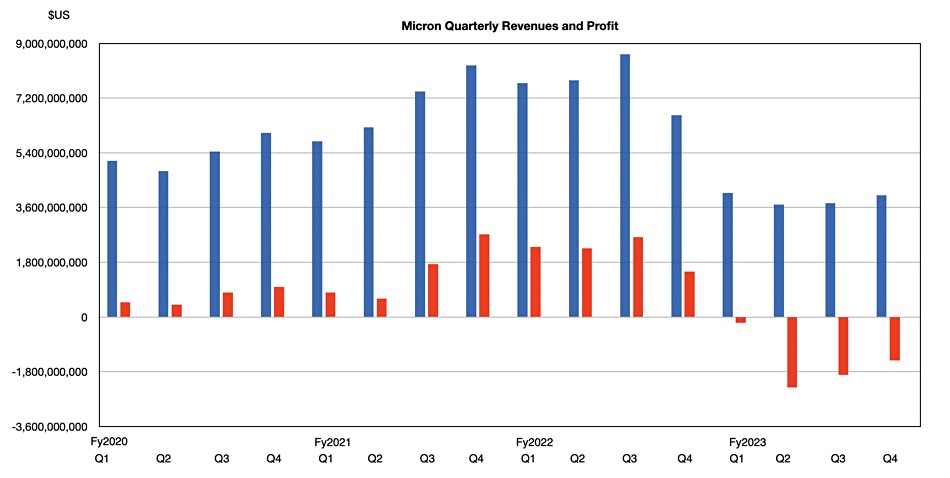

Micron revenues fell again – as expected – in its final quarter of fiscal 2023 ended August 31, with a crappy economy and biting sanctions that prevent its products being sold in China the contributing factors. Execs are trying to put a brave foot forward, banking on a recovery over the following twelve months helped by surging demand for generative AI.

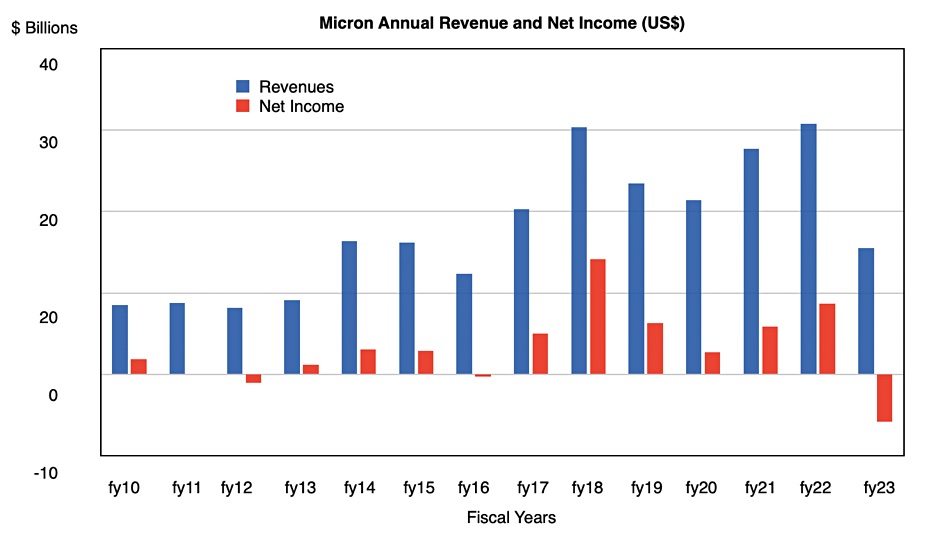

The memory/NAND and SSD maker’s Q4 revenues were down 40 percent year-on-year to $4.01 billion, and it recorded a net loss of $1.43 billion compared to the year-ago $1.49 billion net profit. This is its fifth successive quarter of declining revenues. Full fy2024 revenues were $15.54 billion, down 49 percent, and a net loss of $5.83 billion contrasted sharply with the year-ago’s $8.7 billion profit.

President and CEO Sanjay Mehrotra’s said in a statement: “During fiscal 2023, amid a challenging environment for the memory and storage industry, Micron sustained technology leadership, launched a significant number of leading-edge products, and took decisive actions on supply and cost.”

Micron’s results were affected by China and its Cyberspace Administration (CAC) declaration back in May that Micron’s products represent a security risk in the country and therefore should not be bought by “operators of critical information infrastructure.” That has affected some of Micron’s datacenter and networking sales in China, and is baked into its forward guidance. Micron is working with CAC to resolve the issue but if it is a tit-for-tat response to US technology export bans against China then any resolution will not come quickly.

Micron said it achieved record automotive revenue, record NAND QLC bit shipments for the full fiscal year, and reached record levels in calendar Q2 (fyQ3/Q4) for revenue share in data center and client SSDs.

Q4 fy204 financial summary

- Gross margin: -9 percent

- Operating cash flow: $249 million vs $24 million in prior quarter and $3.8 billion a year ago

- Free cash flow: -$758 million

- Diluted EPS: -$1.31 vs year-ago $1.35

- Cash and investments: $10.5 billion

- Liquidity: $13 billion

- Total debt: $13.3 billion

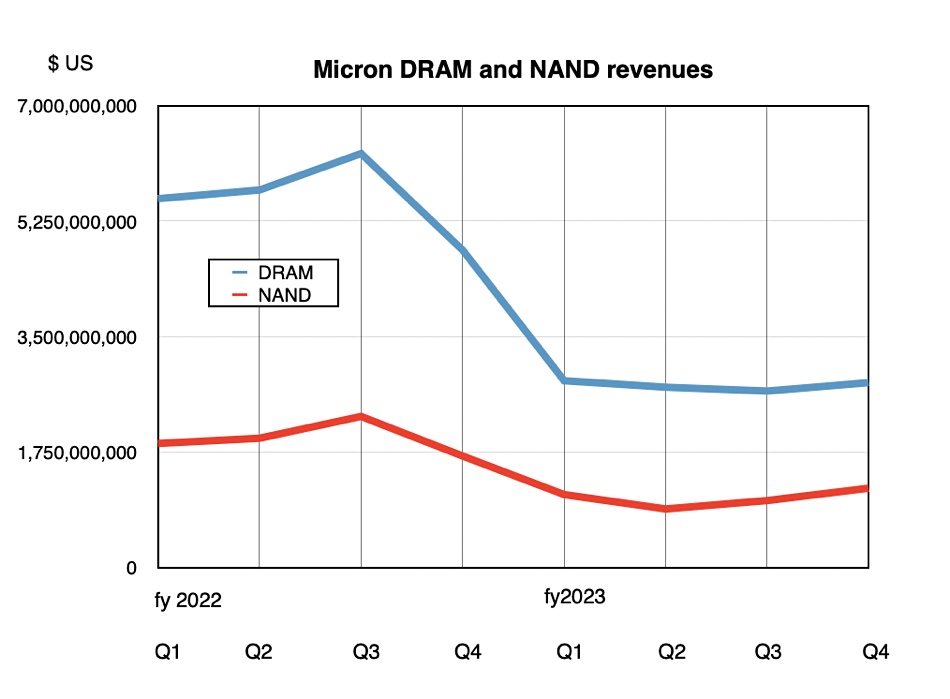

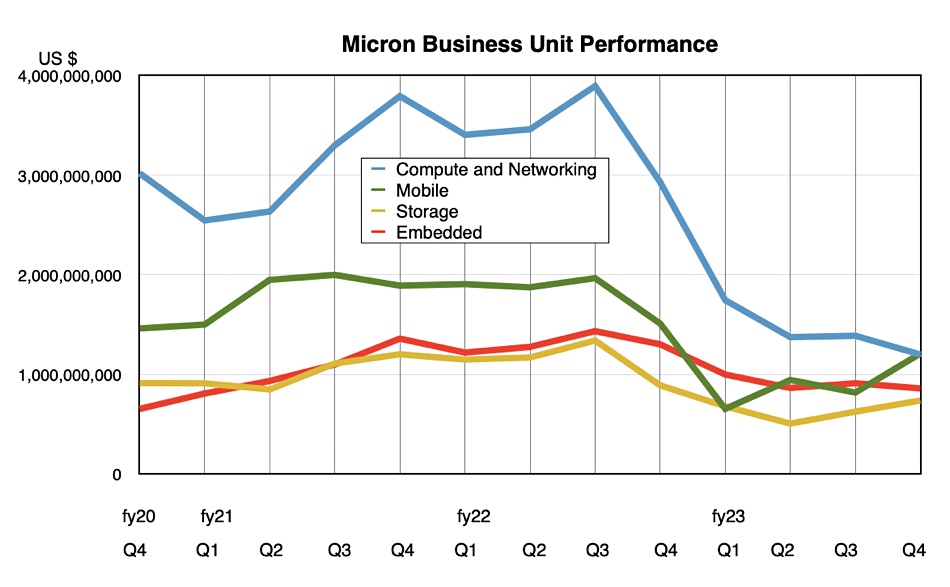

These revenues reflect sales into vertical and geographic end markets, and can be sub-divided into NAND and DRAM-based revenues and also into business unit earnings. We’ll take DRAM and NAND first.

DRAM revenues of $2.8 billion were down 42 percent year/year but up 3 percent quarter/quarter while NAND revenues of $1.2 billion were up 19 percent Q/Q while still being down 29 percent Y/Y.

The chart above shows that Micron’s NAND downcycle bottomed out two quarters ago but the memory downturn has only just started to climb out of a deeper trough, indicating lower server and PC memory demand may be responsible.

Divisional revenues:

- Compute and networking: $1.2 billion – down 59 percent Y/Y and down 14 percent Q/Q

- Mobile: $1.21 billion – down 20 percent Y/Y and up 48 percent Q/Q

- Storage: $739 million – down 17 percent Y/Y but up 18 percent Q/Q

- Embedded: $860 million – down 34 percent Y/Y and down 6 percent Q/Q

The BUs sell into different end markets: the datacenter, PC, mobile, and embedded (automobile and industrial) sectors.

Customers in general are buying fewer products as they reduce their DRAM, NAND and SSD inventories due a depressed economy, weighed down by factors including COVID-19, a slowdown in China, and the Ukraine war. Micron said most customer inventories for memory and storage in the PC and smartphone markets are now at normal levels, as they are across most customers in the automotive market as well. Not so in the datacenter space, although customer inventory there is also improving and will likely normalize in early calendar 2024.

In the datacenter area traditional server demand remains lackluster while demand for AI servers has been strong. AI training servers contain significantly higher DRAM and NAND content, with HBM3E memory a necessary GPU component. Total server unit shipments are expected to decline in calendar 2023, the first year-over-year decline since 2016, but market revenues are touted to expand given the richer configurations.

Mehrotra said: “We believe our data center revenue has bottomed, and we expect growth in fiscal Q1 and increasing momentum through fiscal years 2024 and 2025 in our data center business.”

Micron expects total server unit growth to resume in calendar 2024 (starting in Micron’s fy24 Q2) as workload demand, helped along by AI, starts rising, and it projected to keep on rising.

Datacenter DRAM revenues should be helped by Micron beginning the HBM3E production ramp in early calendar 2024, and to achieve meaningful revenues in the corporation’s fiscal 2024. But HBM3 growth will reduce overall DRAM unit growth because an HBM3 and HBM3E die are roughly twice as large as a DDR5 DRAM die, meaning HBM3 and 3E demand will absorb an outsized portion of industry wafer supply.

The company said its HBM3E technology is currently in qualification for Nvidia GPU products. Mehrotra said in the earnings call: “We are very much still on track for meaningful revenue, several hundred million dollars in our fiscal year ’24. … Micron will be well-positioned to capture the generative AI opportunities that require the kind of attributes that our HBM3E memory brings to the market.”

The mobile market is gradually improving, and Mehrotra said: ”We expect calendar 2023 smartphone unit volume to be down by a mid-single-digit percentage year over year and then grow by a mid-single-digit percentage in calendar 2024. “

The PC market is also tipped recover from declining unit shipments in calendar 2023 to grow by low to mid-single-digit percentage in calendar 2024. AI-enabled PCs may drive memory content growth and an improved refresh cycle over the next two years, at least Intel and others are crossing their fingers for this outcome.

The automobile market held up in 2023 with Micron reporting record revenues and saying it has the leading market share; yet it provided no numbers for either claim. It expects that in the long term memory and storage content per vehicle will increase in both advanced driver-assistance systems (ADAS) and in-cabin applications. Electric vehicles typically have more memory and NAND content than traditional cars so as EV sales rise so too should Micron’s automotive sector revenues.

Sales into the industrial embedded market showed recovery signs in the quarter and Micron expects this to continue in fy2024.

Looking ahead, Mehrotra said: “Our 2023 performance positions us well as a market recovery takes shape in 2024, driven by increasing demand and disciplined supply. We look forward to record industry TAM revenue in 2025 as AI proliferates from the data center to the edge.”

Generative AI may well generate a revenue increase from DRAM needed for running models and NAND used to store their data.

The outlook for the next quarter (Q1fy2024) is for revenues of $4.4 billion +/- $200 million. This is 7.7 percent higher than the year-ago Q1’s $4.1 billion and indicate’s Micron’s overall revenue downcycle has bottomed out.