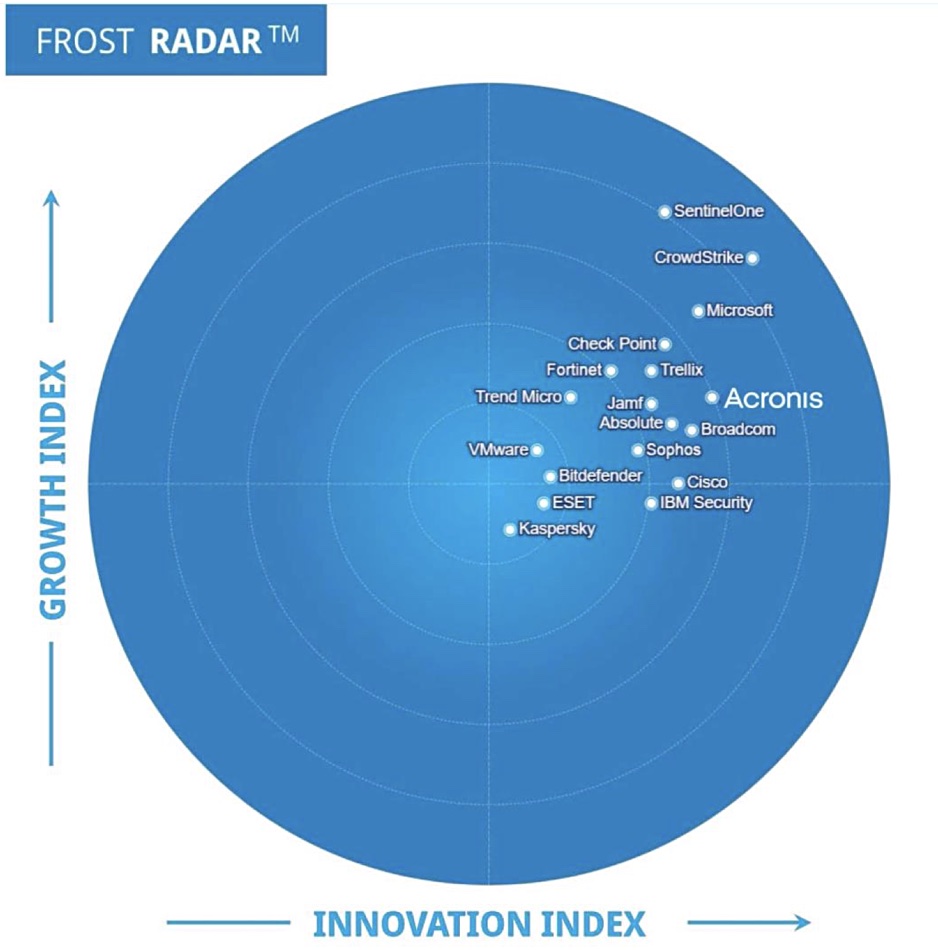

Data protection supplier Acronis has been highlighted in Frost & Sullivan’s Frost Radar report for Endpoint Security as one of the top companies in the space. The report highlights the innovation and growth potential of Acronis, and why it should be strongly considered by organizations looking to invest in or augment the protection of their endpoints. Get a copy of the Acronis section of the report here.

…

Cohesity announced that, according to IDC’s Semiannual Software Tracker, Data Replication and Protection Software, it had the fastest growing worldwide year-over-year revenue growth among the Data Replication and Protection Software market’s top ten largest competitors in the first half of calendar 2023. The IDC report is not publicly available.

.…

Commvault has appointed Michel Borst, based out of Singapore, as Area VP for Asia and Joanne Dean, based in Perth, as Area VP for Channels and Alliances, APAC, expanding its Asia Pacific leadership team.

…

Tiered backup storage target supplier ExaGrid has been named as a Representative Vendor in the November 2023 Gartner Market Guide for Enterprise Backup Storage Appliances. The report identifies three trends:

- Appliances-based deployments, mostly integrated appliances, will continue to see growth,

- Flash-based backup storage will increasingly replace hard drive capacity,

- Appliances with value-added services will see an increasing adoption.

The listed representative vendors are: Acronis, Arcserve, Cohesity, Commvault, Dell, ExaGrid, HPE, Infinidat, Object First, Pure Storage, Quantum, Rubrik and Veritas. Gartner suggests organizations can use a Market Guide to understand how the status of an emerging market aligns with future plans. Seeing Gartner call the backup target market an “emerging market” is unintentionally funny – the thing has been “emerging” for almost 20 years, ever since Data Domain launched its first system in 2004.

…

Fivetran announced that its data integration platform is being utilized by residential furniture supplier La-Z-Boy to break down data silos and accelerate data-driven decision-making across the organization.

…

Analyst firm DCIG has named the Nasuni File Data Platform a “Top Five Storage Solution” in the 15-page 2024-25 DCIG Top Five Enterprise Cloud-based NAS Consolidation Solutions report. DCIG evaluated 31 suppliers and the top five in alphabetic order were:

- CTERA Enterprise File Services Platform,

- Nasuni File Data Platform,

- NetApp Cloud Volumes ONTAP,

- Panzura CloudFS,

- Zadara zStorage.

Nasuni supports over 800 enterprise customers, including numerous Fortune 500 enterprises, in over 70 countries. Last year, it surpassed $100 million in annual recurring revenue (ARR) and continued its growth in 2023. Get a report copy here.

…

David Bennett, CEO at Object First, made two 2024 predictions. (1) In 2024, immutable backups will be a requirement for companies covered by cyber insurance. Cyber insurance underwriters will bring reality to the market. The average ransomware demand increased by 74% this year and cyber claims have already jumped 12%. In 2024, cyber insurers will have no choice but to raise premiums – a lot – in order to reel in losses, or take it upon themselves to advocate for better cyberattack preparation amongst their customers.

(2) Investments in data recovery and resiliency will increase massively in 2024. As immutability and object storage are elevated to the security stack, we will see a massive increase in data recovery and resiliency. Companies will realize they’re in over their head when it comes to ransomware and effectively protecting their data, and will look to their channel partners and vendors for help. The answer many channel partners/vendors will come back with is to focus on simple and secure backup storage solutions.

…

Quantum announced that MR Datentechnik, a German IT solutions and managed services provider, has implemented Quantum ActiveScale object storage as the foundation of its new MR S3 Storage Service for backup and recovery, archiving, and data security. MR Datentechnik wanted to support S3 applications and workflows for integration with its cloud storage solution, also to have the latest version of Veeam Backup & Replication supported.

…

Scality says Spanish VAD V-Valley, a subsidiary of the Esprinet Group, will distribute Scality’s RING and ARTESCA software-defined object storage products in Spain.

…

Seagate has launched a 24TB Skyhawk surveillance disk drive based on its 24TB Exos HDD technology announced in October. The existing SkyHawk generation tops out at 20TB. The MTBF rating jumps up from 2 million hours to 2.5 million hours, the cache doubles to 512MB, and the sustained data transfer rate increases to 285MB/sec from 260MB/sec. It has a RAID RapidRebuild feature that rebuilds volumes up to three times faster than standard hard drives. It also includes a five-year limited product warranty and three years of Seagate’s Rescue Data Recovery Service. Shipping this month, SkyHawk AI 24TB is available for $599.99. Datasheet here.

…

Veeam announced new Backup-as-a-Service (BaaS) capabilities for Veeam Backup for Microsoft 365 with Cirrus by Veeam and support for Microsoft 365 Backup Storage. Customers have three options in how they wish to utilize Veeam and manage Microsoft 365:

- Cirrus by Veeam: Delivers a simple, seamless SaaS experience, without having to manage the infrastructure or storage within Microsoft 365 Backup Storage,

- Veeam Backup for Microsoft 365: Deploy Veeam’s existing software solutions for Microsoft 365 data protection and manage the infrastructure,

- A backup service from a Veeam Cloud & Service Provider (VCSP) partner: Built on top of the Veeam platform, with value-added services according the provider’s area of expertise.

…

Wasabi issued its 2024 predictions from from Kevin Dunn, country manager UK/Ireland & Nordics. The first prediction is that, unfortunately, not much will change in the cloud market – or in the tech market more generally. The big players will continue to dominate at the cost of consumers and businesses, despite the regulations being finalized, planned, or promised which aim to redistribute power and influence away from the heaviest hitters. There will be a growing number of regulations to create a fairer market. AI will increase demand for storage providers and multi-cloud will become more common. All the new data being collected and stored to train AI should be copied and stored with another cloud provider for security.