Analysis. One of the most important discussions in the storage industry has been opened up by Pure Storage saying no new hard disk drives (HDDs) will be sold after 2028. Pure’s bold claim means that all the capacity of the new HDDs – ones not replacing failed drives – that would have shipped in 2029 will be replaced by shipped SSD capacity. That is a huge number of extra SSD shipments, and raises a question about global NAND manufacturing capacity being able to make enough flash.

We attempted to work out if Pure’s prediction was even possible, just from the NAND manufacturing point of view – ignoring TCO implications for HDDs and SSDs. This needs justifying.

HDD and SSD price trends

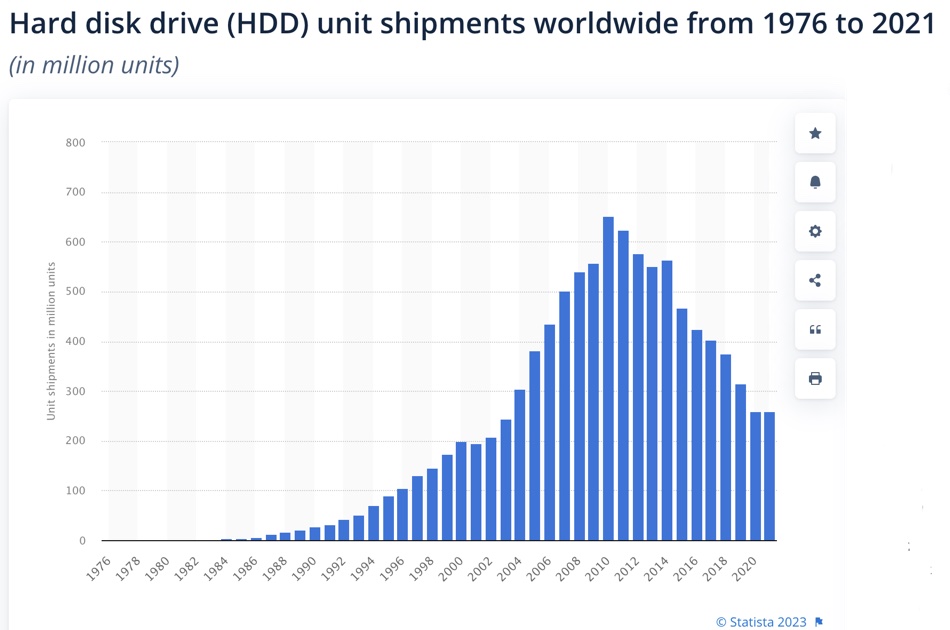

Hard disk drive sales in unit terms have been consistently falling for more than five years because SSDs offer a compelling alternative in more and more drive categories. SSDs respond to I/O requests faster than HDDs because they don’t have to wait for a read-write head to be moved across a platter’s surface to the right track, and then wait until the disk’s rotation brings the right data block to the head.

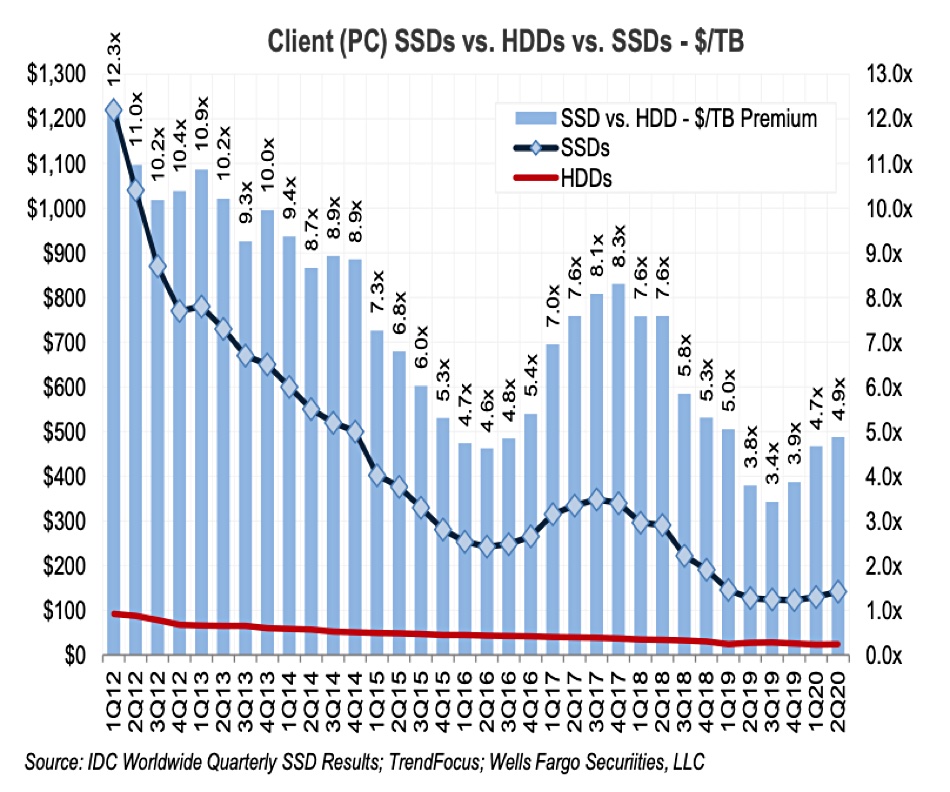

SSD costs have been falling steadily – though at a decreasing rate as the amount of flash capacity in a die has increased. This is due to three things: the NAND die components shrinking in size, the addition of more layers of cells in 3D NAND technology, and the use of multi-bit cells with TLC (3bits/cell) now mainstream. Data reduction technologies (compression and deduplication) mean that an SSD can hold more data than its raw physical capacity, moving its cost per TB closer to HDDs when they don’t use data reduction.

The overall HDD market has declined because of this. Notebook computers have almost completely to SSDs, desktop PCs are following suit, and fast (10,000rpm 2.5-inch) mission-critical HDDs are being replaced by SSDs as well. The HDD business market is coalescing around nearline (7,400rpm, 3.5-inch) drives. However, QLC (4bits/cell) SSD technology brings SSD cost per TB down another notch, and continuing layer count increases will sustain this downward trend.

HDD manufacturers say their technology advances, such as HAMR, will continue to bring their prices down and so preserve their cost advantage over SSDs. Flash drive prices will not become lower than HDD prices because HDD cost declines will sustain magnetic media’s affordability.

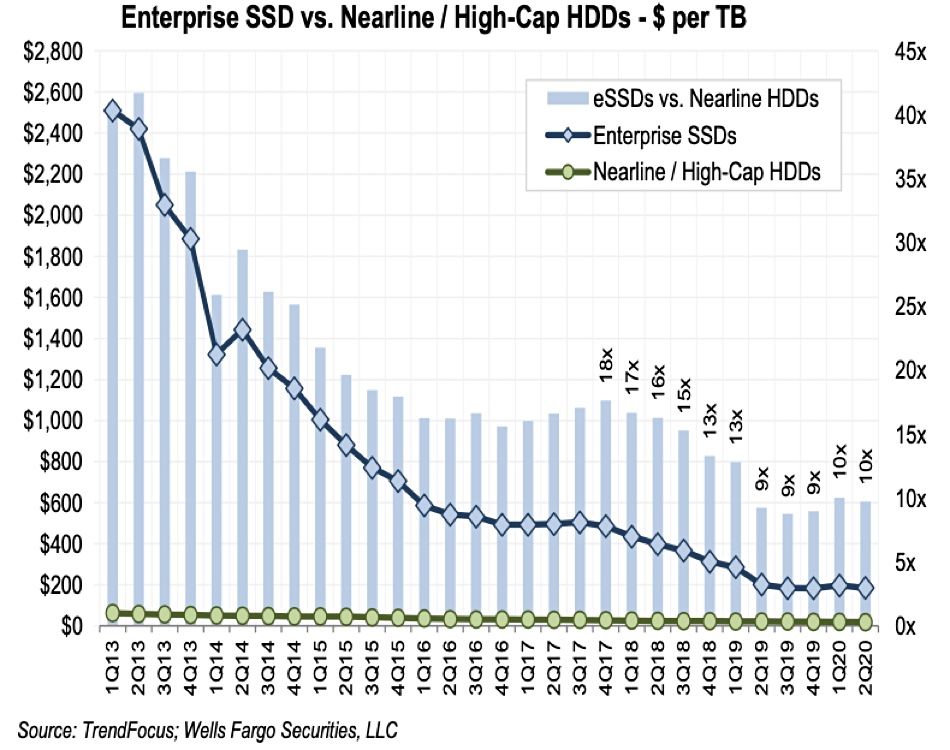

Wells Fargo senior analyst Aaron Rakers predicted in 2019 that enterprise storage buyers will start to prefer SSDs when prices fall to 5x that of hard disk drives. He noted an 18x premium in 2017 for enterprise SSDs over mass capacity nearline disk drives. This dropped to a 9x premium in 2019. In 2020 Rakers said enterprise SSDs cost in general $185/TB and nearline HDDs cost about $19/TB – meaning enterprise SSDs carried a 9.7x price premium. This stayed constant for several quarters, as a chart shows:

Customers of HDDs generally want faster data access and would use SSDs if the costs were equal to or at least not too much more than HDDs, and SSDs lasted as long as HDDs. The barrier to this happening, as analysts have pointed out, is that there simply isn’t enough NAND manufacturing capacity in the world to replace all the HDD capacity that customers buy.

Pure has become the first flash storage supplier to say unambiguously that flash will replace hard disk drives. It claims its QLC flash systems can replace nearline storage drive arrays because their TCO over five years is lower than that of a nearline drive array. The continuing decline in flash’s cost per TB, coming from even higher density drives, will strengthen this advantage.

A TCO calculation starts from acquisition prices, and then brings in drive lifetime power and cooling costs, and also disposal costs at end-of-life. These are estimated as they lie in the future, and disk drive manufacturers can present alternative numbers based on different assumptions.

Even setting the cost and price issues aside, the question remains of whether there is enough NAND manufacturing capacity to replace the millions of hard drives sold each year.

NAND manufacturing capacity

Micron Senior Director Colm Lysaght said in 2019: “Clearly SSD price/GB will get closer to HDD price/GB over time … However, the raw number of EB needed for a ‘wholesale switch’ from nearline HDD to SSD is far too large for the NAND flash industry to contemplate. The capital investment needed to generate the EB required … is prohibitively expensive.

“SSDs may nibble (and maybe even munch) at the nearline HDD market, but both will coexist for many years to come.”

Analysts such as Wikibon’s David Floyer have said NAND manufacturing capacity will not be a limiting issue. He forecast in 2021 that NAND production efficiencies will result in SSDs becoming cheaper than HDDs on a dollar per terabyte basis by 2026. That is a bold claim.

Here we are in 2023 and Pure has essentially indicated that it thinks flash manufacturing capacity will not be a limitation – “The capital investment needed to generate the EB required” is no longer “prohibitively expensive.” Is that true? Can NAND manufacturing cope with the disk drive capacity replacement load?

Modeling NAND manufacturing

To work out if the NAND foundry industry can produce the capacity needed for the growth in SSD data storage needs and replace new HDDs by 2029, we have to estimate stored data growth rates, current shipped HDD and SSD capacity, and NAND foundry capacity. How much does that foundry capacity have to increase to match the need, and how will increasing NAND layer counts and bits/cell increases affect the manufacturing output?

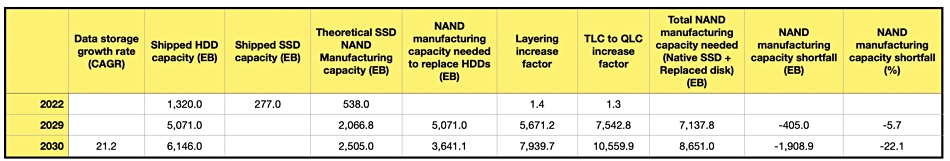

We set out an initial simplified spreadsheet model and shared that with some analysts and vendors, whose views improved and refined the model. Bottom line, it suggests that there will be a 5.7 percent shortfall in NAND foundry output in 2029 – 405 exabytes.

Model assumptions

We start with approximately 1,320EB of HDD capacity and 277EB of SSD capacity shipped in 2022 – gleaned by checking vendor and research house numbers. If the 1,320EB of shipped HDD capacity in 2022 falls to zero EB by 2029 and data growth continues, the SSD industry will have to grow to meet its own market needs and also supply the missing HDD contribution.

It will be affected by stored data growth in the interim period. This will involve fairly simplistic assumptions, but that’s acceptable here because we are only trying to see if the manufacturing capacity basics are in place. Jim Handy of Objective Analysis said: “IDC’s Datasphere is frequently quoted as a measure of the speed with which data production is growing. They say that 221,178 exabytes of data will be generated in 2026, and that can be trended out to 394,127 in 2029.” That provides a 21.2 percent data growth CAGR from 2026 to 2029.

We apply that to the shipped HDD capacity in 2022 to arrive at 5,071EB needed in 2029. Next we ask how much NAND manufacturing capacity existed in 2022? Handy tells us: “2021 EB shipments were 538EB, so they had the capacity to have shipped at least that much in 2022.” That.s our start point.

We trend that out to 2029 using the 21.2 percent CAGR number to reach 2,067 EB in 2029. Then we add in the HDD replacement number – 5,071 EB – to get 7,137.8EB of NAND manufacturing capacity needed in 2029.

How much will additional 3D layering and QLC bring on stream? Handy told us: “New capacity will be needed, and it’s being brought on line at a rate to support annual EB growth of ~30 percent. Flash layers have doubled about every two years. That gives the industry a growth rate of about 40 percent, so they don’t need to add layers at that high of a rate. I don’t know if a doubling of layers will require a doubling of fab tooling and floor space to process a fixed number of wafers, though.”

That’s a big if.

We’ll use a 40 percent addition from increased layering per year to total an extra 3,375.9EB in foundry capacity in 2029. Say there’s an additional 33.3 percent increase with a switch from TLC (3bits/cell) to QLC (4bits/cell) NAND. That brings us to 5,671.2 EB x 1.33 = 7,542.8 EB – a shortfall of 405EB from the 7,137.8EB needed. It means extra NAND manufacturing capacity is required, and that implies new NAND foundries will have to be built.

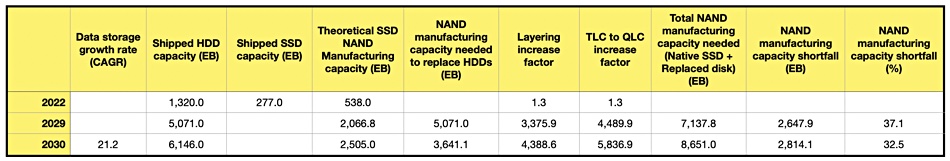

The layering increase factor is a key number. If it’s changed down to 30 percent/year then we end up with a 2,647.9EB NAND manufacturing shortfall in 2029.

Supplier views

A Dell spokesperson said: “Our sentiment is our portfolio enables Dell to be flexible and offer customers a very broad range of drive options. With continued innovation for higher density and low cost HDD, we expect it’s too soon to say customer demand won’t exist beyond 2028.”

Seagate CTO John Morris told us: “Simply, we do not think it is remotely possible to replace HDD with NAND. Not only because of the massive capex investment needed to exponentially increase NAND supply, but also because NAND does not hit the cost per bit required to drive a transition away from HDD.

“More importantly, there’s always been a synergy between SSDs and HDDs as they each serve different workload demands in the enterprise world. In the majority of the storage market, they are deployed together to create the most cost-optimized solutions. This architecture will persist for the foreseeable future. Our belief in the value of hard drives is reflected in our continued investments in the future of HDD innovation.”

He also suggests: “Rather than looking at total HDD and SSD EB, it is helpful to focus on only nearline HDD and enterprise SSD EB (and associated CAGRs). CY22 actuals reflect nearline HDD EB ~7× compared to enterprise SSD.”

Pure’s response

A Pure Storage spokesperson said: “When looking at the NAND market supply we would encourage you to look beyond the current SSD consumption and instead at the market as a whole … research by TrendFocus … qualifies the entire NAND market to be ~2.5x larger than what is currently used for SSDs today.

“While SSD NAND is different than that used in phones/tablets/USB sticks/automobiles and appliances, this points to a much larger available pool of NAND manufacturing and fabs from which to drive growth and balance demand. Ultimately manufacturers will scale their production and retool their fabs to meet the markets that are most fruitful and we do expect the transition from HDD to SSD to be a major factor for that demand.

“Your model assumes a 1:1 conversion of traditional HDD to SSD. While this is appropriate for a model of this magnitude, we do believe that there will be incremental opportunities for capacity consolidation as enterprises move from HDD to SSD due to increased data reduction, increased performance (reduced need for replicas), lower failure rates, and better erasure coding efficiency.”

All in all, our (very simplified) modelling exercise shows that, as long as layer counts increase at a 40 percent/year rate, the SSD NAND manufacturing output shortfall will be less than six percent. That’s without taking into account the Pure point, that the total NAND manufacturing capacity is “~2.5x larger than what is currently used for SSDs today.”

A 5.7 percent difference is also well within a margin of error. Basically, we don’t think there appears to be a NAND foundry capacity problem in building flash for SSDs to replace new HDD ships by 2029.

You can bet we’ll be watching closely, to see what the future holds.