IDC’s latest quarterly external storage market tracker shows a great year-on-year advance by Huawei, and a tremendous fall by IBM — but, really, nothing much has changed at all.

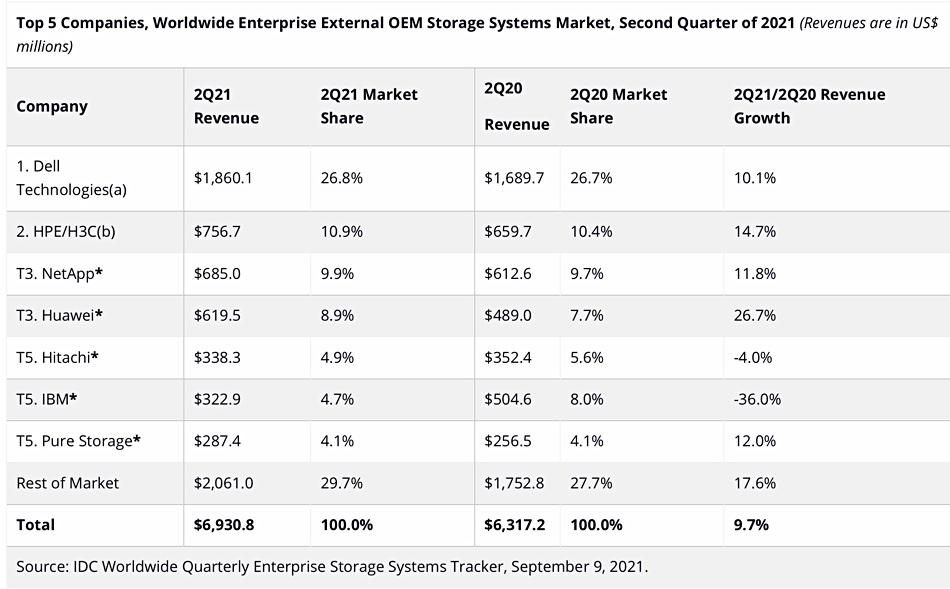

The worldwide enterprise external OEM storage market grew 9.7 per cent year-on-year to $6.93 billion, with Dell leading at $1.86 billion and 26.8 per cent market share. Joint third-ranked Huawei was the top growth performer at 26.7 per cent, its revenues rising from the year-ago $489 million to $619.5 million. Joint fifth-ranked IBM was the worst growth performer, with a 36 per cent drop from $504.6 million a year ago to $322.9 million.

Total external OEM storage capacity shipped was up 27.9 per cent year-over-year to 22.1 exabytes during the quarter. Research manager, Infrastructure Platforms and Technologies at IDC, Zsofia Madi-Szabo, provided an IDC statement about its tracker: “The external storage systems market recovery observed during first quarter of 2021 continued even stronger during the second quarter. The degree to which demand returned was highly influenced by the rate at which each regional economy has recovered from the difficulties associated with the global pandemic.”

An HPE statement said: “Recently, HPE unveiled HPE GreenLake offerings that represent HPE Storage’s transformation to a cloud-native data services business. We are already seeing tremendous customer uptake of HPE Alletra, a core component of the new offerings. We also continue to see strong uptake of HPE Nimble dHCI, which continues to disrupt the HCI market.”

So Alletra is off to a good start. That’s good news. HPE didn’t call out Alletra sales in its latest quarterly results, only mentioning Nimble and Primera.

Pure provided a statement as well: “According to the IDC data, in Q2, Pure executed on all fronts showing growth in every region. While the external OEM market showed a strong recovery in Q2, growing 9.7 per cent year-on-year, Pure did even better, growing 12 per cent. Pure also grew 12 per cent in the AFA market (the overall market grew 7.6 per cent).”

William Blair analyst Jason Ader said: “The market improvement was driven by a lessening impact on the economy from the pandemic and a release of pent-up demand for on-premises infrastructure, which was underpinned by strong second-quarter growth from storage leaders like NetApp, HPE, and Pure Storage.”

Here’s an IDC table showing its numbers for the top seven suppliers:

Going by this table, Huawei is doing fantastically well while IBM is heading downwards, ready to be overtaken by Pure Storage with its 12 per cent growth rate. The group of suppliers (rest of market) outside the top seven grew 17.6 per cent, so there must be smaller suppliers outgrowing most of the leaders.

Same old, same old

However, looking at the storage tracker trends from 2016 shows a different story, and we’ve charted it:

Dell (+ EMC) is the clear and steady leader revenue-wise, though it has fallen behind the aggregate of the market since the second 2019 quarter. Then there is the following pack — a group of six suppliers, some of whom drop in and out of IDC’s tracking scheme. That’s because IDC actually tracks the top five suppliers but declares a statistical tie between suppliers whose revenues are within oneper cent of each other — hence the joint third positioning between NetApp, Hitachi and Huawei.

Our chart shows that Huawei’s storage revenues exhibit large rises and falls — it has overtaken Hitachi before, only to then fall back. Similarly with IBM. HPE, NetApp and Pure Storage are more consistent, with HPE and NetApp overtaking each other again and again. Pure Storage in fact has been close to IBM’s revenues before: Q1 2019, Q1 2020 and now Q2 2021. Each time, IBM has accelerated away, and may do so again, probably with help from the mainframe cycle and high-end, mainframe-attached array sales. It’s possible to discern a long-term trend for Pure Storage to catchup with IBM and potentially overtake it in the future — maybe after the next mainframe cycle.

However, the long-term trend has both Huawei and Pure Storage growing their revenues at a faster rate than the other pack suppliers. Pure Storage’s growth is more consistent than Huawei’s but it has not been kicked out of the US market — a shock with which Huawei has had to cope.

All-flash arrays accounted for $2.7 billion in revenues, up 7.6 per cent year-on-year. Hybrid flash/disk arrays exceeded this with 13.3 per cent growth to $2.8 billion.

Looking at the regions

Regional market growth rates varied widely:

- China — up 33.3 per cent (benefitting Huawei we expect);

- Japan — down 21.2 per cent (to the detriment of Hitachi);

- Asia/Pacific (ex-China and Japan) — up 15.4 per cent;

- Europe, Middle East and Africa — up 3.7 per cent;

- Central and Eastern Europe — up 26 per cent;

- USA — up 5.9 per cent;

- Canada — up 29.5 per cent;

- Latin America — up 12.5 per cent.

All in all the storage market grew. Huawei, HPE, Pure Storage, NetApp and Dell outgrew the market, while IBM and Hitachi did not. Let’s see what happens next quarter with a hopefully stronger recovery world-wide from the pandemic.