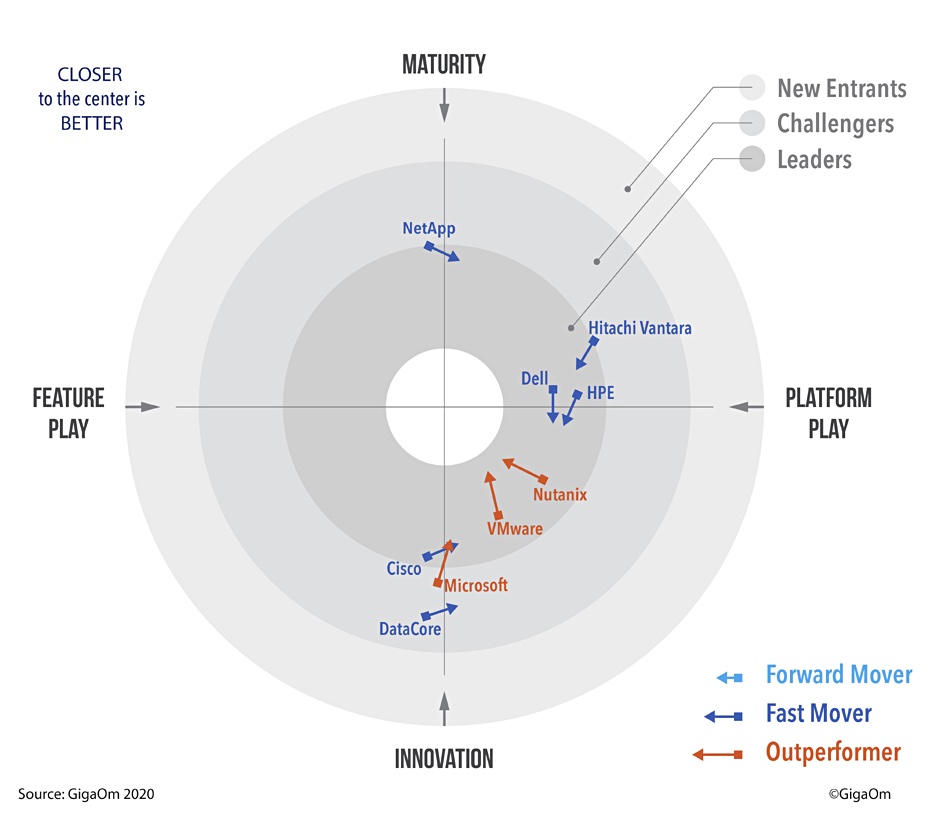

According to GigaOm, there are two distinct hyperconverged infrastructure (HCI) markets, namely Enterprise and Edge. Accordingly, the analyst firm has compiled two separate “radar screens”, its version of Gartner’s Magic Quadrant.

VMware, Nutanix and Dell EMC dominate Enterprise hyperconverged systems by revenues. But for the purposes of the GigaOm radar screen, report author Enrico Signoretti sets market share aside and concentrates on technology.

He summarises the enterprise HCI market thus: “Hyperconvergence for the enterprise market is both mature and consolidated. VMware Cloud Foundation (VCF) holds the lion’s share of the market in terms of deployments, and also enjoys technology leadership. At the same time, alternative solution stacks are gaining popularity by offering compelling value and innovative approaches.”

Signoretti thinks “interest has shifted from core virtualization features to the platform ecosystem and integration of core, cloud, and edge components. Other aspects of hyperconvergence infrastructure (HCI) that are quickly gaining traction include automation and orchestration, as well as integration with Kubernetes. The final goal is to build hybrid cloud infrastructures that can provide a consistent user experience across different environments while enabling applications and data mobility.”

This can be achieved both by classic HCI and disaggregated HCI, with separate compute and storage.

Here is the enterprise HCI Radar screen.

We can see outperformers VMware and Nutanix lead, with Cisco, Dell and HPE in the same leaders’ ring. NetApp, Hitachi Vantara and outperformer Microsoft are entering the leaders ring, leaving DataCore alone in the Challengers’ ring.

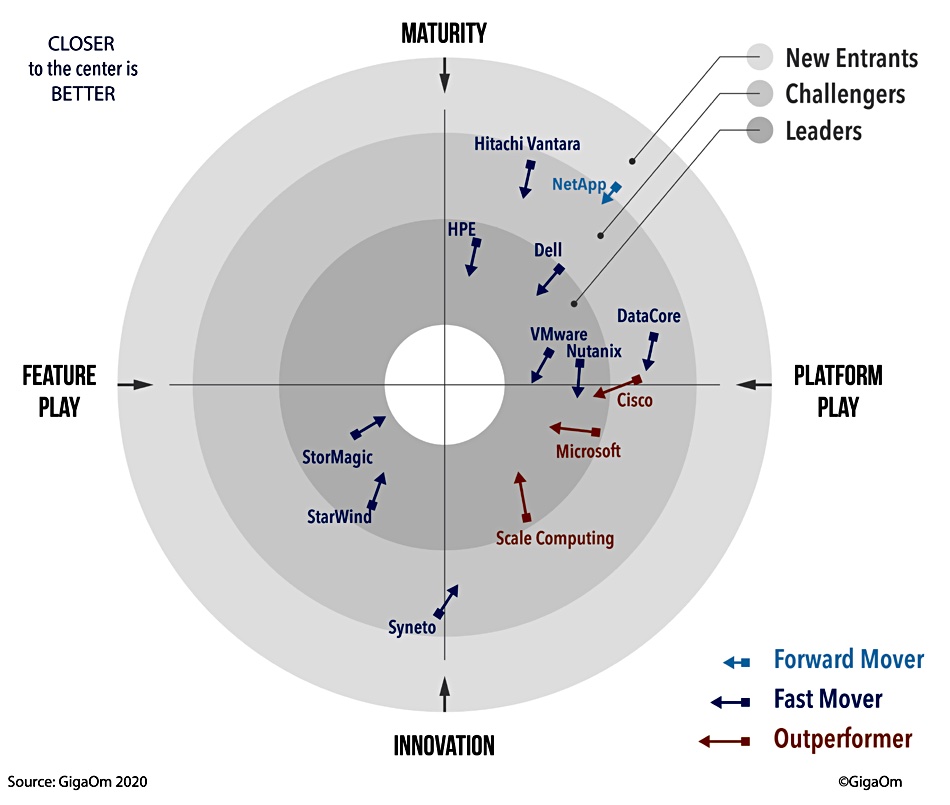

Close to the edge

Signoretti says there is a lot overlap between Enterprise and SME/Edge HCI systems. However, the SME/Edge HCI systems have a smaller minimum cluster size and higher efficiency in small configuration. They also have software tools to manage numerous sites, which may number in the thousands, as hands-on management is impractical

Here is the GigaOM radar screen for small and medium enterprise and Edge.

The leaders are StorMagic, then VMware, with HPE and Nutanix following. Then we see Dell, Starwind, outperformers Scale Computing and Microsoft, with outperformer Cisco entering the leaders’ ring from the Challengers’ ring while Data Core, Hitachi Vantara and Syneto are making progress in that ring. NetApp, which has recently announced smaller configurations, is entering the Challengers’ ring from the new entrants ring.

Signoretti reckons “market leaders in the enterprise HCI segment can’t scale down their edge solutions too much if they want to maintain full compatibility with their data centre solutions.” The smaller players can capitalise on this by tailoring their systems for efficiency and cost.

Pivot3 declined to participate in Signoretti’s research.