NetApp grew its revenues 12 per cent year-on-year to $1.46 billion in its first fiscal 2022 quarter, ended July 30, and near the high end of its guidance, with profits up 162.3 per cent to $202 million.

This was not as high a growth rate as Pure’s 23 per cent, but far better than Dell’s one per cent decline in its storage revenues.

The announcement statement by CEO George Kurian was straightforward: “Building on our accelerating momentum through last year, we are off to a great start to fiscal 2022, with strong revenue, gross margin, and operating leverage across the entire business.”

He was much more enthusiastic in the earnings call: “We just finished a phenomenal quarter. In Q1, we grew our all-flash business by 23 per cent, overall product revenue by 16 per cent and cloud by 155 per cent year-on-year. We raised our fiscal year to eight to nine per cent growth and anticipate delivering close to $5 in earnings per share. These are all record numbers, right, operating margins, full year and earnings per share for the company. So, I feel very, very, very good about where we are.”

Kurian is confident that NetApp gained share in the storage and all-flash markets.

Financial summary:

- Operating margin — 69.3 per cent;

- Cash and cash equivalents — $4.55B;

- Cash provided by operations — $242M compared to $240M a year ago;

- Free cash flow — $191M, up from $188M last year;

- Gross margin — 69 per cent, an all-time high;

- EPS -— $0.88 in contrast to $0.35 a year ago.

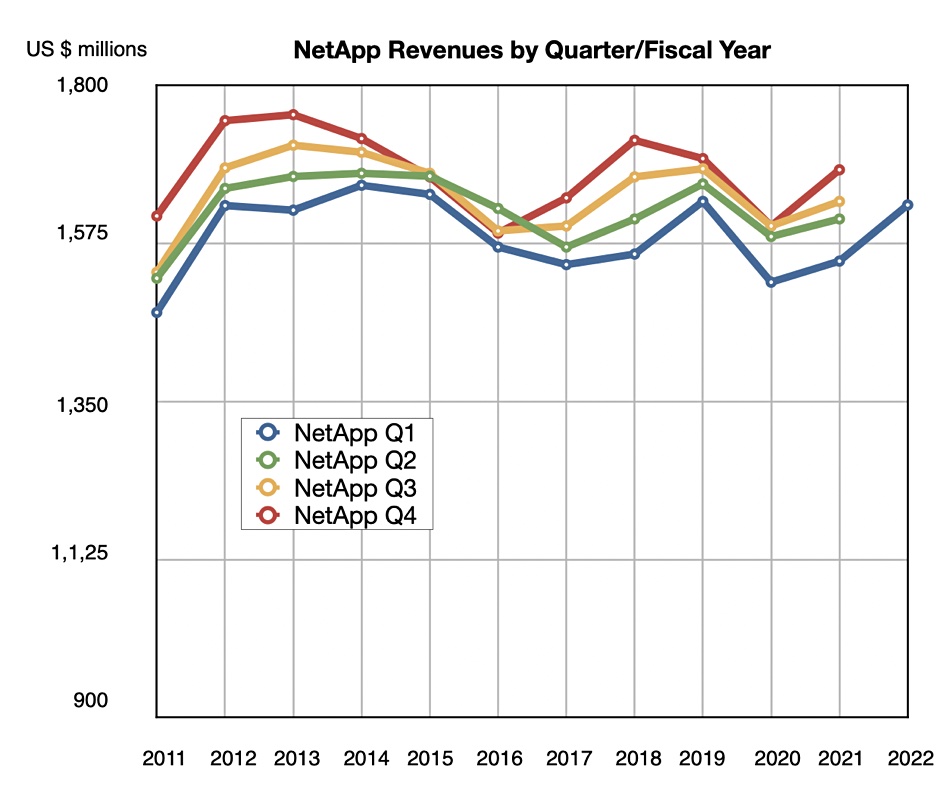

A chart shows the renewed growth pattern in its quarterly revenues, with five successive growth quarters since its fiscal 2020 year commenced:

There is still some way to go to get back to fiscal 2012 and 2013 revenue levels, but we are seeing a strong recovery as the COVID pandemic plays out.

NetApp saw strength and momentum with All-Flash Arrays (AFA), which now have a $2.8 billion run rate — although that was down from last quarter’s $2.9 billion. NetApp’s AFAs have a 29 per cent penetration of the installed ONTAP base, so there is still a lot of latent demand ahead.

CFO Mike Berry said “We ended Q1 with over $3.9 billion in deferred revenue — an increase of eight per cent year-over-year. Q1 marks the 14th consecutive quarter of year-over-year deferred revenue growth, which continues to be the best indicator of the health of our recurring revenue.”

Public Cloud business

NetApp rejigged its reporting segments with two new classifications: Hybrid Cloud and Public Cloud. The Hybrid Cloud segment covers on-premises/private cloud storage and data management products, such as ONTAP and StorageGRID arrays, with links to the public cloud. The Public Cloud includes products delivered as-a-service from public clouds, such as Spot.

Hybrid Cloud revenues in the quarter were $1.38 billion — up 8.7 per cent on a year ago and driven by AFA growth. The much smaller Public Cloud segment pulled in just $79 million, up a huge 154.8 per cent over the same period. This was driven by driven by Cloud Volumes, Cloud Insights, and Spot by NetApp services. Public Cloud annual recurring revenue rose 89 per cent to $337 million.

We think that NetApp must have high hopes indeed for its Public Cloud segment to be be separating it out at such a low revenue point. It is a completely different business from its traditional storage business — as we pointed out in July when NetApp added a Windows 365/CloudPC offering to its Spot cloud broking business.

Kurian said “Our Public Cloud services not only allow us to participate in the rapidly growing cloud market, they also make us a more strategic data center partner to our enterprise customers, driving share gains in our Hybrid Cloud business.”

He is confident that the Public Cloud business will grow. “I think we see that over the next few years, as businesses deploy more of their core operations on public clouds, the opportunities we have around compute automation management through Spot, storage and data protection and management through Cloud Volumes and monitoring through Cloud Insights will be a very, very strong business. And all of the hyperscaler partners that we work with see it much the same way, which is why they’re building more and more capabilities with us.

“We also see a new growth engine in the Public Cloud segment with all of the cloud native work we are doing around containers and serverless.“

The Public Cloud focus is influencing M&A, with Berry pointing out: “Our acquisition strategy … will remain focused on bolstering our strategic Public Cloud roadmap.”

Outlook

The outlook for the second FY22 quarter is $1.54 billion +/- $50 million — an 8.8 per cent rise on a year ago. The full FY22 outlook is for revenues to be eight to nine per cent higher than FY21’s $5.74 billion, meaning $6.2 billion to $6.26 billion.