Dell Technologies has consolidated its hyperconverged infrastructure market share lead over second-placed Nutanix in IDC’s latest quarterly storage tracker.

Nutanix’s growth rate did not keep pace with the market in Q4 2019. And among the chasing pack, Cisco appears to gathering momentum.

Greg Macatee, IDC research analyst, delivered a quote: “Hyperconverged (HCI) system sales remained robust during the fourth quarter and carried overall converged systems market growth despite annual declines of other product types.”

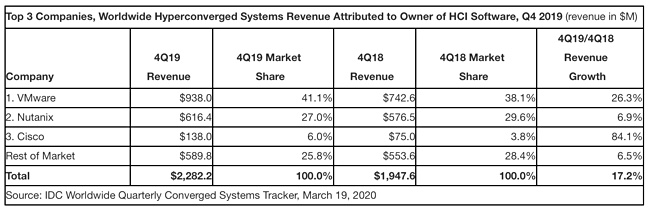

IDC measures HCI vendor revenues in two ways: by the brand of the sold system and by the owner of the software. Identifying HCI sales by software owner provides a snapshot of performance by Dell’s VMware and Nutanix.

Branded HCI market view

In IDC’s branded HCI market view:

- Dell Technologies led with $760m revenues, up 37.6 per cent, and 33.3 per cent share of market

- Nutanix was second with $312.9m (up 10 per cent, 13.7 per cent share)

- Cisco ($138m, up 84 per cent, 6 per cent share), Lenovo ($12m 43.2 per cent, 5.3 per cent share) and HPE ($115.5m, up 24.4 per cent, 5.1 per cent share) tied in third place. IDC ranked the companies equally because there was a difference of one per cent or less in revenue share.

HCI market share by software vendor

Q4 2019 sales cut by HCI software owner shows VMware revenues growing 26.3 per cent to $938m revenues and 41.1 per cent market share. Nutanix grew revenues 6.9 per cent to $616.4m but market share eased from 29.6 per cent to 27 per cent. Cisco, in third place, is a long way behind but growing fast. Revenues jumped 84.1 per cent to $138m and market share grew from 3.8 per cent to six per cent.

Market splits

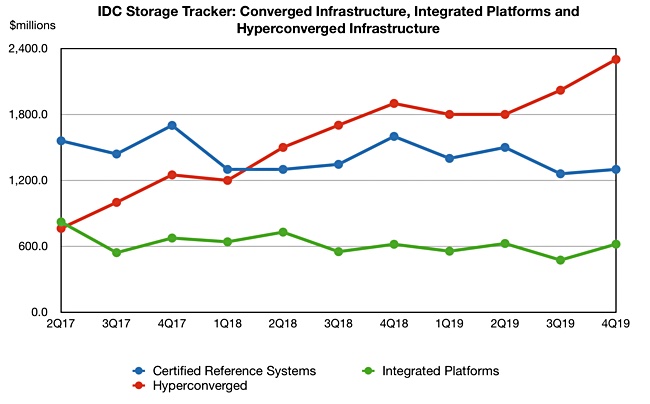

Converged systems overall grew 1.1 per cent annually to $4.2bn, with the HCI segment jumping 17.2 per cent to $2.23bn – 54.5 per cent share of revenue.

Converged systems include certified reference systems and integrated infrastructure such as NetApp and Cisco’s FlexPod, and integrated platforms such as Oracle’s Exadata.

The certified reference systems / integrated infrastructure segment pulled in $1.3bn revenues, down 18.5 per cent on the year, while integrated platforms was flat at $620m. The chart below shows the HCI segment pulling ahead.

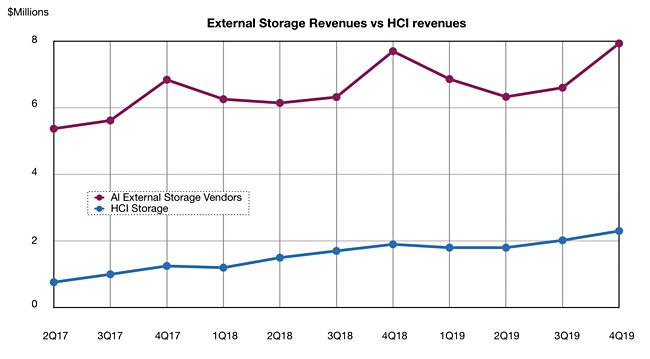

The IDC number crunchers show HCI growth outstripping a flat external storage market in Q4 2019, albeit from a much lower starting point – $2.23bn revenues vs the external storage market’s $7.93bn. However, external data storage purchases by hyperscalers remain strong. And hyperscalers don’t buy HCI systems.

.