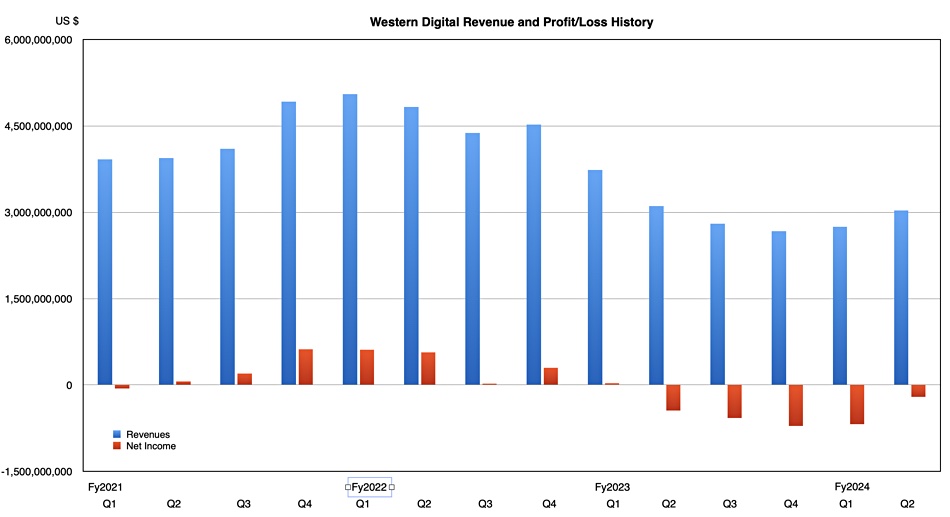

The disk/SSD downcycle low point has been reached for Western Digital with its second successive sequential revenue growth quarter.

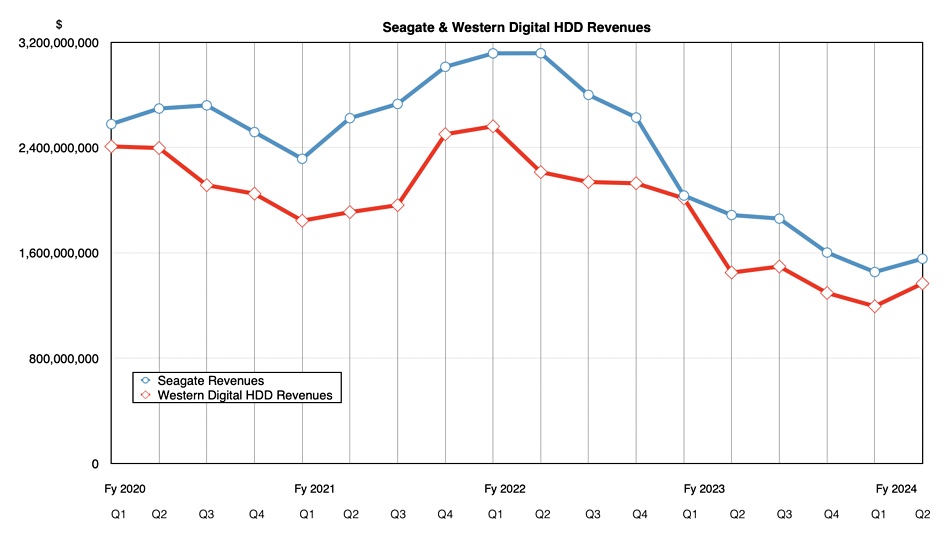

Revenues in the second quarter of its fiscal 2024, ended December 29, were $3.03 billion, two percent down yer-on-year but up 10 percent sequentially. There was a loss of $268 million, lower than the year-ago $446 million loss. The charted pattern of quarterly results clearly shows a trough has bottomed out:

WD CEO David Goeckeler said in a canned statement: “Western Digital’s second quarter results demonstrate that the structural changes we have put in place over the last few years and the strategy we have been executing are producing significant outperformance across our flash and HDD businesses.”

Overshadowing the results [PDF] are WD’s decision to split its HDD and SSD units into separate businesses and Seagate’s newly opened-up capacity and density lead with its HAMR tech – but we’ll finish with the quarter’s numbers before getting to these issues.

Financial summary

- Gross margin: 16.2% vs 17% a year ago

- Operating cash flow: $92 million

- Cash and cash equivalents: $2.48 billion

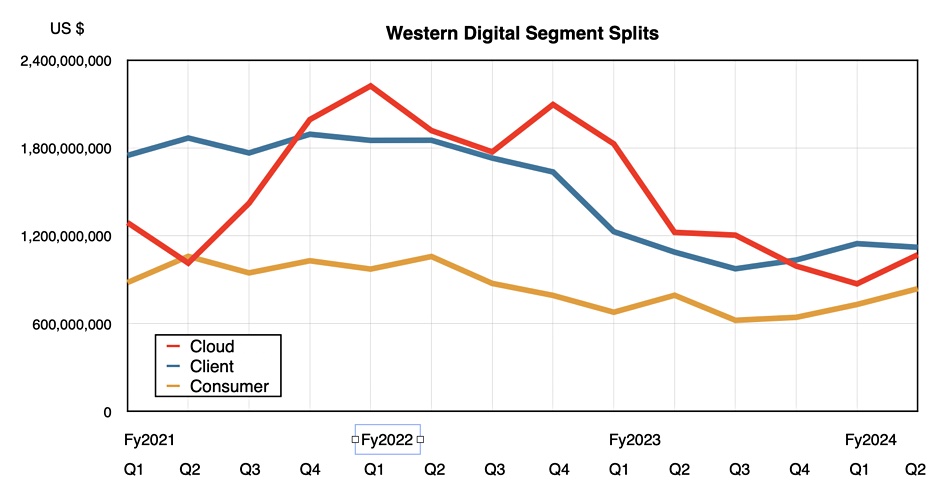

WD sells its SSDs and HDDs into three markets: cloud (enterprise and CSP), client (PC and notebook), and consumer (retail). The client ($1.1 billion, up 3% y/y) and consumer ($839 million, up 6% on seasonal buying) segments grew year-on-year while cloud ($1.1 billion, down 13%) went downhill year-on-year but rose an encouraging 23 percent sequentially;

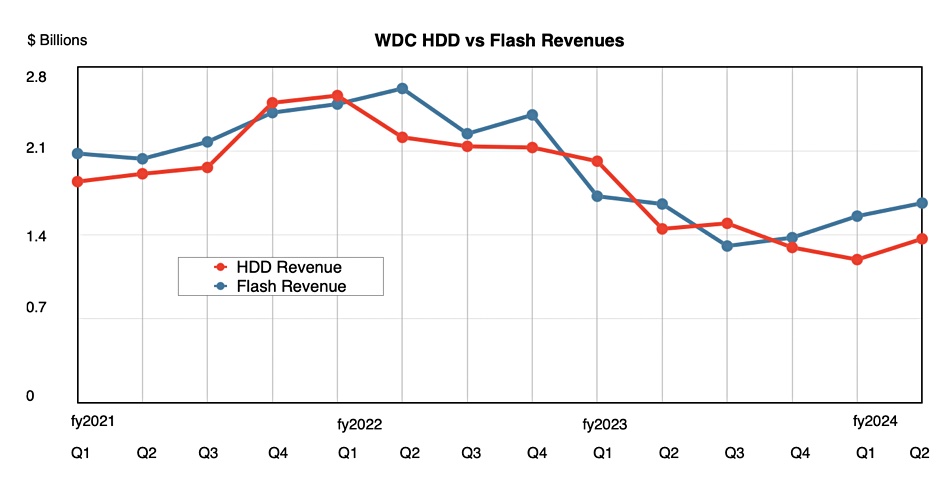

Its flash-based revenues were $1.7 billion in the quarter, flat year-on-year, while HDD revenues at $1.4 billion were down six percent, although up sequentially. Goeckeler said: “The sequential revenue increase was driven by improving nearline demand and pricing. Moreover, we are encouraged by demand in China with revenue doubling on a sequential and year-over-year basis, both of which were ahead of our expectations. We anticipate year-over-year growth in HDD throughout this calendar year.”

WD said its WD_BLACK gaming SSD products achieved record revenue with bit shipment growth of over 50% year-over-year.

SMR (shingled magnetic recording) disk drives were important as WD shipped approximately one million UltraSMR hard drives in both the first and second quarters of fiscal 2024. It expects SMR drive shipments to comprise the majority of nearline demand by calendar year 2025. Goeckeler said: “SMR drive shipments to continue to outgrow that of CMR drives going forward. Importantly, the adoption of UltraSMR is broadening to our major customers worldwide including a third cloud titan in the US this year, as well as hyperscale and smart video customers in China.”

Goeckeler added: “The sequential revenue increase was driven by improving nearline demand and pricing. Moreover, we are encouraged by demand in China with revenue doubling on a sequential and year-over-year basis, both of which were ahead of our expectations. We anticipate year-over-year growth in HDD throughout this calendar year.”

WD’s disk revenues grew a little closer to industry leader Seagate’s as a chart shows;

Earnings call

Goeckeler was optimistic about the future in an earnings call with analysts on Thursday, saying: “In addition to the recovery in both flash and HDD markets, we believe storage is entering a multiyear growth period … We believe the second wave of generative AI-driven storage deployments will spark a client and consumer device refresh cycle and re-accelerate content growth in PC, smartphone, gaming, and consumer in the coming years. Our flash portfolio is extremely well positioned to benefit from this emerging secular tailwind.”

His prepared HDD remarks seemed, we stress “seemed,” inappropriate as Seagate has just announced its 30 TB and 32 TB HAMR drives, beating WD’s 24 TB PMR and 28 TB SMR disks capacity-wise. Goeckeler said: “In HDD, Western Digital’s leading ePMR platform and enhanced UltraSMR technology allow us to provide the highest-capacity drives for mass market deployment.” Well, actually they won’t, or will they?

He continued: “We have a strong conviction that our portfolio strategy of first commercializing Western Digital’s industry-leading UltraSMR technology, which will be followed by our transition from ePMR to HAMR offers the best TCO to our customers in both the near and long term while delivering leading portfolio profitability in the industry.”

Then he said: “Over the next several years, we will be introducing a number of exciting products, including multiple generations of nearline drives, combining ePMR, OptiNAND, and UltraSMR technologies in the 30 to upper 30-terabyte capacity range, all of which will be ready for high-volume production to support the explosion of AI training data and content.”

But Seagate is talking about shipping 40+ TB drives in two years. On this basis WD is falling behind. But, in answering a question on the call, Goeckeler said he sees it differently: ”I can tell you our customers have an enormous amount of confidence in our road map, in our current products, and you’re seeing that in the performance of the business. You’re seeing accelerating growth, you’re seeing better profitability, you’re seeing share gains, that’s a clear indication that customers are very happy with our products.”

Also: “For our portfolio, given our UltraSMR technology; it’s been adopted by the market. HAMR does not make sense until you get to four terabytes per platter and because HAMR adds a lot of costs to the product … We will transition to HAMR when we get to that four terabytes per platter, that’s the economic crossover, right, that we’re looking for from a portfolio management point of view.”

Forty terabytes is in reach with WD’s existing technology, Goeckeler said: “We’ve built a technology road map that allows us to get to 40 terabytes on very well-proven, cost-controlled, high manufacturing ability technology. And we’re looking forward to delivering that to the market over the next couple of years.”

NAND and SSDs

In the flash area Goeckeler said: “We remain on track to ramp an array of QLC-based client SSDs utilizing BiCS6 technology. Our ability to combine this new high-performance node with our in-house controller development allows us to offer a portfolio of client SSDs with unmatched performance and value. We expect these products to lead the transition to QLC flash in calendar year 2024. Additionally, BiCS8 yield is progressing well, and we remain on track to productize this technology.”

But WD will not increase flash manufacturing capacity, with Goeckeler saying: “Although flash pricing has started to increase, our profitability and cash generation continue to be well below the level that justify an increase in capital investments. We anticipate wafer equipment spending will remain at historic lows in the near term and flash to be undersupplied for an extended period of time. Overall, we will continue to focus on allocating our bids to the most attractive end markets and anticipate flash ASP increases to be the primary revenue growth driver throughout this calendar year.” Price increases will drive WD flash revenues higher.

The coming split between WD’s HDD and NAND/SSD businesses was not discussed. Wells Fargo’s Aaron Rakers expects an analyst day meeting in the mid to late-summer timeframe to focus on this.

Next quarter’s outlook is for revenues of $3.3 billion +/- $0.1 billion, which will be a 17.7 percent increase on the year-ago Q3. Let the good times roll.