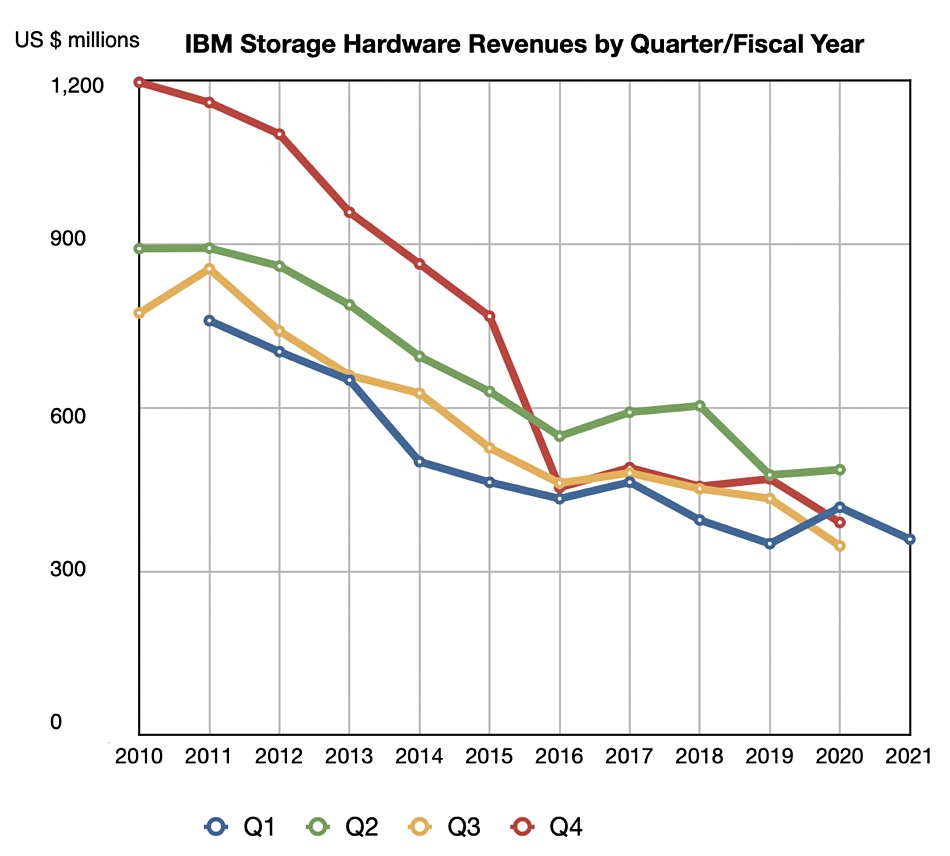

IBM’s quarterly storage hardware revenues have continued their long term decline. In the first 2021 quarter earnings report the company disclosed that “Power and Storage Systems declined,” with Power servers falling by 13 per cent and storage hardware 14 per cent.

Update: story amended reflecting discovery of storage hardware sales number. 21 April 2021.

IBM noted in the earnings presentation yesterday that “Storage and Power performance reflects product cycle dynamics.” Sales of the recently launched FlashSystem 5200 have not pushed storage hardware revenues higher as the product was not fully available in the quarter.

In its first 2021 quarter, ended March 31, IBM reported revenues of $17.7bn, up 1 per cent Y/Y and its first growth quarter after declines in all four 2020 quarters.

IBM segment revenue results:

- Cloud and Cognitive Services – $5.4bn – up 34 per cent Y/Y

- Global Business Services – $4.2bn – down 1 per cent

- Global Technology Services – $6.4bn – down 5 per cent

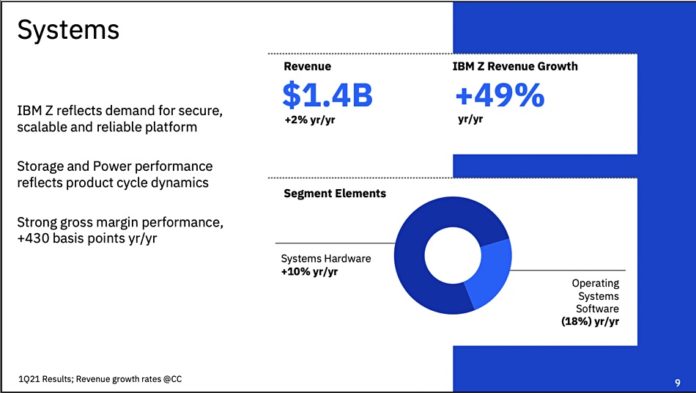

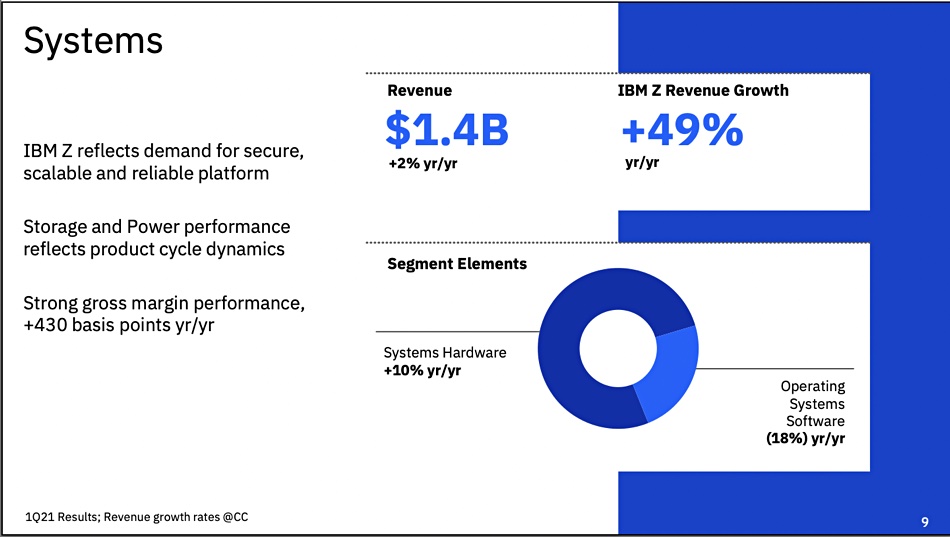

- Systems – $1.4bn – up 2 per cent

- Global Financing – $240m – down 20 per cent

Within the systems segment, the smallest of its four main business segments, overall hardware revenues rose 10 per cent Y/Y while operating systems software declined 18 per cent. Z mainframe business revenues were up 49 per cent Y/Y, acting as the Systems segment growth engine. CFO James Kavanaugh said in prepared remarks: “That’s very strong growth, especially more than six quarters into the z15 product cycle.’

The sales jump was attributed to customers appreciating mainframe reliability and security in the time of the pandemic with increased online purchases and remote working.

In the earnings report the company disclosed that “Power and Storage Systems declined,” with Power servers falling by 13 per cent and storage hardware 14 per cent. We calculate this to mean storage hardware brought in $359m compared to the year-ago $417.6m.

Storage hardware is a tiny fraction of IBM’s results, representing 2 per cent of its $17.7bn overall revenues.

IBM chairman and CEO Arvind Krishna is concerned with big picture issues, such as spinning off Global Technology Services – Kyndryl – and returning IBM to growth in a hybrid cloud world, using AI, Red Hat and quantum computing.

His prepared remarks included this comment: “We see the hybrid cloud opportunity at a trillion dollars, with less than 25 per cent of workloads having moved to the cloud so far. … We are reshaping our future as a hybrid cloud platform and AI company. … IBM’s approach is platform-centric. Linux, Containers and Kubernetes are the foundation of our hybrid cloud platform which is based on Red Hat OpenShift. We have a vast software portfolio, Cloud Paks, modernised to run cloud-native anywhere.”

Compared to this multi-billion dollar future, storage hardware, bringing in a few hundred million dollars, is small and shrinking potatoes. Its sales have seen an overall consistent and long-term decline, as a chart showing them by quarter each year shows;

There have been transitory storage hardware revenue rises, for example, one from Q1 2019 to Q1 2020, but that has not been repeated over the Q1 2020 to Q1 2021 period. Instead there has been another decline of 14 per cent.

IBM also sells storage software, such as Spectrum Scale, and storage services such as its IBM Cloud Object Storage. There is also a storage element in Red Hat’s sales. These various storage software revenues are not aggregated and revealed by IBM, and so we cannot know how IBM’s total storage business; hardware and software, is doing. All-in-all, it is a confusing and incomplete picture with a disappointing storage hardware element.