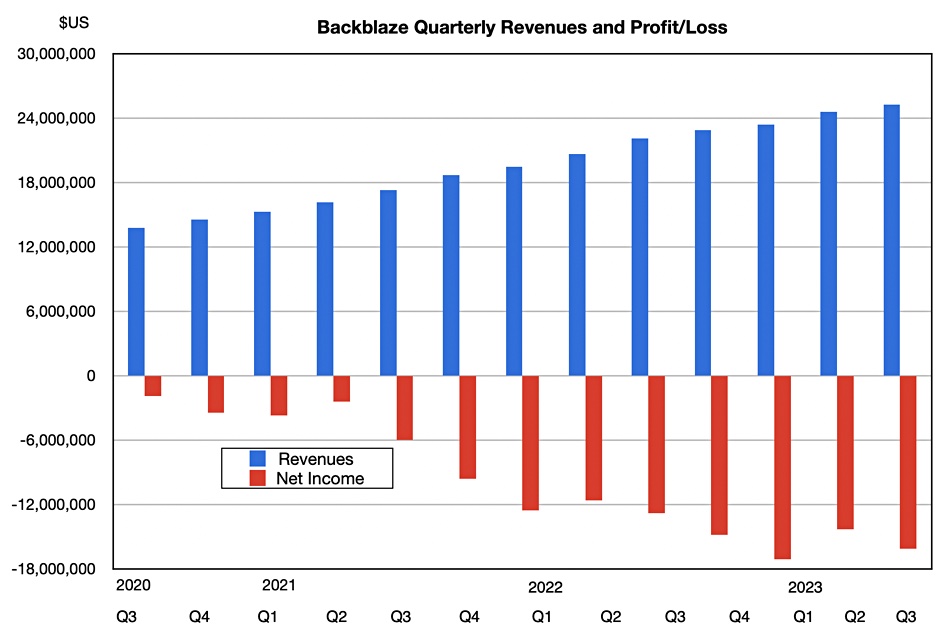

Cloud storage provider Backblaze grew revenues 15 percent year-on-year in its third 2023 quarter but backup storage revenues declined quarter-on-quarter.

Revenues were $25.3 million in the quarter ending September 30, with a loss of $16.1 million, as Backblaze prioritized growth over profitability. This compares to a year-ago loss of $12.8 million on revenues of $22.1 million. Cash, short-term investments, and restricted cash amounted to $35.8 million at quarter end.

Annual recurring revenue (ARR) rose 15 percent year-on-year to $100.9 million. CEO Gleb Budman said: “In Q3, we passed the $100 million in ARR milestone and are on track to achieve adjusted EBITDA profitability in Q4 through continued strong growth and efficient execution.

“Looking ahead, our recent price increase supports continued investments in the platform and positions us for profitable growth while continuing to offer customers a compelling and cost effective storage solution.”

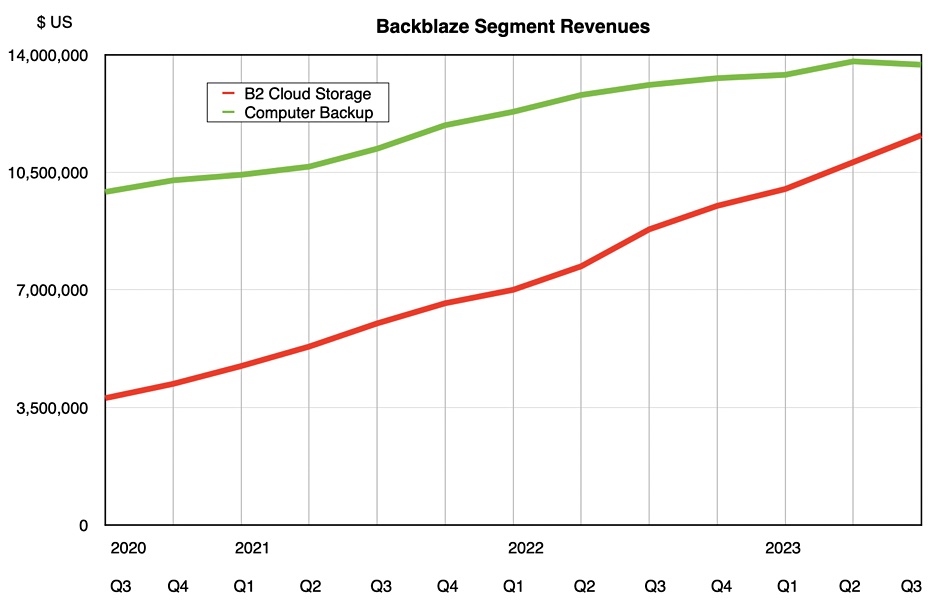

Its computer backup business brought in $13.7 million, up 4 percent year-over-year, while the B2 cloud storage business generated $11.6 million, but B2 cloud storage ARR rose 31 percent year-over-year to $46.8 million. There have been price increases for both B2 cloud storage and computer backup storage, with the larger increase for computer backup. That may have stymied growth. Customers can pay monthly or have one or two-year contracts.

Budman said: “We’ve actually seen some customers wanting to switch from monthly to one and two year to lock in the price point ahead of the pricing.” He doesn’t see the computer backup business growth rate getting to double figures. “We’re going to have a growth rate in the upper single digits for computer backup.”

Backblaze started off selling backup storage in its cloud then branched out into general B2 cloud storage, now the fastest-growing part of its business, representing 46 percent of revenues. Budman said: “Long-term B2 is overtaking as the dominant product quickly.” Backup suppliers like HYCU utilizing B2 cloud storage will contribute to this growth.

The company is offering free egress with its B2 cloud storage, and Budman said: “We saw new customers engage with us directly because high egress fees charged by other providers are a major pain point for them.”

Budman said in the earnings call: “We believe that we’re at an inflection point with higher revenue growth expected in Q4 and 2024 … We’ve made great progress on our financial performance, particularly adjusted EBITDA and cash.”

CFO Frank Patchel added: “Next quarter, we expect to accelerate revenue growth, reduce cash usage by about half sequentially, and reach positive adjusted EBITDA … We expect Q4 adjusted EBITDA margin between a positive 1 percent and a positive 3 percent. Q4 is expected to be our first quarter of positive adjusted EBITDA as a public company.”

He also said: “Cash break-even would be in the first half of 2025.” Profitability should follow after that, it will be hoping.

Backblaze said it would use CoreSight colocation facilities in Reston, Virginia, for its expanded service in the eastern US data region.

The outlook for Backblaze’s final 2023 quarter is for revenues of $29.1 million plus/minus $400,000, a 21 percent rise from a year ago at the mid-point. Full 2023 year revenues would then be $101.6 million, a 19 percent annual increase.