Analysis: Storage sales from IBM’s Systems unit declined in its fourth calendar quarter as the z15 mainframe cycle continues to wind down.

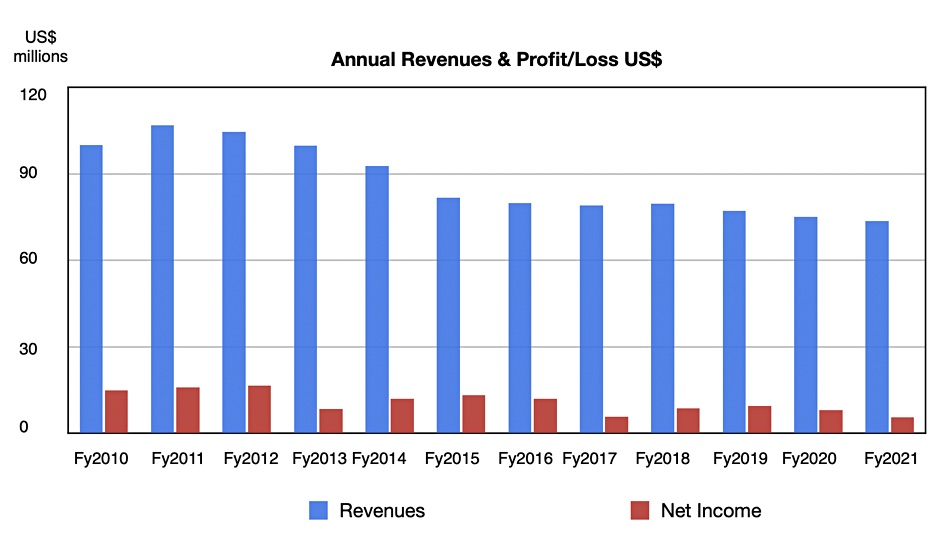

As The Register reports, IBM’s Q4 2020 revenues of $20.4bn were down six per cent Y/Y with its $1.3bn net income 65 per cent down Y/Y. Full year revenues of $73.6bn were down five per cent Y/Y and net income was $4.3bn, down 51 per cent. Yet the IBM money-making machine has delivered, with the company ending the quarter with $14.3bn cash in hand.

IBM’s revenues are languishing, and have been for seven years. Last year’s Red Hat acquisition has yet to boost revenues. So Q4’s Systems segment storage revenues – $390m – represents just 2 per cent of what IBM Chairman and CEO Arvind Krishna has to worry about. The systems segment as a whole represents 12 per cent of IBM’s revenues, so in this context the storage component is chump change, and its revenues wax and wane with the mainframe cycle.

Mainframe cycle blues

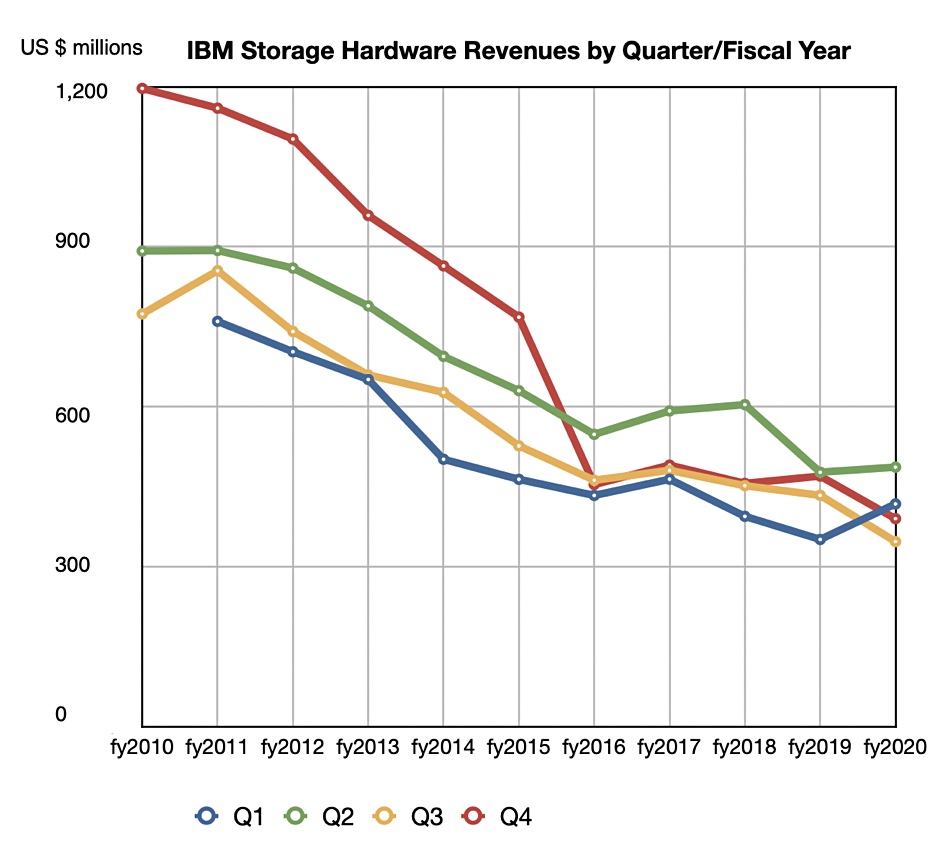

The z15 mainframe launched in September 2019 and we see IBM storage revenues rose in the fourth 2019 quarter, and the first and second 2020 quarters, only to fall back in the third and fourth quarters as the new mainframe boost to high-end storage array sales weakened.

The previous z14 mainframe was launched in April 2018. If we assume a 30-month cycle between mainframe versions then the z16 can be expected around April 2022. Storage revenues in IBM’s Systems segment can be expected to languish until then, absent any other developments.

Outside IBM, a data storage business with $390m in quarterly revenues would be fairly important, but not massive – it’s about the quarter of the size of NetApp.

IBM’s quarterly financial reporting structure does not help in trying to get a picture of IBM’s storage business. There are four big business units or segments with storage products spread across two of them;

- Global Business Services

- Cloud and Cognitive Software

- Systems

- Global Technology Services

Cloud and Cognitive Software include Cloud and Data Platforms, Red Hat and Cognitive Applications.

Storage products like Spectrum Scale, Cloud Object Storage and the Red Hat storage software products tuck into the Cloud And Cognitive Software segment. IBM does not split out storage product revenue in this segment

In the Systems segment, CFO Jim Kavanaugh’s statement included this: “Revenue was down 19 per cent, driven by product cycle dynamics,… We saw the product cycle dynamics play out in IBM Z, Power and Storage. Power revenue was down at a level consistent with last quarter, and Storage revenue was also down, driven by high-end storage tied to the IBM Z cycle.”

But he said Red Hat “delivered double-digit growth in both Infrastructure and App Development and emerging technologies.”

We can say with a degree of confidence that the Systems business’ storage revenues are in a long term decline and that two quarters of positive z15 mainframe cycle influence has been lost. But the storage revenues in the Cloud and Cognitive Software segment are unknown. We suspect that the Rd Hat acquisition has had a positive impact and think that IBM’s storage cloud (IBM COS) revenues may also be growing.

Therefore the overall Big Blue storage picture may be more upbeat than the Systems storage results indicate.