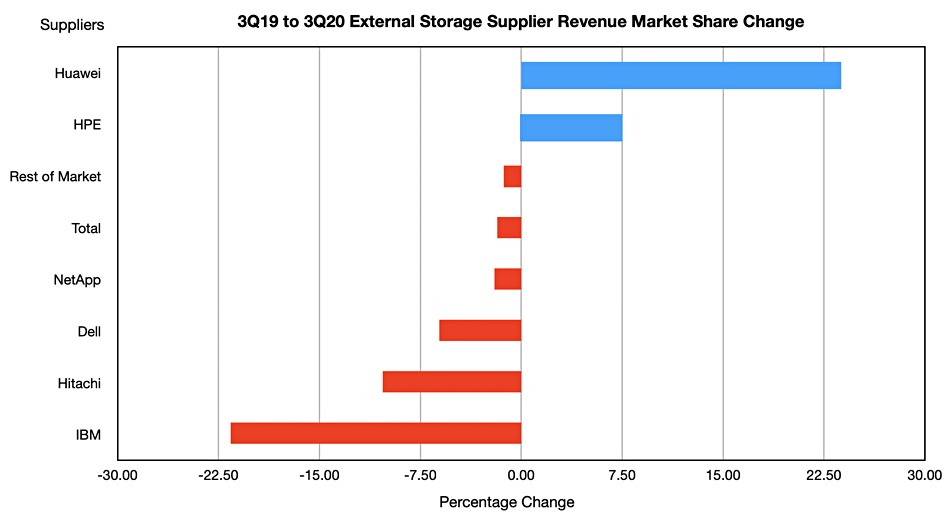

IBM’s enterprise external storage revenues tumbled 21.6 per cent in the third quarter while HPE and Huawei outgrew an anaemic market. However, there is a helluva long way to go before anyone catches up with Dell.

IDC’s quarterly Storage Tracker Q3 2020 show the enterprise external storage market eased 1.8 per cent Y/Y to $6.74bn. IDC research analyst Greg Macatee said the product segment “continued to face headwinds due to the effects of the global pandemic”.

According to IDC, the market bright spots in Q3 were China’s booming external OEM market, and no-brand ‘ODM’ vendors selling direct to hyperscalers. “Collaboration tools and content delivery networks were key drivers of ODM sales as consumers continue to demand these types of at-home services on top of traditional enterprise-driven ODM Direct infrastructure consumption,” Macatee said.

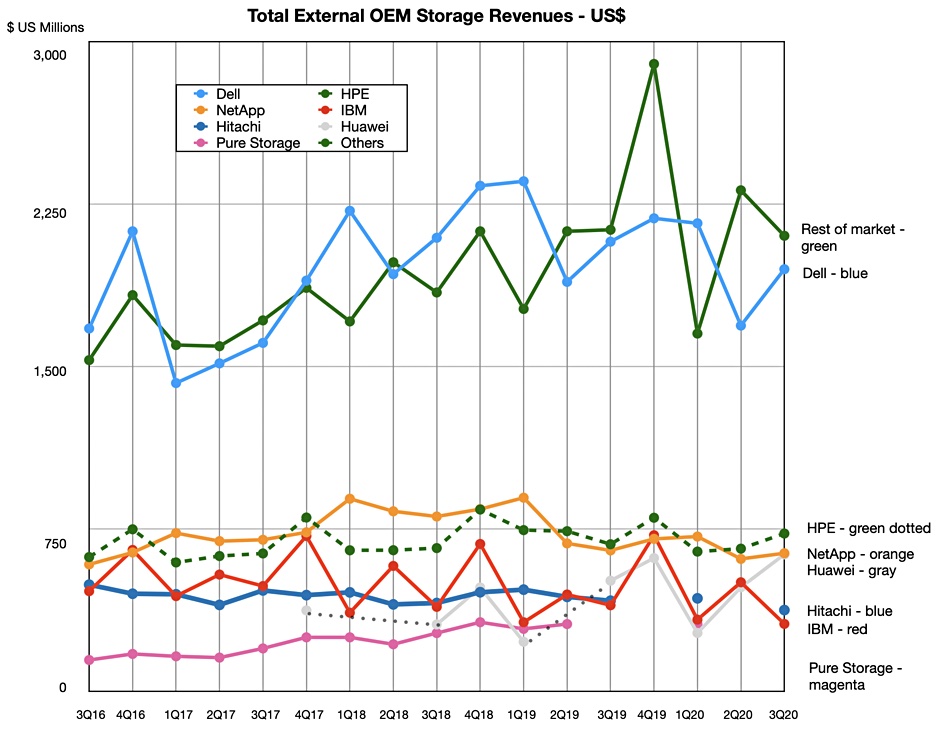

Dell Technologies led the suppliers with a 28.9 per cent revenue share of £1.95bn, down 6.1 per cent on the year, and HPE in second place climbed 7.3 per cent to $729.6m. NetApp and Huawei were in joint third place but arrived there differently. NetApp revenues of $638.5m were down two per cent Y/Y while Huawei’s $633.3m revenues were 23.7 per cent higher.

Hitachi and IBM bagged joint fifth place, with Hitachi revenues falling 10.3 per cent to $376.2m, while IBM slumped 21.6 per cent to $312.3m. We assume IBM’s mainframe storage sales are in a cyclical downturn.

Hitachi recently refreshed its midrange storage line with faster and better price performance options, and so may fare better in a couple of quarters’ time

Again, Pure Storage did not appear in IDC’s top supplier listings. The company posted $410.6m revenues, down 4.2 per cent for its third fiscal quarter ended November. The reporting period overlaps for two months (minus a day) with calendar Q3 2020. Pure revenues grew two per cent Y/Y in the prior fiscal quarter, a one month overlap with Q3 2020, so we cannot ascertain the direction of revenues in calendar quarter terms. IDC knows but isn’t releasing the numbers publicly.

A chart shows how the vendors have performed over time:

IDC estimates the total all-flash array market was worth $2.6bn in the quarter, down 0.4 per cent Y/Y. The total was slightly lower than the $2.8bn total revenues for hybrid flash/disk arrays, which was down 0.7 per cent.

Charting the supplier Y/Y growth percentage changes we see: