After last quarter’s 14 percent Y/Y revenue drop, HPE reported a three percent increase in its latest quarter, driven by AI system sales, and outperforming last quarter’s outlook by some measure. It raised its full year revenue expectations as a result.

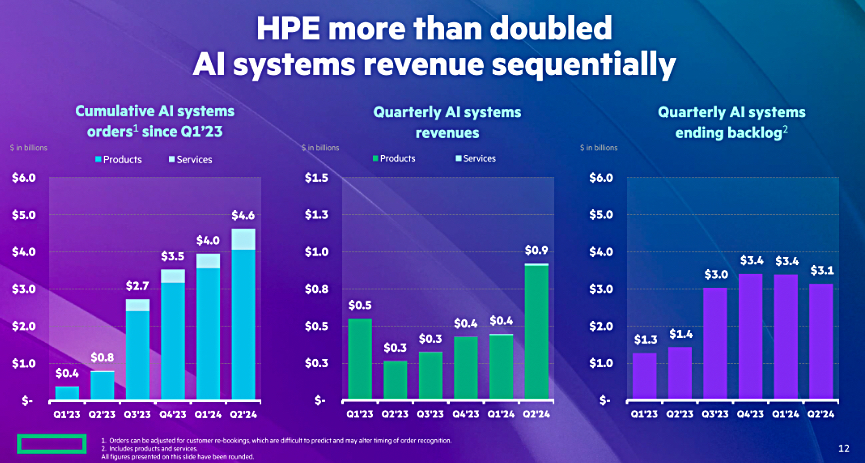

Revenues of $7.2 billion were well north of last quarter’s 6.8 billion outlook, although its profits were down to $314 million, 24.9 percent lower that the year-ago profit. The server business unit brought in $3.87 billion, up 18 percent on the year. It grew orders for trad servers both Q/Q and Y/Y and AI server revenues grew as well. In fact AI systems revenue of $900 million+ more than doubled Q/Q.

The Intelligent Edge business unit was down 19 percent annually to $1.1 billion with Hybrid Cloud bringing in $1.26 billion, down 8 percent. Although corporate investments and other earned $252 million, up 8 percent, and Financial Services $867 million, up 1 percent, the numbers were too small to swing HPE’s financial needle significantly.

President and CEO Antonio Neri’s statement said: “HPE delivered very solid results in Q2, exceeding revenue and non-GAAP EPS guidance. AI systems revenue more than doubled from the prior quarter, driven by our strong order book and better conversion from our supply chain.”

Financial summary

- Gross margin: 33.0 percent, down three percent year-over-year

- Operating cash flow: $1.1 billion

- Free cash flow: $610 million

- Cash, cash equivalents, and restricted cash: $3.9 billion vs $2.8 billion last year

- Diluted earnings per share: $0.24, 25 percent lower than last year

- Capital returns to shareholders: $214 million in dividends and share buybacks

Neri said in the earnings call: ”I am very optimistic about where we’re headed. AI demand continues to accelerate with cumulative AI systems orders reaching $4.6 billion this quarter. We anticipate continued revenue growth driven by increased AI systems demand, continued adoption of HPE GreenLake, and ongoing improvement in the traditional infrastructure market, including servers, storage, and networking.”

The AI sector is turning into a goldmine for the company – at least during the current time period. After initial public and sovereign cloud orders: “Enterprise orders now comprise more than 15 percent of our cumulative AI systems orders, with the number of Enterprise AI customers nearly tripling year-over-year. As these engagements continue to progress from exploration and discovery phases, we anticipate additional acceleration in enterprise AI systems orders through the end of the fiscal year.”

CFO Marie Myers amplified this view: “We remain in the very early days of AI, yet it is already driving strong interest, pipeline, orders, and revenue across our portfolio from service to storage to services to financing. Our AI system revenue inflected positively in Q2. We are winning deals in the AI market now and are well positioned for additional demand from enterprises and software into the future.”

HPE’s edge over competing AI server suppliers is its Cray supercomputing business and, Neri stressed, HPE’s decades of liquid cooling experience and credentials with its more than 300 patents in the area. GPU servers will increasingly need to be liquid-cooled. The company also managed to sell its AI systems without having to compress profit margins which unfortunately affected Dell’s AI server sales results.

HPE recruited around 3,000 new customers to its GreenLake subscription service and its as-a-service total contract value went past $15 billion. The total GreenLake customer count is now 34,000. This is an annual recurring revenue bank for the future.

Storage

In storage, Neri said: “More than 1,000 new HPE Alletra MP systems have been deployed to date, which is the fastest product ramp in the history of our company.”

Myers said: “Our traditional storage business was down year-over-year. The business is managing two long-term transitions at once.” The first is the migration to the SW-focused Alletra platform. Myers said: “This is reducing current period revenue growth, [but] locking in future recurring revenue.”

The second ”is from block storage to file storage driven by AI. While early, this is also on the right trajectory. Our new file offerings, plus [a] sales force investment Antonio mentioned, tripled our pipeline of file storage deals sequentially in Q2.” That’s good news for VAST Data whose file storage SW is OEM’d by HPE.

She said “Reduced revenue scale and an unfavorable mix of third-party products and traditional storage was the largest driver of the sequential change,” in the storage operating margin of “0.8 percent, which was down 300 basis points sequentially and 110 basis points year-over-year.”

Networking was dull, with Neri saying “the market remained in transition during the quarter, as customers continued to work through their current inventory.”

The Q3 outlook is for revenues of $7.6 billion+/-$200 million, an 8.5 percent rise from a year ago. The full fy2024 outlook is one to three percent in constant currency terms. It was flat to two percent before. Neri noted: “Our lead time to deliver NVIDIA H100 solutions is now between six and 12 weeks, depending on order size and complexity. We expect this will provide a lift to our revenues in the second half of the year.”

Myers added: “We expect a materially stronger second half led by AI systems, traditional servers, and storage, networking and HPE GreenLake.”