Apple’s coming iPhone 15 could have a memory range of 256GB, 512GB and 1TB, eliminating the 128GB entry point of the iPhone 14, according to Wells Fargo analyst Aaron rakers.

…

Data protector CrashPlan has signed a distribution agreement with Ingram Micro’s Emerging Business Group (EBG) to distribute its cloud backup offerings to Ingram Micro’s US channel partner network.

…

A few years ago DataCore sold a vFilo product that used Hammerspace file technology. No more. A Hammerspace spokesperson said: “DataCore is no longer an OEM of Hammerspace for net new opportunities. We are still working together to jointly support existing customers. The relationship has evolved to a referral partnership where we each sell and support our respective technology.”

…

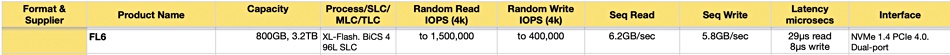

The second gen Dell PowerMax used storage class memory for metadata. It possibly did this to avoid the penalty of increasing battery requirement to support the memory-based vaulting architecture inherited from EMC Symmetrix and VMAX. When Intel nixed Optane, VAST Data pivoted to using Kioxia’s FL6 as an Optane SCM alternative.

A storage industry contact suggested that a future PowerMax could use CXL-connected shared memory between its controllers to speed data IO and this would require substantial battery backup to protect against power failure.

…

Hornet Security, which also provides backup, has published a Backup Bible. It has 150 pages discussing how to prepare for, respond to, and recover from a substantial data loss event. It contains instructions and examples for building and maintaining a thorough data protection system, and includes customizable templates enabling business owners to create their own personalized backup strategy. Get it here.

…

Dun & Bradstreet is using Ocient’s Hyperscale Data Warehouse as a Service on Google Cloud. D&B is projecting $3.4 million in cost savings over five years and ROI achieved within 10 months. It is experiencing 96.3 percent lower elapsed processing time and has has >1 million mainframe CPU seconds re-platformed. It moved to Ocient after end of support for its Netezza data warehouse was getting near and it decided to re-platform that and mission-critical jobs on its mainframe environment. It migrated years’ worth of data points about each of the 500 million commercial entities in its data cloud. Within the first six months, more than 1.5 million CPU seconds were re-platformed with the new solution maintaining 99.992 percent uptime and zero business disruption. Read about it here.

…

Pure Storage reported the largest individual sale of its Cloud Block Store (CBS) to a Fortune 500 healthcare organization at almost eight figures in its fiscal 2024 Q1. Pure’s CBS was bought because of its ability to securely store data in the cloud with enterprise features, reduced management overhead, and lower TCO. The customer says that it will be able to significantly reduce its cloud storage spend.

…

Data protector Rubrik has appointed Richard Cassidy as its EMEA Field CISO. He brings extensive cyber leadership, threat intelligence and technical advisory experience to the role. He joins Rubrik from Securonix, where he was VP of Global Technology. Cassidy said: “Running breach and threat hunting investigations in the UK & Europe has set me up well for a CISO position, where I’ve been involved with organizations across industry verticals such as finance, military, central and national government and automotive.”

…

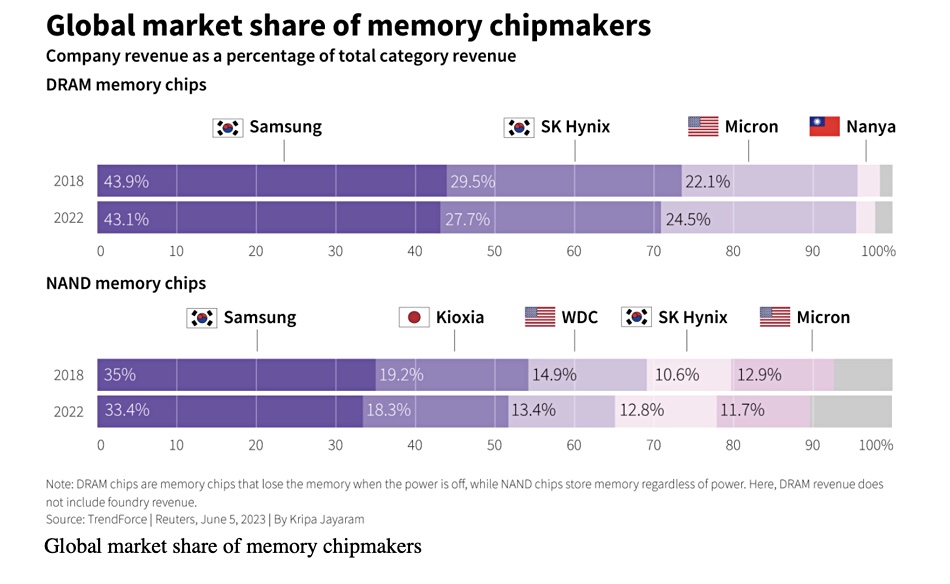

Reuters says Samsung Electronics reported a likely 96 percent plunge in second quarter operating profit on Friday as an ongoing chip glut drives large losses despite a supply cut. Samsung’s DRAM revenue market share shrank to 43.1 percent in 2022 from 43.9 percent in 2018. Micron gained DRAM share from 22.1 percent in 2018 to 24.5 percent in 2022. Samsung’s NAND market share declined from 35 percent in 2018 to 33.4 percent in 2022. SK hynix was the gainer, increasing from 10.6 percent in 2018 to 12.8 percent in 2022.

…

Data protector Storware has announced the release of Backup & Recovery 6.0 with new OS agent support for Linux and Windows. Previously Storware has primarily embraced an agentless approach. The inclusion of OS agents allows users to protect their systems at the file level, offering enhanced flexibility and control over data backup operations. Users can specify the folders they want to safeguard, and full and incremental backups are supported. 6.0 includes a the technical preview of tape support, with a Tape Manager component to streamline and simplify tape-related operations. Users can define tape pool backup destinations to protect VMs, applications, and storage instances by registering the Tape Manager in the system. Release 6 also adds OpenShift Virtualization support plus backing up stateful sets for regular container deployments, and also OpenNebula support.

…

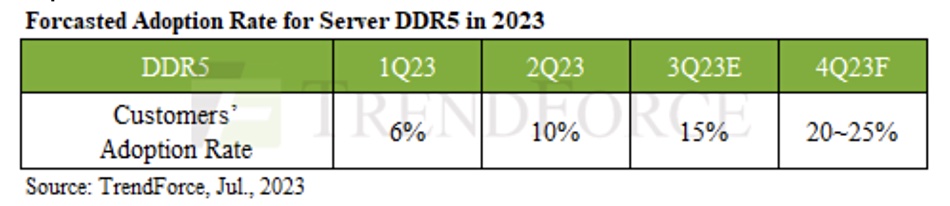

Research house TrendForce says the adoption rate of DDR5 is still affected by clients extending the product cycles of older models and postponing the introduction of new models. It estimates the adoption rate for server DDR5 in 2023 will be approximately 13.4 percent. It’s expected that DDR5’s adoption rate will not surpass DDR4 until the end of 3Q24.

…

TrendForce says NAND prices are still declining despite production output being scaled back. It’s expected that the NAND flash market will continue to be in a state of oversupply in 3Q23. It predicts that NAND flash wafers will be the first to see a price hike in 3Q23 as prices for module products such as SSDs, eMMCs, and UFS will likely continue to fall due to tepid downstream demand. Consequently, the overall ASP of NAND flash is forecast to continue dropping by about 3-8 percent in 3Q23, though a possibility exists that prices may recover in 4Q23.

…

If VAST Data is going to bring AI to data in its August Build Beyond announcement, does this mean it is adding its own version of computational storage?

…

WANdisco has confirmed a software support and maintenance contract renewal with Tesco for a two-year period, valued at $200,000, for its usage of WANdisco’s Live Data Plane product. It expects to recognize revenue from this renewal from 3Q23.

…

Phil White is looking for businesses or people an interest in acquiring all of the IP he’s developed over the last 30-plus years regarding error-correcting codes and fault-tolerant storage systems as described here.