Gartner has kissed the HCI appliance market goodbye. Its analysts have taken a fresh look at the HyperConverged Infrastructure (HCI) market, and moved away from an appliance approach, looking instead at full stack software suppliers of server, storage and network infrastructure management.

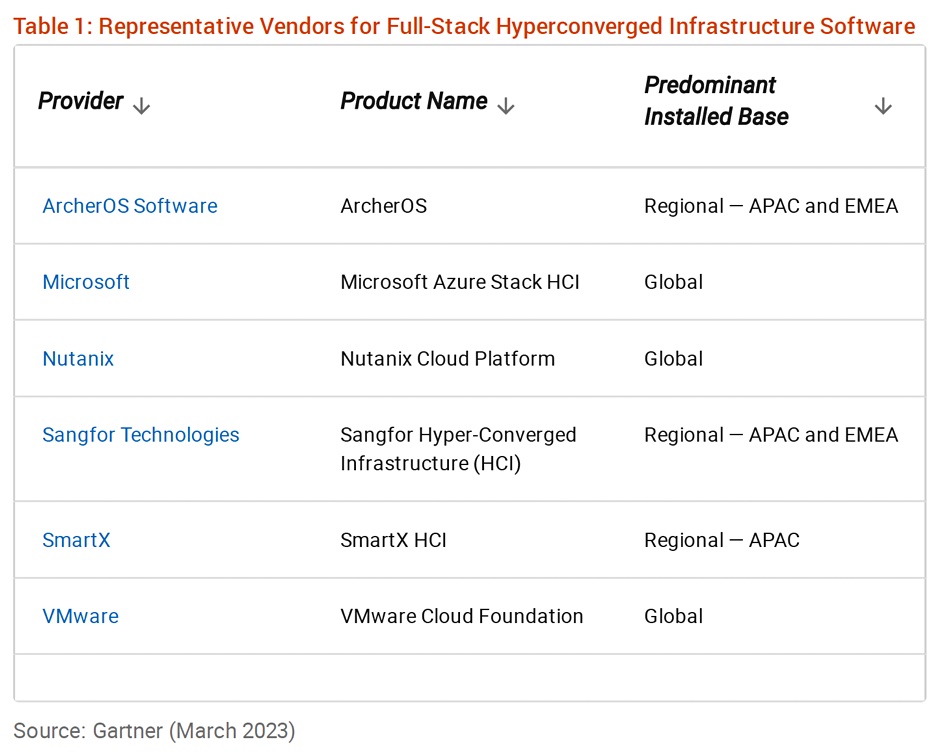

The folk at Gartner have produced a Market Guide for Full Stack HyperConverged Infrastructure Software which looks at three well-known suppliers: Microsoft (Azure Stack HCI), Nutanix and VMware (VMware Cloud Foundation); and three less prominent suppliers: ArcherOS, Sangfor Technologies, and SmartX. They say this is not an exhaustive list. We note that HCI systems from Cisco (HyperFlex), HPE (Alletra 5000 and SimpliVity), Quantum (Pivot3) and Scale Computing (HyperCore) are not included. Neither are the VxRail and PowerFlex systems from Dell.

The report’s strategic planning assumption is that, “through 2024, more than 75 percent of data center x86 workloads will continue to use hypervisor-based virtualization, down from approximately 80 percent in 2020, and despite cloud migration and container adoption.” It declares: “This market consists of those vendors that develop and sell hyperconverged infrastructure software comprising the vendor’s own server virtualization, software-defined storage and network management tools.”

The full stack components are hypervisor, containers, storage, network, infrastructure management, cloud management and monitoring. The global full stack HCI market is worth more than $1 billion. The report writers think that, “as full-stack HCI software has evolved, the integrated support of orchestration tools such as Kubernetes has increased across many providers.” The actual use of these tools, though, is minimal at the moment. Edge computing support is another coming feature.

There are two kinds of suppliers: global ones and regional ones. Microsoft, Nutanix and VMware are global. China-based ArcherOS is an APAC and EMEA supplier as is Sangfor, also China-based, while SmartX, another China-based provider, is an APAC region player. The Chinese players have an APAC presence, obviously, with two having expanded into EMEA, but none of the three have meaningful presence in North America.

The report profiles each vendor and closes by saying it “provides Gartner’s initial coverage of the market and focuses on the market definition, rationale for the market and market dynamics.” There is no Magic Quadrant for this sector, yet.

In some ways this Gartner document is equivalent to a GigaOm Sonar emerging technology report, being an introduction to a new field with a fresh set of players. But it is also, of course, an attempt to inject fresh analytical energy into what has become a boring, mature and staid market – the hyperconverged infrastructure appliance market. That is dominated by Dell, VMware and Nutanix, and not set to change anytime soon.

This new Gartner report could find welcome readers in the APAC and EMEA regions who are exposed to the three Chinese HCI suppliers.

Bootnote

The Gartner report ID is G00779344 and the analysts were Jeffrey Hewitt, Philip Dawson, Tony Harvey, and Julia Palmer.