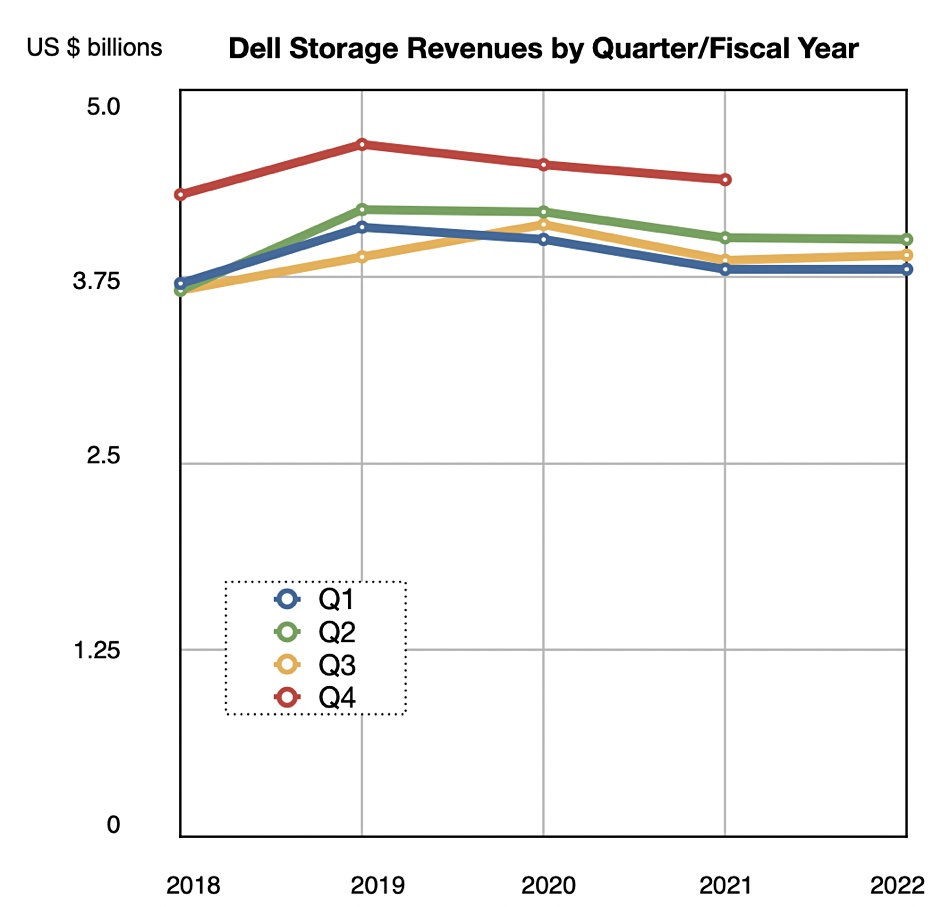

Dell’s quarterly revenues rose 21 per cent year-on-year to a record $28.4 billion, but storage revenues were anaemic with a mere 0.9 per cent rise to $3.89 billion.

This was the best third quarter in Dell Technologies history — helped, Dell said, by robust demand, durable competitive advantages, and strong execution. The company generated record revenue of $28.4 billion in the quarter ended October 29, up 21 per cent, with growth in all business units, customer segments and geographies, and strength across commercial PCs, servers and (much less so) storage. VMware revenue was $3.2 billion — up 10 per cent with general strength across its product portfolio. Dell has now separated itself from VMware.

Chuck Whitten, co-COO Dell Technologies, said in a statement: “We’re three quarters into what will prove to be a historic year for Dell, and we are just beginning to write the next chapter of the Dell Technologies story. We are uniquely positioned in the data era, with durable advantages and market-leading positions. Our strategy is focused on growing our core business and in adjacent multi-billion-dollar markets including multi-cloud, edge, telecom and as-a-Service.”

Jeff Clarke, vice chairman and co-COO Dell Technologies, said in his statement: “Our product, global operations and sales teams did an outstanding job this quarter as we shipped a record number of products and delivered record revenue.”

Yes, but storage rather let the side down. We’ll focus on that while acknowledging that Dell has done an outstanding job elsewhere in its results for the quarter.

Storage

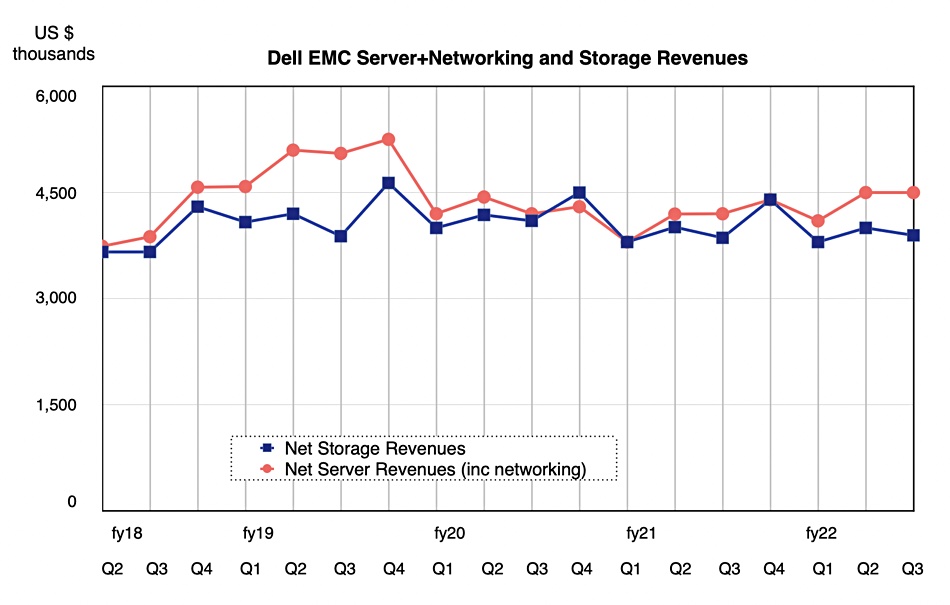

Storage revenues in the Infrastructure Solutions Group (revenues $8.4 billion; up 5 per cent) were almost flat while server-plus-networking revenues rose 9 per cent year-on-year to $4.5 billion.

A chart shows a widening gap between the two product categories over the past three quarters:

The seemingly stubborn resistance Dell’s storage shows to product sales growth is holding ISG revenues back. We should say that Dell is the leading storage product shipper, being number one in external enterprise storage, storage software, all-flash arrays, hyperconverged systems, converged systems, and purpose-built backup appliances. Yet it has barely grown storage revenues over the past three quarters while competitors — such as Pure Storage and NetApp — have grown their revenues.

What is the problem? A results presentation slide said there was “Strong storage demand, orders growth in Hyperconverged Infrastructure up 47 per cent, Data Protection up 26 per cent and Midrange up 18 per cent.” There must have been significant weakness elsewhere in the product range to have overall storage growth be just 0.9 per cent

This suggests disappointing high-end array sales could be a factor and possibly also low or no growth in Dell’s PowerScale file and ECS object storage products. There could be increased competition from suppliers such as Infinidat, Pure Storage, VAST Data, Qumulo and others to account for this.

Earnings call

We looked for any clues in Dell’s earnings call. Co-COO Jeff Clarke declared: “We are pleased with our storage performance in Q3, where we saw storage return to growth.”

He declared: “Momentum in our mid-range storage business continues to be led by PowerStore, where 23 per cent of PowerStore customers renewed to Dell storage and 28 per cent were repeat buyers. PowerStore is the fastest-ramping storage product in our history.”

That’s all very well but storage must have been a disappointment to Clarke with its lacklustre growth.

Answering a question, CFO Tom Sweet said: “Storage demand tends to be more back-end loaded in the quarter, and we clearly saw that again this quarter, perhaps a bit more than in prior quarters. And as a result of that, we were not able to convert that backlog to revenue … and we also deferred a fair amount of revenue to the balance sheet, just given the service attach rate as well as the software content within the storage.”

Whitten jumped in to strengthen Dell’s answer here: “We’re encouraged by storage orders growth because in the most strategic category, software defined storage, we grew 47 per cent, mid-range orders grew 18 per cent, which is now the fourth consecutive quarter our mid-range business has grown. … Data protection grew, unstructured data grew and our entry-level orders grew as well in the storage business, so … we remain encouraged by the orders growth.”

Will this backlog translate into growth next quarter? Possibly not, as Sweet said: “The reality is, as we highlighted in the talk track that we’re continuing to face supply chain challenges. And so how much of server demand gets converted or backlog gets converted into shippable revenue is something that the teams are working every day.”

He also said though: “that Q4 tends to be a higher storage quarter for us.”

It seems fair to assume that Dell is facing headwinds in the high-end array, filer and, possibly, object storage space. There must have been quite severe revenue declines in its storage portfolio outside the highlighted growth areas, such as the mid-range. This suggests that there are product weaknesses needing to be fixed and that could be a multi-quarter exercise.