Western Digital’s Q2 revenues out-stripped expectations on the back of strong client-side and retail sales for disk drives and flash device. Yesterday’s earnings announcement saw the company’s stock jump 10 per cent in after hours trading. However, the strong financials also highlight WD’s continuing weakness in two key areas – nearline enterprise disk drives and enterprise SSDs, where it has fallen way behind the competition.

WD generated $3.93bn revenues for the quarter ended December 31, 2020. Net income was $62m – much better than the year-ago loss of $163m. Disk drive revenues totalled $1.9bn, down 20 per cent, and flash revenues climbed $2.03bn to 10.7 per cent. WD’s disk drive unit ship number was 25.7 million, down 22 per cent.

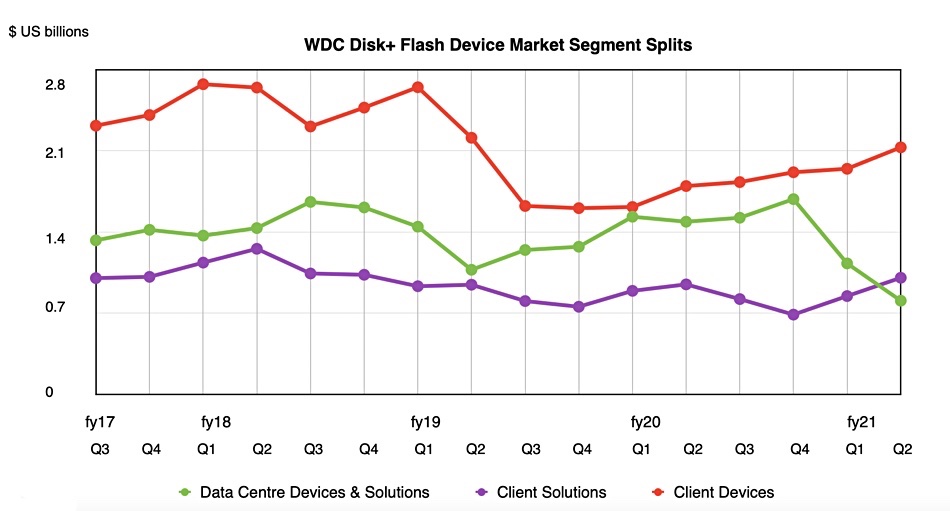

WD three business segments had contrasting fortunes in the quarter, as the revenue splits show.

- Data Centre Devices and Solutions – $807m, down 46 per cent Y/Y,

- Client Solutions (Retail) – $1.005bn, up 6 per cent

- Client Devices (Notebook/PC) – $2.13bn, up 19 per cent.

Charting their revenues over the past few quarters show contrasting fortunes – and two quarters of steep decline in the data centre segment.

There are two reasons for the data centre poor performance. WD has ceded nearline disk drive market leadership to Seagate’s 16TB drive; and it has effectively no presence in the enterprise SSD market – just one per cent, according to TrendForce estimates.

“The positive side of WD’s eSSD results over the past few quarters, in our opinion, is that it is hard to see things get worse,” Wells Fargo analyst Aaron Rakers wrote in a note to subscribers.

The difference between Seagate and WD in enterprise disk capacity shipments is stark. Rakers estimates “WD’s nearline HDD capacity ship at ~56-57EBs, representing more than a 20 per cent y/y decline and declining double-digits q/q. This compares to Seagate reporting 71.2EBs, +45 per cent y/y; Toshiba’s nearline HDD capacity ship totalled ~17.4EBs, +19 per cent y/y in 4Q20.”

But there are reasons to be cheerful. WD has “completed 18TB [disk drive] qualifications at 3 out of 4 major cloud customers with a ramp expected to materialise through 2HF2021.”

In the enterprise SSD field the company has now completed “150 qualifications for its 2nd-gen NVMe eSSDs, including one cloud titan that is commencing ship in F3Q21,” Rakers said. This is up from the 100+ qualifications reported three months ago.

WD did much better in the client device market where its NVMe-based SSDs and major PC OEM relationships contributed to a record level of exabyte shipments.

Work in progress

David Goeckeler, WD CEO, had this to say in his prepared remarks: “During the quarter, we captured strength in the retail business and also delivered on our target outcome to complete qualification of our energy-assisted hard drives and second-generation enterprise SSD products with some of the world’s largest data centre operators.

“While there is still more work to be done, we remain extremely focused on meeting the needs of our customers and ramping our next-generation products throughout calendar 2021.”

WD expects next quarter’s revenues of $3.95bn at mid-point, down 5.5 per cent. Rakers anticipates an upturn in the following quarter.