Privately owned cloud object storage player Wasabi has raked in $250 million to carry on building its business following a fifth round of funding.

The company says it provides S3-compatible public cloud storage for a fifth of AWS with no egress or API access charges, and revenues more than doubled from 2020 to 2021, though Wasabi does not reveal actual revenues figures. The organization now has more than 40,000 customers in over 100 countries, 13,000 partners, 250-plus global employees, and 13 storage regions across North America, Europe, and Asia Pacific.

CEO and co-founder David Friend said: “Closing a large up round in this environment speaks to the spectacular growth of Wasabi, the magnitude of the cloud storage opportunity, and our leadership as the industry’s largest pure-play cloud storage vendor.”

Investor Kerstin Dittmar, a managing partner at L2 Point, added: “We believe this capital raise will allow Wasabi to continue to expand its offering across additional services and geographies to meet their global customers’ needs.”

Wasabi has partnerships with over 350 technology companies, including most of the world’s leading backup, disaster recovery, and surveillance companies. Its cloud is used to store data across a wide range of industries, including professional sports, energy and natural resources, finance, surveillance, education, manufacturing, consumer technology, healthcare, scientific research, and media and entertainment.

The latest round is 50/50 split between equity and debt financing. Wasabi raised $125 million in Series D equity led by L2 Point Management with participation from Cedar Pine, and existing investors including Fidelity Management & Research Company and Forestay Capital. The valuation was over $1.1 billion. Wasabi also bulked up its existing debt facility with MGG Investment Group to $125 million, taking the round total to $250 million.

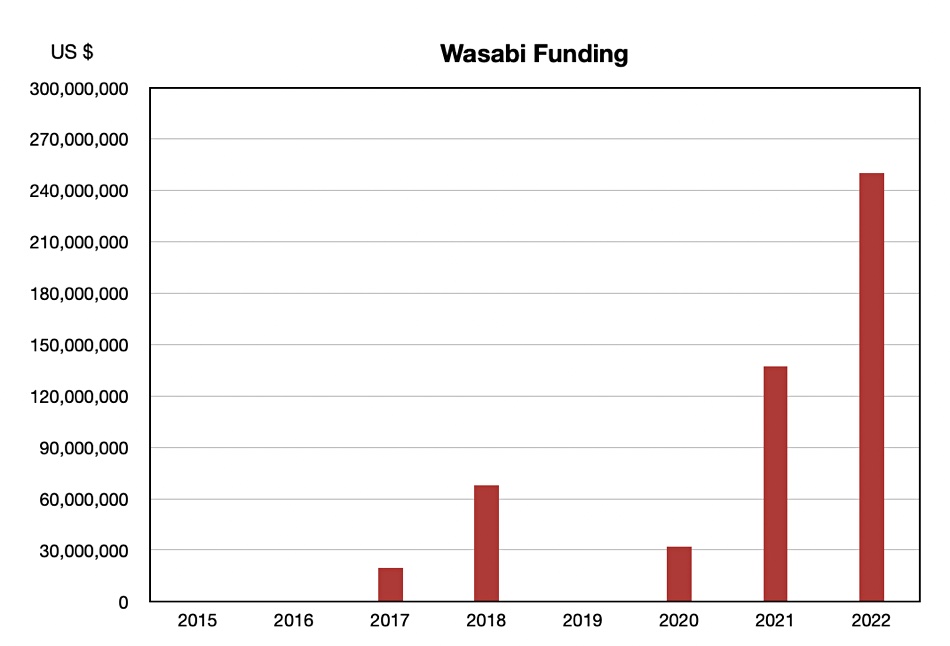

Our records show overall funding to date is now $534.2 million, which includes $27.5 million of debt financing last year. The latest $250 million is classed as a D-round. The B-round had three parts to it in 2017, 2018, and 2020 for a total of $108.8 million, following the $8.9 million A-round in 2017. It’s a complicated picture.

The $125 million equity portion will drive expansion into more geographies and vertical markets, bev used to strengthen Wasabi’s channel partnerships, and scale the company’s go-to-market team and global brand strategies.

The company’s marketing spend includes relationships with the UK’s Liverpool Football Club, sponsorship of the Fenway Bowl annual college football bowl game, as well as the Boston Red Sox baseball team, and Boston Bruins hockey team. Like Acronis, which sponsors the Red Bull racing team, Wasabi believes sports sponsorship pulls in the punters.

The debt finance part will fund capital equipment and infrastructure in Wasabi’s storage regions around the world, and investment in developing Wasabi’s technology. The company said this will lay the groundwork for a new generation of cloud storage architecture.