Disk and solid state drive maker Western Digital’s $4.1bn revenues declined 1 per cent year-on-year in its third fiscal 2021 quarter, ended April 2, as its data centre business slipped down by a whopping 19 per cent to $1.24bn. But client devices appeared to prevent the topline falling down too far, and its outlook has improved.

The storage firm made a net profit of $197m, up by a $180m from a year ago.

The largest revenue rise was seen in the client devices segment (PCs, notebooks, game consoles), which lifted 10 per cent to $2bn, and its client solutions (retail) segment, up 8 per cent to $888m. Digging into those, there seem to have been some deals going on with flash memory device pricing as lockdowns accelerated purchases of notebooks and consoles. CEO David Goeckeler told investor mag Barron’s that Western had “been able to raise prices for consumer products sold through retailers and distributors on weekly, and in some cases, daily basis”.

That gloomy data centre outlook did have one silver lining: NVMe SSD sales were up, particularly at an unnamed cloud hyperscaler customer.

Goeckler said: “We reported solid results above the guidance range, driven by increasing momentum of our energy-assisted drives and our second-generation NVMe enterprise SSDs, improving NAND flash pricing trends, along with the continued accelerated digital transformation across end markets.”

Financial summary

- Gross margin – 26.4 per cent

- Operating Expenses – $774m

- Op income – $317m

- Operating cash flow – $116m

- Cash and cash equivalents – $2.7bn

- EPS – $0.63 (up 950 per cent Y/Y)

Rival Seagate did a tad better in its latest quarter with flat results.

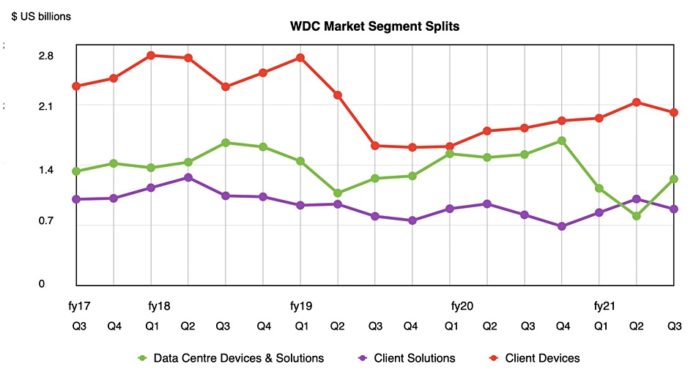

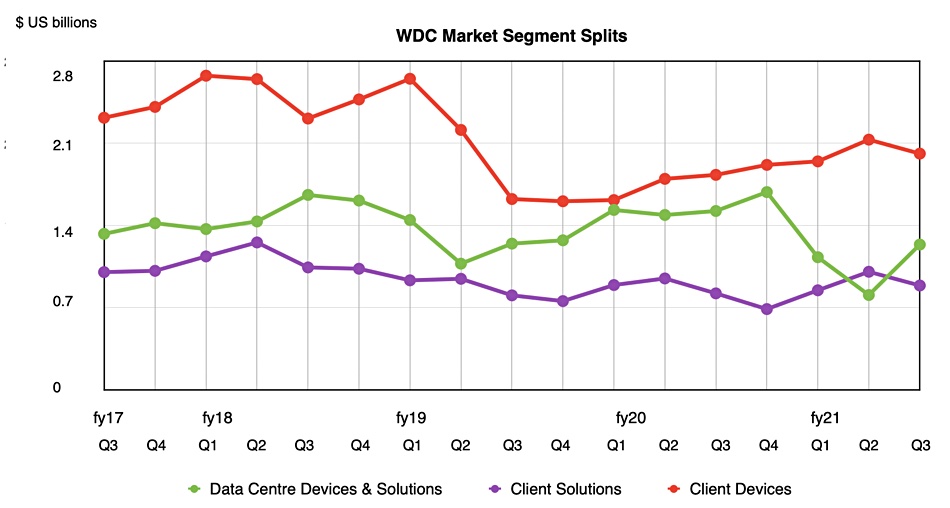

A chart of WD’s three market segment revenues over time shows an abrupt reversal in the relative positions of the Client Solutions and Data Centre businesses as Data Centre revenues improved Q/Q:

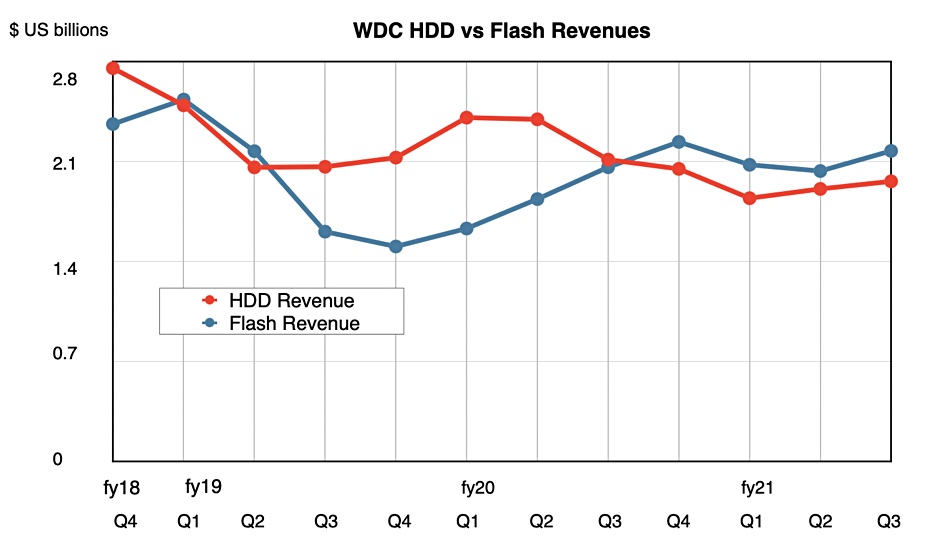

The firm said its separation of the HDD and SSD businesses was seeing “increased operational focus enabled by [the] new business unit structure is driving results.” HDD revenues of $1.96bn, down 7.2 per cent Y/Y, compared to flash revenues of $2.12bn, up 5.5 per cent Y/Y, with the gap widening in SSD’s favour as a second chart indicates:

Total disk exabyte shipments rose 7 per cent Y/Y with disk units of 23.2 million, down 5 per cent Y/Y with an $82 ASP; that compares to $85 a year ago.

Outlook

Wells Fargo analyst Aaron Rakers noted WD shipped around 70EBs of nearline disk capacity, down 8 per cent Y/Y, which compares to Seagate’s 95.5EB, up 25 per cent Y/Y, and Toshiba’s 25.6EB in comparative quarters. Seagate has taken a lead in shipping more 16TB drives that WD and Toshiba. The transition to 18TB drives could see WD regaining lost ground. It has entered into agreements with some public cloud hyperscalers for 18TB disk drive supply, which is promising.

SSD bit shipments increased 8 per cent Q/Q and also Y/Y but at a slower rate. There was strong NVMe SSD revenue growth at a cloud hyperscaler customer which us welcome news.

The fourth quarter outlook is for revenues of $4.5bn plus or minus $100m, a $200m increase Y/Y at the $4.5bn level. Rakers noted: “HDD and flash revenue are expected to be up sequentially. The company noted that it sees strong overall demand into C2H21.”

Forecast full year revenues of $16.56bn – the Q4 outlook at the mid-point – would represent a slight decline on last year’s $16.74bn.