Micron has posted a 13.6 per cent uplift in revenues to $5.44bn for the third fiscal 2020 quarter ended 28 May. Net income eased 4.4 per cent to $804m.

Outlook for the next quarter is $6bn at the mid-point, which is 23.2 per cent more than last year. The US memory chip maker forecasts $21.4bn revenues for fiscal 2020 – 8.6 per cent lower than fiscal 2019.

Sanjay Mehrotra, president and CEO, said in a canned quote: “Micron’s exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment.”

Pandemic impact

The company noted a limited Covid-19 impact on production in Malaysia early in the quarter, but was able to offset this with adjustments elsewhere. Mehrotra said: “The pandemic has impacted the cyclical recovery in DRAM and NAND, causing stronger demand in some segments and weaker demand in others.”

“Market segments driven primarily by consumer demand have seen a negative impact. Calendar 2020 analyst estimates for end-unit sales of autos, smartphones and PCs are meaningfully lower than pre-Covid-19 levels, even though estimates for enterprise laptops and Chromebooks have increased. The reduced level of global economic activity has also curtailed near-term demand.”

The general situation is that the pandemic is encouraging enterprises and the public sector to store and process more data at endpoints, and this needs DRAM and NAND. The next two quarters should see a healthy data centre outlook, improving smartphone and consumer end-unit sales, and new gaming consoles. Micron said these trends will drive DRAM and NAND demand upwards.

Micron’s DRAM business accounted for 66 per cent of revenues in Q3, up six per cent y/y, and NAND provided 31 per cent, up 50 per cent. This was a record quarter for NAND.

The DRAM and NAND chips are used in four business units:

- Compute and Networking – $2.22bn revenues, up 7 per cent y/y

- Mobile – $1.53bn revenues, up 30 per cent

- Storage – $1.01bn, up 25 per cent

- Embedded – $675m revenues, down four per cent – there was a slump in the auto market due to the pandemic

The earnings call revealed that Micron expects to gain a larger share of the SSD market over the next few quarters, with NVMe SSDs and QLC drives providing an opportunity.

The company has started customer shipments of 128-layer NAND chips and QLC NAND has grown to represent 10 per cent of its overall NAND production.

Huawei

Mehrotra said shipments to Huawei are affected by US government entity list stipulations, but Huawei accounts for less than 10 per cent of Micron’s revenues so the impact is not substantial. The US government wants to encourage more semiconductor manufacturing in the USA, but Micron will need solid financial reasons to transfer more production to its home country. At the moment this is lacking.

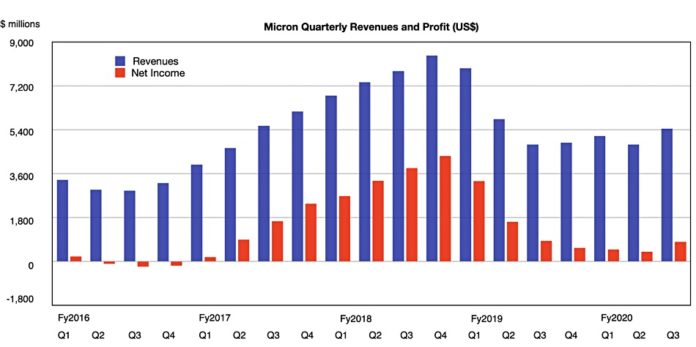

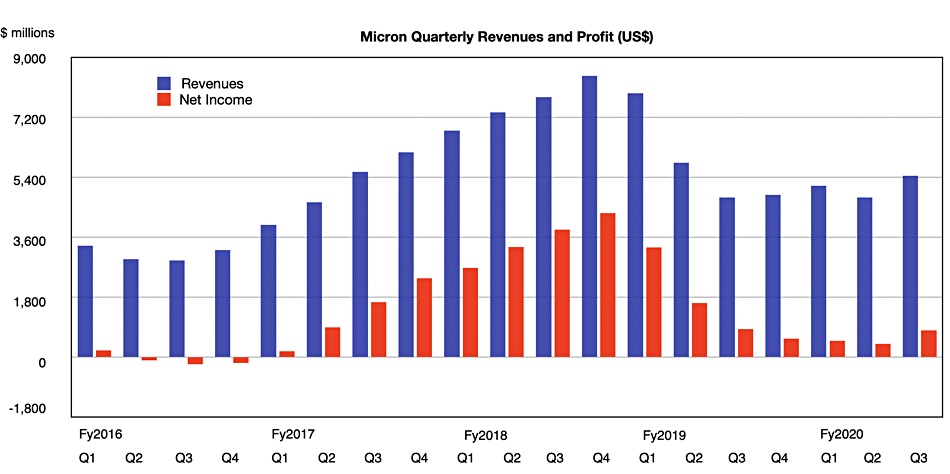

A chart of quarterly revenues and profits since 2016 shows Micron pulling out of a slump that started at the end of fy18. A couple more quarters under its belt will confirm if this is sustained.