Research house TrendForce has laid bare the SSD market decline in the last 2022 quarter and changes in suppliers’ market shares, with Samsung gaining and SK hynix and Micron losing.

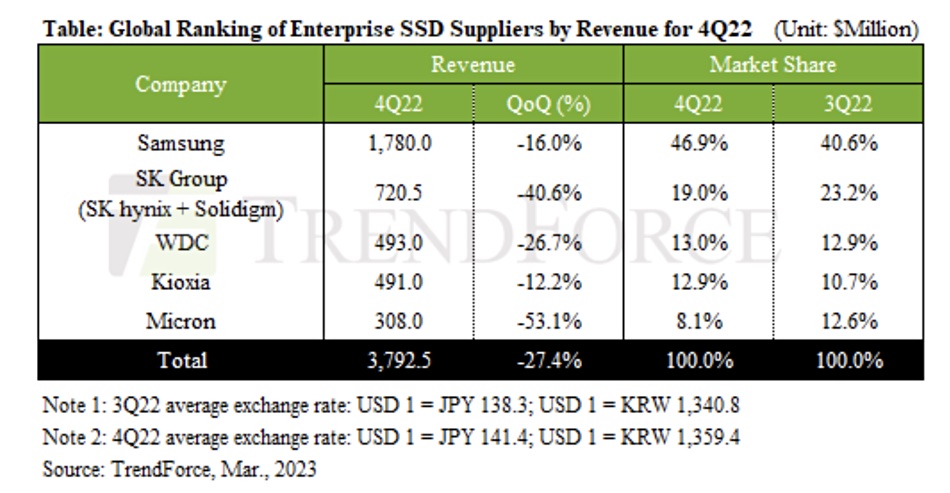

Taiwan-based TrendForce says server OEMs, including ones from China, bought fewer SSDs in the second half of 2022. Despite a need for more SSDs for notebook computers and smartphones, this caused a market contraction in Q4. There was a 25 percent enterprise SSD price decline from Q3 to Q4 2022, and total enterprise SSD revenues in Q4 were $3.79 billion, 27.4 percent lower than in Q3.

TrendForce expects another decline to take place in the current quarter, Q1 2023.

The analyst believes Micron was the worst affected by the market contraction, with a 53.1 percent revenue drop to $308 million and a market share change from 12.6 percent in Q3 to 8.1 percent in Q4, making it the smallest supplier by revenue in the enterprise SSD market. The reason for this, apart from general market conditions, is that Micron makes more SATA enterprise SSDs than the other suppliers and shipments of its 176-layer, PCIe 4.0 product have been weaker than expected, but should rise this quarter.

Number two player SK hynix was the next worse affected, with a 40.6 percent revenue drop from Q3 to its Q4 total of $720.5 million, helping it to lose three points of market share, with a 19 percent portion. It was particularly affected by Chinese buyers purchasing less and a delay in launching new products by Solidigm, say the researchers.

Market leader Samsung saw a 16 percent revenue decline to $1.78 billion but a six-point gain in market share to 46.9 percent. TrendForce says Samsung has a technological need and a rounded product set. It is well placed for the coming PCIe 5.0 SSD market as it has already sent samples of its PCIe 5.0 products to customers for qualification.

Like Micron, it has a high bandwidth memory (HBM) product line so is well positioned for AI and HPC workloads needing faster and more memory bandwidth. The researchers think Samsung is in a stronger position compared with its competitors.

The analyst also pointed out a limitation it sees with Western Digital: “On account of its limited resources for R&D, WDC lags behind its competitors in the launching of PCIe 4.0 enterprise SSDs. Hence, there are some concerns about its ability to expand market share in the future.” Also PCIe 5.0 is coming but “WDC appears to be slightly less prepared for the arrival of PCIe 5.0. In sum, WDC will likely experience more difficulties in maintaining its market share during 2023.”

Kioxia saw the smallest loss of revenue from Q3 to Q4 2022 – 12.2 percent to $491 million. It’s the main supplier of SAS SSDs and “because SAS products have a higher unit price compared with PCIe products, Kioxia was able to somewhat limit the QoQ decline in its revenue despite the lower-than-expected order volume.” Its PCIe 4.0 SSD shipments should rise this quarter and it is marketing PCIe 5.0 product to server ODMs. We’re also told “Kioxia aims to catch up to other suppliers in the race to attain the 23X-L technology by 2024.”

With TrendForce expecting a further enterprise SSD market decline in the current quarter, it is to be hoped that the second and third quarters will see a market recovery.