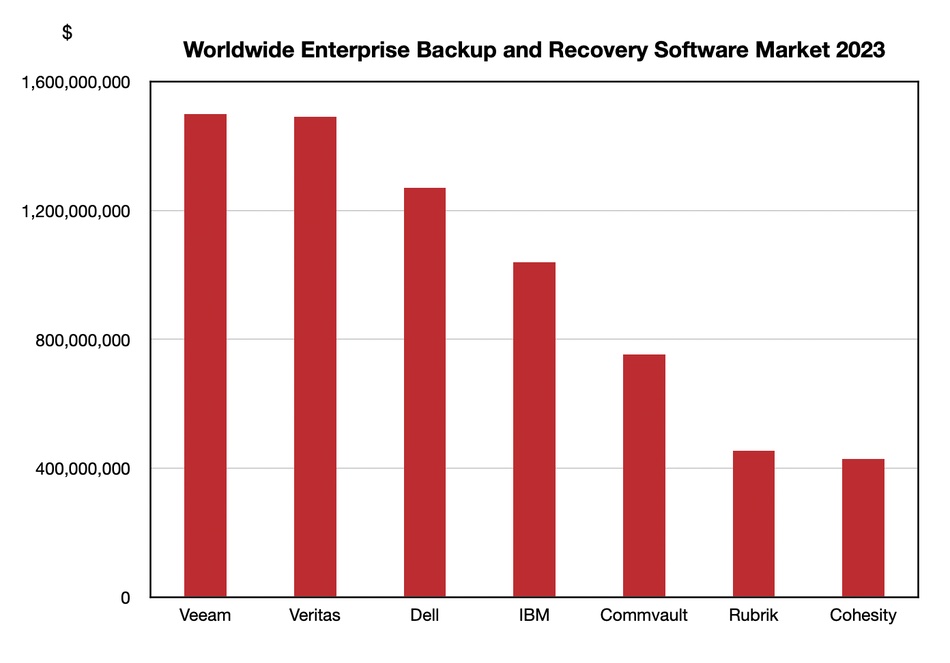

The top five in terms of revenue are: Veeam ($1.5 billion), Veritas ($1.49 billion), Dell ($1.27 billion), IBM ($1.04 billion), and Commvault ($753 million).

While Veeam holds a 15.1 percent market share, Veritas slipped to 15 percent, with Dell on 12.8 percent, IBM on 10.4 percent, and Commvault with 7.6 percent. Illustrating the crowded market, other vendors made up 39.2 percent of the market.

Compared to their 2022 growth, Veritas, IBM and Commvault experienced higher revenue growth of 3.2 percent, 3.3 percent and 5.3 percent, respectively, while Dell experienced a revenue decrease of 1.8 percent.

Veeam told us it is twice as large as Commvault, 3.3x bigger than Rubrik, and 3.5x bigger than Cohesity in revenue. In fact, Veeam is almost as big as Cohesity, Commvault, and Rubrik combined ($1.503 billion vs $1.637 billion), and Veeam has the fastest growth of the top five leaders (2x Commvault, 3.5x Veritas and IBM).

We have charted the actual top five revenue numbers and estimated Rubrik and Cohesity revenues, using Veeam’s 3.3x and 3.5x multiplier comparisons, respectively:

With Veritas set to merge with Cohesity, this combination may well become the market leader in terms of sales and market share going forward. Their combined 2023 revenues were $1.92 billion, putting them clearly in the lead.