DRAM and NAND maker Micron reported its highest ever revenues in its latest quarterly results but is forecasting a 13 per cent drop next quarter as PC and smartphone memory demand falls. This was attributed to market weakness, indicating competitors could also suffer.

Revenues of $8.64 billion in the quarter ended June 2 were up 16.4 percent year-on-year, with profits of $2.63 billion, up 51 percent annually.

President and CEO Sanjay Mehrotra was upfront about the coming downturn: “Micron delivered record revenue in the fiscal third quarter driven by our team’s excellent execution across technology, products and manufacturing. Recently, the industry demand environment has weakened, and we are taking action to moderate our supply growth in fiscal 2023. We are confident about the long-term secular demand for memory and storage and are well positioned to deliver strong cross-cycle financial performance.”

Financial summary

- Gross margin – 46.4 percent,

- Cash from operations – $3.8 billion

- Free cash flow – $1.3 billion

- Diluted EPS – $2.59

- Cash, marketable investments and restricted cash – $11.97 billion

- Cash minus debt – $5.0 billion of net cash at quarter end

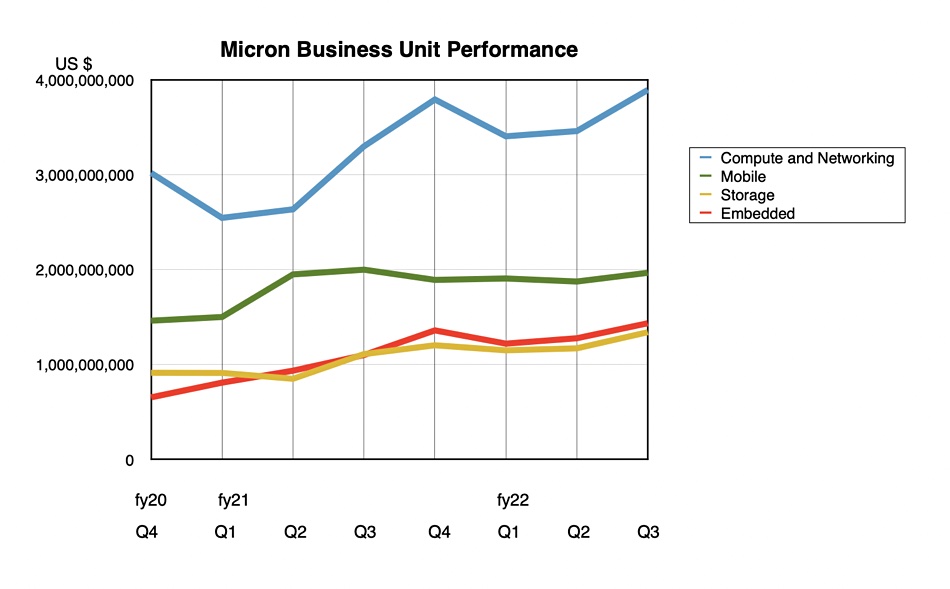

The company cuts its numbers into DRAM and NAND elements and then into four business segments.

DRAM revenues in the quarter were $5.72 billion, up 15 per cent annually, providing 73 per cent of Micron’s total revenues. NAND revenues were $2.29 billion, up 26 percent annually and representing 26 percent of total revenues. (There was a 1 percent revenue contribution from an “others” category which can be set aside.)

So far so good. But the business unit (BU) segment results reveal cracks:

- Compute and networking BU revenues were $3.8 billion, up 18 percent in the year

- Mobile BU revenues went down 2 percent annually to $1.97 billion as smartphone memory sales stalled

- Storage BU revenues rose 33 percent to $1.34 billion

- Embedded BU revenues of $1.44 billion grew 30 percent

Micron CFO Matt Murphy’s prepared remarks pointed out: “We achieved record SSD revenue, with both datacenter and client SSD revenues reaching all-time highs. Datacenter SSD revenue more than doubled year over year.”

However, there were issues in the compute and networking BU as Mehrotra said: “Delays in the rollout of new server CPU platforms have slowed the industry DDR5 ramp versus prior expectations.”

PC memory demand also fell: “A number of factors have impacted consumer PC demand in various geographies. As a consequence, our forecast for calendar 2022 PC unit sales is now expected to decline by nearly 10 percent year over year from the very strong unit sales in calendar 2021.” The expectation, now blown out of the water, was for roughly flat calendar 2022 PC unit sales at the start of this calendar year. The change amounts to 30 million fewer PCs being bought.

The Mobile BU was hit because “smartphone unit sales expectations have declined meaningfully for calendar 2022. We are now projecting smartphone unit volume to decline by mid-single-digits percentage range year over year in calendar 2022, well below the industry and customer expectation earlier in the year of mid-single-digit percentage growth.” That means something like a 130 million reduction in smartphone unit sales versus the number expected at the start of the year.

These two factors will feed into Micron’s guidance for next quarter. Mehrotra said: “Near the end of fiscal Q3, we saw a significant reduction in near-term industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone. These consumer markets have been impacted by the weakness in consumer spending in China, the Russia–Ukraine war, and rising inflation around the world.”

As a result: “Several customers, primarily in PC and smartphone, are adjusting their inventories, and we expect these adjustments to take place mostly in the second half of calendar 2022.” This indicates the slowdown will last for a couple of quarters.

The outlook for next quarter is for revenues of $7.2 billion ± $400 million, implying a $1.1 billion drop, minus 13 percent, from the year-ago Q4 revenue of $8.3 billion. This puts an end to eight consecutive quarters of year-on-year revenue growth.

Notwithstanding this, Mehrotra said: “We remain confident about the secular demand for memory and storage… The memory and storage TAM is expected to grow to $330 billion by 2030 and become an increasing portion of the semiconductor market.”

Market blip or recession?

Micron said its DRAM and NAND technologies are advanced and industry-leading, with 1-alpha DRAM and 176-layer NAND. Taken at face value, this means its revenue problems in server DDR5 DRAM, smartphone and PC memories are not due to weak products but to weak markets. That in turn means we can expect similar issues to affect the other DRAM and NAND foundry operators: Kioxia, Samsung, SK hynix/Solidigm and Western Digital and, in China, YMTC.

Is a recession coming or is this just a short-term thing caused by lingering COVID, Chinese market weakness, and the Ukraine-Russia war causing both supply chain issues and higher inflation, which itself leads to lower consumer spending?

Micron’s earnings call casts some light on its thinking about this. Mehrotra pointed out the impact of lower PC and smartphone demand: “PC and smartphone combined represent half of the memory and storage worldwide demand in terms of bits … with this adjustment primarily happening in the second half of this year in these two markets, clearly that is resulting in a year-over-year change versus prior expectations in DRAM as well as NAND demand growth.”

Answering a question, Mehrotra said non-consumer demand was strong: “On the enterprise server OEM side, the end market demand continues to be healthy… cloud demand to us is relatively healthy as well.” He is convinced that “the long-term trends absolutely bode well for memory and storage.”

Micron will supply customers more from its inventory and stop making as much product as before, and so avoid contributing to a chip glut. Asked if this would last longer than two quarters, Mehrotra said: ”We, of course, have macroeconomic uncertainties as well. It has been a rapidly changing and uncertain environment… We think that sometime in fiscal ‘23 is when demand will rebound… we are not pointing to any specific quarter at this time.”

The revenue downturn could last for two, three or four more quarters.

Bloomberg reported Micron shares declined 3 percent after the results report.