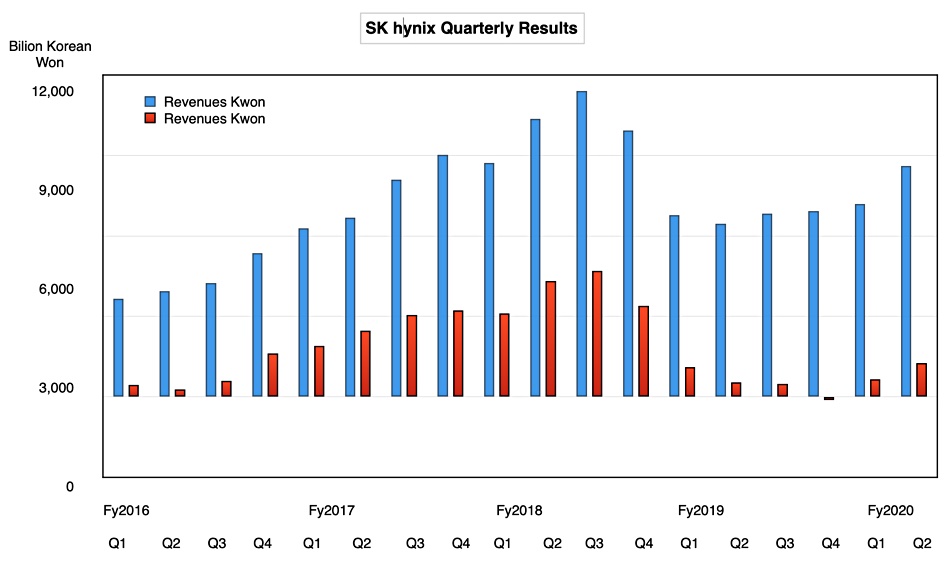

The second 2020 quarter marked a revenue and profits uptick for SK hynix, which sold more server memory and lowered costs by increasing process yield.

Revenues of ₩8.6tn ($7.15bn) were 33.4 per cent higher than a year ago and there was 135.4 per cent profit lift to ₩1.26tn ($1.1bn).

Sk hynix experienced weak mobile demand for DRAM in the quarter but demand for server and graphics DRAM increased. So much so that DRAM bit shipment and average selling price increased by two per cent and 15 per cent QoQ respectively.

NAND bit shipment and average selling price increased five per cent and eight per cent QoQ respectively. As well as making NAND chips, SK hynix is pumping out a lot more SSDs. This quarter, SSD sales for the first time accounted for almost half of its NAND flash revenues.

In the next quarter or two the company thinks the pandemic will continue to cause economic uncertainties. But it anticipates 5G smartphones and next-generation gaming consoles will stimulate DRAM, NAND and SSD growth.

To accompany the earnings release, sk Hynix teased out some roadmap details to accompany the earnings. It will focus on 1Ynm mobile DRAM, LPDDR5 DRAM and 64GB server DRAM product sales, while embarking on mass production of the next, 1Zmm memory node.

The company will also focus on more customer qualifications for its 128-layer 3D NAND product to drive sales upwards. It is also aiming to increase enterprise SSD sales.

Glad all over

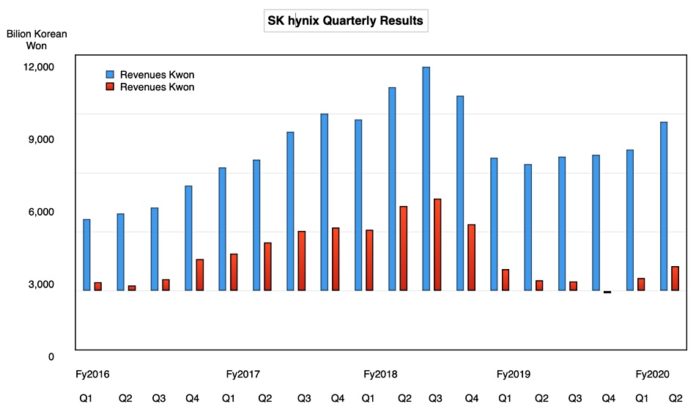

The Korean memory chip maker’s recovery from the recent worldwide DRAM and NAND glut is gaining pace. A chart of revenues and profit by quarter shows the upturn:

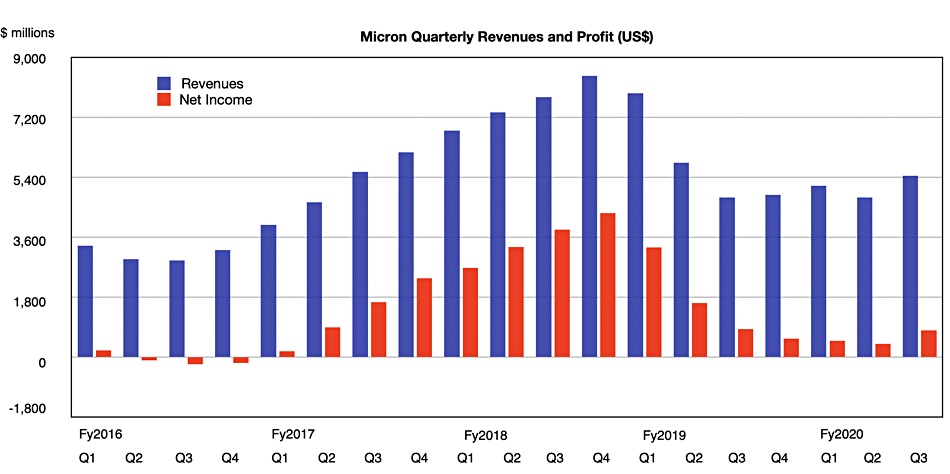

Competitor Micron saw a sales uplift in its most recent quarter which ended on May 28; 13.6 per cent to $5.44bn. It also exhibited four glut-trough quarters before this one, as the chart shows:

Western Digital revenues climbed 14 per cent on the back of record flash memory performance to $4.18bn in its third fiscal 2020 quarter ended April 3.

It certainly looks as if the DRAM and NAND glut is over.