Western Digital’s latest quarterly revenues dropped 8 percent year-on-year due to falling PC and consumer disk drive purchases – and the storage giant is forecasting 26.7 percent weaker revenues for next quarter, meaning the business situation is worsening.

Revenues in the fourth quarter of WD’s fiscal 2022 ended July 1, were $4.53 billion ($4.9 billion in Q4 fy2021) with a profit of $310 million, lower than a year ago by 52 percent. Full year revenues were $18.8 billion, 11 percent up on the year, with a profit of $1.5 billion, 82.7 percent higher than the prior year.

It was a good year spoiled by a poor final quarter.

CEO David Goeckeler said: “I am proud of our team for driving strong fiscal year 2022 performance, during which revenue grew 11 percent and non-GAAP EPS increased 81 percent, demonstrating progress in unlocking the earnings potential of our business. … The combination of our innovation engine and the multiple channels to deliver our products to the market puts Western Digital in a great position to capitalize on the large and growing opportunities in storage ahead even in the midst of macro dynamics weighing on near-term demand.”

We understand the revenue drop was due to pandemic effects, the Ukraine-Russia war and supply chain issues, compounded by inflation and recession fears holding back consumer spending.

WD generated $295 million in cash flow from operations, made a scheduled and discretionary debt repayment of $150 million and ended the quarter with $2.33 billion of total cash and cash equivalents. Gross margin was 31.9 percent, up 0.1 percent on the year. EPS was $0.95, down 52 percent annually.

The Q4 segment results:

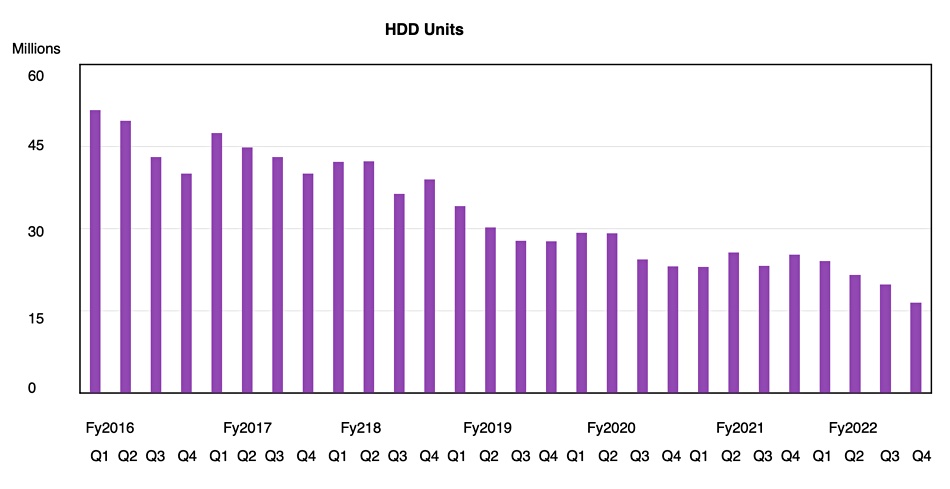

- HDD Units: 16.5 million, down 34.8 percent annually

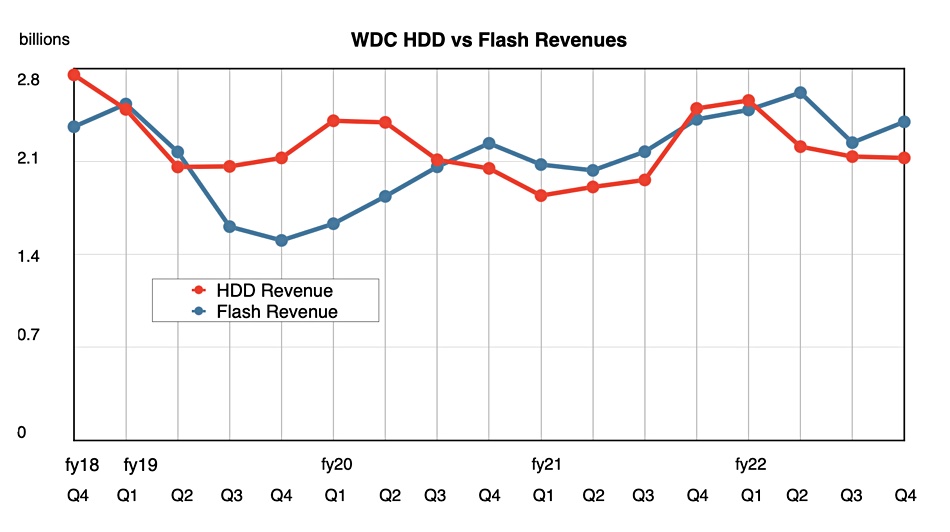

- HDD revenues: $2.13 billion, down 14.9 percent

- Flash/SSD revenues: $2.4 billion, down just 0.8 percent

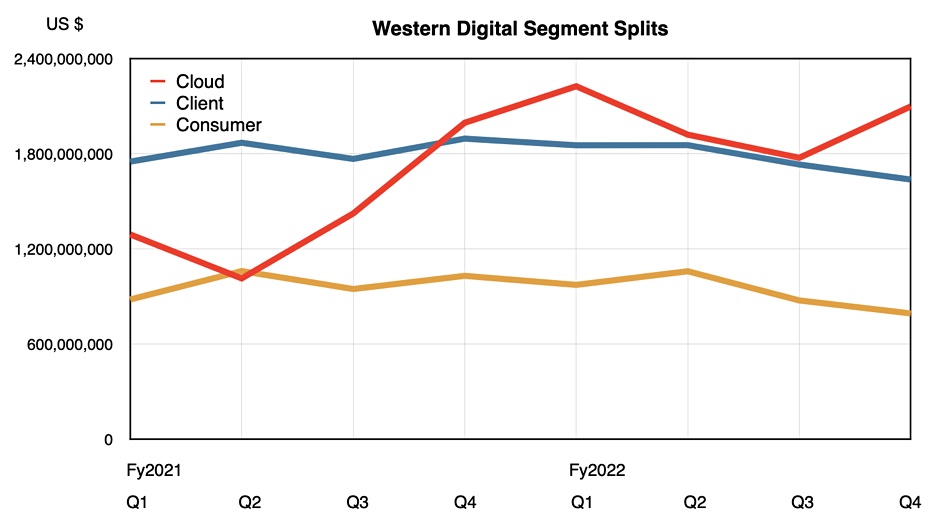

Revenue by end-market:

- Cloud (hyperscalers): $2.1 billion, up 5 percent

- Client: $1.64 billion; down 14 percent and 36 percent of revenues

- Consumer: $793 million; down 23 percent; now just 18 percent of revenues

Customers bought fewer desktops and notebooks with disk drives, and fewer retail disk drives as well. Wells GArgo analyst Aaron Rakers told subscribers: “The y/y decline was driven by broad-based retail weakness across both HDD and flash products.”

But the hyperscalers bought more nearline disk drives and they had more capacity than a year ago, with WD shipping a total of 111 EB to cloud customers in the quarter. The average selling price per disk was up by nearly a quarter on the year, at $120, reflecting the increased disk capacity.

WD said it was ramping a second cloud customer with SMR (Shingled Magnetic Recording) disk technology this quarter and is on track to lead the industry’s transition to SMR based drives for the cloud.

HDD competitor Seagate’s latest quarterly results exhibited a 10 percent year-on-year revenue fall.

WD’s flash/SSD revenues overall were flattish; down just 0.8 percent. Enterprise SSD revenue more than doubled sequentially in the quarter and rose 38 percent annually. Gaming exabyte shipments grew nearly 70 percent year-over-year.

The outlook for next quarter’s revenues is $3.7 billion plus/minus $10 million; down a huge 26.7 percent year-on-year. This surprisingly weak guidance sent the share price down 8.8 percent, from $50.02 to $45.63, in early post-results trading. Rakers said: “WD expects Flash to lead its F1Q23 q/q rev. decline while HDD rev. is expected to decline modestly…. WD’s significantly weaker outlook reflects deteriorating consumer & client (PC) demand.”