GigaOm analysts have surveyed the cloud file storage area and found it necessary to split it into two distinct areas for its Radar reports: distributed cloud file storage, with a focus on collaboration, and high-performance cloud file storage. Three suppliers are present in both reports: Hammerspace, Nasuni and Panzura. CTERA leads the distributed cloud file storage area while NetApp is ahead in the high-performance cloud file storage report.

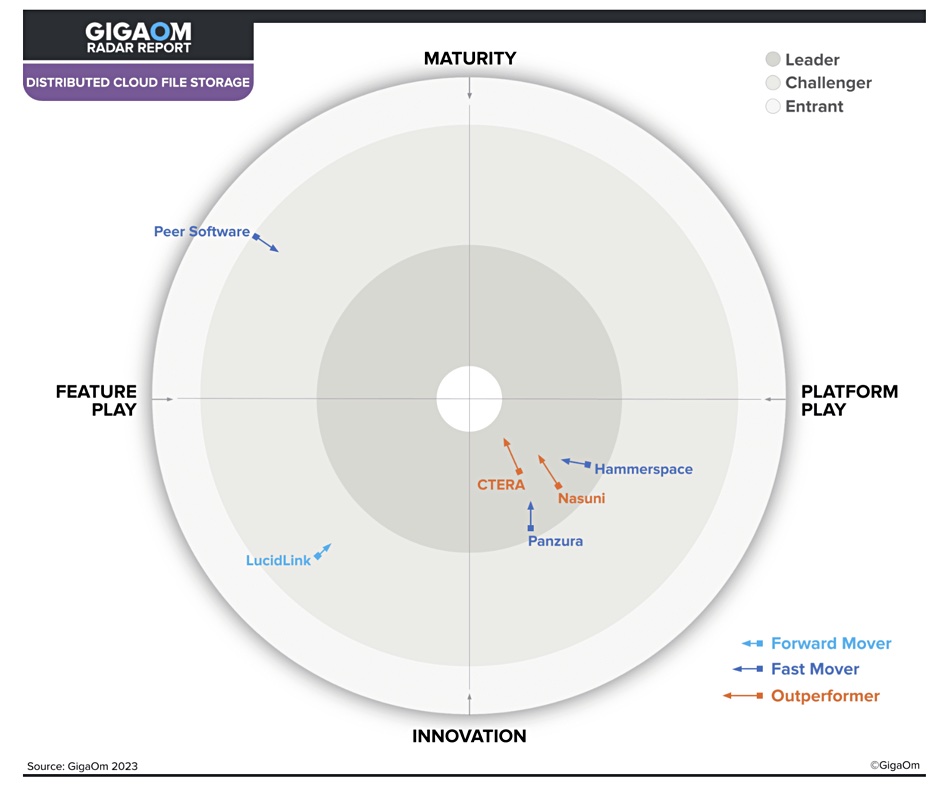

A Radar report is GigaOm’s view of the main suppliers in a market area, summarizing their attributes within three concentric rings – entrant (outer), challenger, and leader (inner) – with those set closer to the center judged to be of higher overall value. Vendors are located with reference to their scores on two axes – Maturity to Innovation and Feature Play to Platform Play. An arrow projects each vendor’s offering over the coming 12 to 18 months. The arrows represent three types: a forward mover, a fast mover, and an outperformer.

GigaOm Distributed Cloud File Storage Radar

There are just six suppliers present in the distributed file storage group: two separated outsiders in the challenger’s area, Peer Software and LucidLink; and a group of four close together in the Leaders’ ring with a balance between being innovators and generalized platform players.

The front-ranked supplier is CTERA, followed by Nasuni, both classed as outperformers, and then Hammerspace and Panzura. Hammerspace is a data orchestration supplier whereas CTERA, Nasuni, and Panzura are cloud file services suppliers with a collaboration focus.

Peer Software is described by GigaOm’s analysts as providing Global File Services (GFS) software on which customers can abstract distributed file services on top of existing storage infrastructure, and supporting scalability in the cloud. The company has an ambitious roadmap and recently introduced a new analytics engine, but it will take time to execute.

LucidLink’s Filespaces software presents on-premises applications with instant access to large S3 and Azure Blob-stored datasets over long distances, with local storage caching of the current data needed. It also works with on-prem object stores.

Analysts Max Mortillaro and Arjan Timmerman say: “Areas where we found the most significant variances were: data management, analytics, advanced security, and edge deployments. All of these areas are important, but we can’t stress enough the urgency of advanced security measures as a mitigation strategy against elevated persistent ransomware threats. Well-designed and varied edge deployment options are also critical now that most organizations must accommodate a massively distributed workforce.”

The vendors may need to provide data classification, data compliance, and data sovereignty features in the future.

GigaOm Radar for High-Performance Cloud File Storage

There are 14 suppliers who are placed in three groups:

- IBM (Storage Scale), Zadara, and DDN (EXAScaler) all classed as more mature suppliers

- Cloud file storage mainstreamers

- Public cloud group

NetApp is the clear front runner in the leaders’ area, followed by Hammerspace then Qumulo. Weka, Nasuni, and Panzura are challengers poised to enter the leaders’ ring. These six suppliers are more platform than feature-focused, and represent, in our view, a mainstream group.

It is somewhat surprising that Weka, very much focused on high-performance file data access, has a relatively low ranking, being beaten by NetApp, Hammerspace, Qumulo, and Nasuni. The report authors suggest Weka’s data management needs improving: “It is expected that, in the future, Weka will improve some of its capabilities in this area, notably around metadata tagging, querying, and so on.”

IBM, Zadara, and DDN are in a top right quadrant and classed as challengers.

ObjectiveFS, Microsoft, and Amazon are a separate group of challengers, with entrants Google and Oracle set to join them in a public cloud-oriented group that is more focused on adding features than being a platform play.

Timmerman and Mortillaro say: “The high-performance cloud file storage market is interesting. It might seem obvious to many that, thanks to their dominance and massive market share, public cloud providers would provide the most comprehensive solutions. Nothing could be further from the truth.

“The primary concern with these is that, with a few notable exceptions (such as Tier 1 partnerships with vendors such as NetApp), these public cloud solutions typically need additional adjustments and improvements to meet enterprise requirements.”

Hammerspace, Nasuni ,and Panzura are all present in GigaOm’s Distributed Cloud File Storage Radar report as well as this high-performance cloud file storage report. No other suppliers have a dual report presence.

You can read the report here courtesy of Hammerspace. It provides excellent and concise descriptions of each vendor’s offerings.

GigaOm Radar reports are accompanied by Key Criteria that describe in more detail the capabilities and metrics used to evaluate vendors in this market. GigaOm subscribers have access to these Key Criteria documents.