Enterprise SSD sales are rising sharply but so too are nearline disk drive sales, according to a TrendFocus SSD industry review of the first 2020 quarter. Nearline disks are ten per cent of the capacity cost of SSDs – which is the very simple reason for the robust performance of this storage media format.

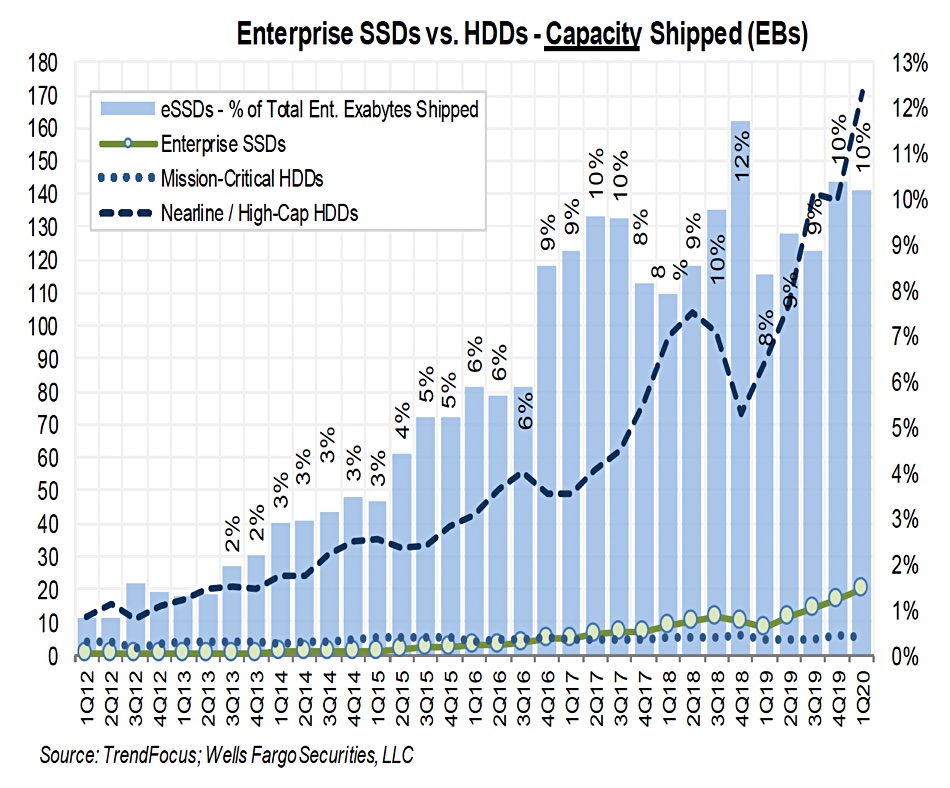

About 12.7 million enterprise SSDs shipped in the quarter, totalling 20EB in capacity – a 134 per cent capacity jump year over year (Y/Y). Even so, enterprise SSD capacity shipments amount to around 10 per cent of the HDD capacity shipped in the quarter, and HDD capacity shipped was up 94 per cent Y/Y.

The chart above, by Wells Fargo analyst Aaron Rakers, shows enterprise HDD capacity shipped rising more steeply than enterprise SSDs from 2012 onwards. The curve grew more steeply in 2019. Enterprise SSD capacity shipped also grew more quickly in 2019 but at a slower rate than HDDs.

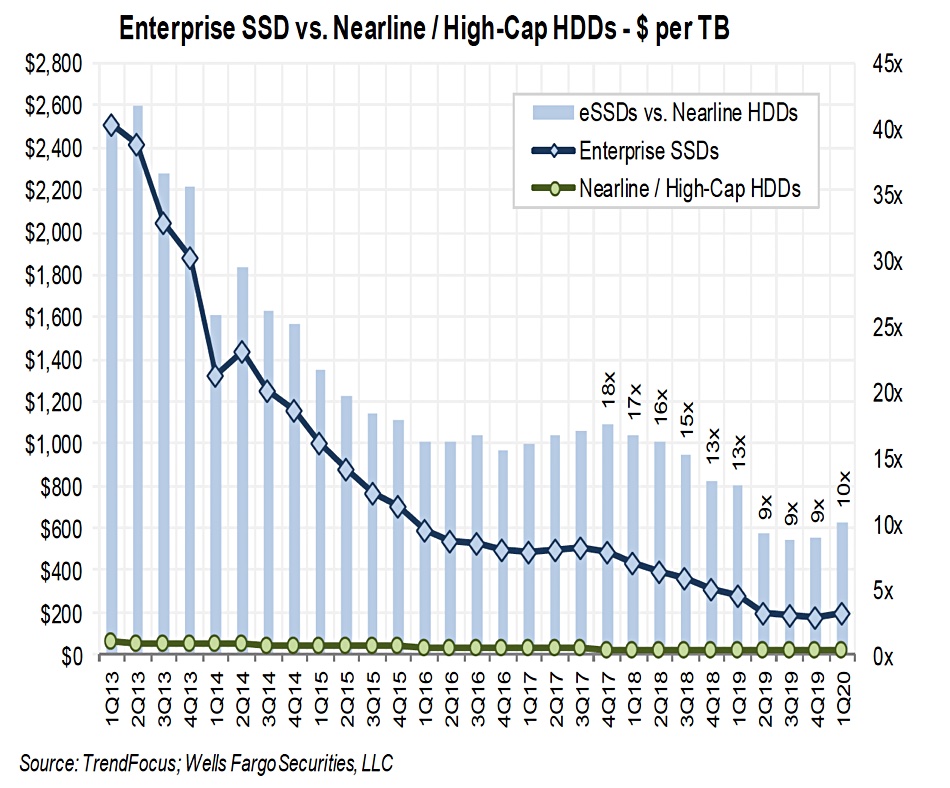

Rakers tells subscribers: “On a $/TB basis, we estimate that enterprise SSDs are approximately 10x more expensive than nearline enterprise HDDs.”

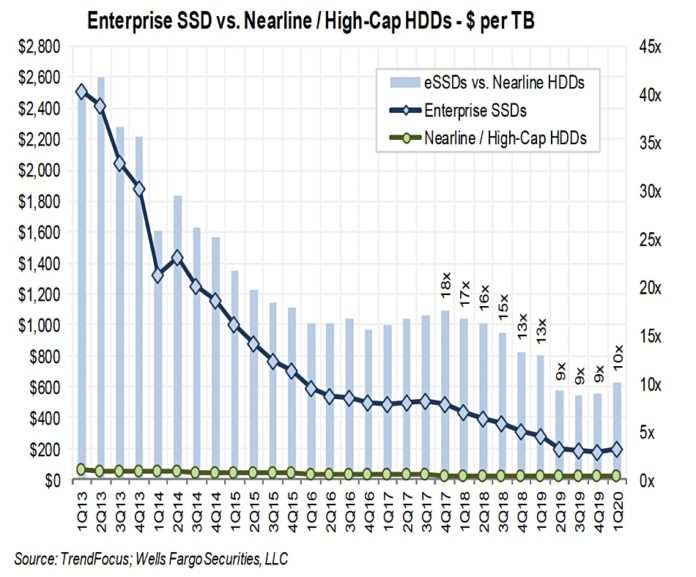

Another Rakers-produced chart, shown below, plots the $/TB price differential between enterprise SSDs and nearline disk drives. It plummets in 2013, falls at a slower rate in 2014, slower still in 2015-2018 and levelled off in 2019. The blue bars in the chart show the SSDs at nine to 10 x the nearline HDD price in 2019 and 2020’s first quarter.

More layers for 3D NAND and energy-assisted recording for HDDs will soon hit the market. These capacity advancements should help maintain the cost differentials between the two media types.

SSDs are about 2.2x more expensive on a $/TB basis than mission-critical HDDs – the 10,000rpm 2.5-inch disk drives. This helps explain why all-flash arrays are supplanting disk-based arrays for storing primary enterprise data.

The TrendFocus study shows that the category of enterprise SSDs using the PCIe/NVMe interface accounted for just over 11EB of capacity, nearly tripling Y/Y, and 55 per cent of total capacity shipped.

Rakers comments: “We continue to believe enterprise PCIe/NVMe SSDs will grow to account for the majority of the enterprise SSD capacity shipped over the next few years.”

The approximate supplier enterprise SSD capacity shipped shares in the quarter were:

- Samsung – 42%

- Intel – 23%

- Micron – 10%

- Western Digital – 7%

Those shares are different if we just look at PCIe/NVMe enterprise SSDs;

- Samsung – 42%

- Intel – 28%

- SK hynix – 11%

- Western Digital – 9%

- Micron – 3%

- Kioxia – 2%

There’s more competition and Micron needs to up its game.

PCIe 4.0 SSDs, that are double PCIe gen 3’s speed, are coming. These will help spread the NVMe message, and widen the access speed difference with mission-critical disk drives. Blocks & Files thinks PCIe gen 4 could be the kiss of death for this class of disk drive.

The faster PCIe interface could also make QLC (quad-level cell) SSDs more attractive for fast access archive data. The future is bright for NAND foundries and SSD manufacturers. But in the absence of technology development disasters, the future for nearline disk drives is also bright – because SSD capacity technology can’t overtake disk drive technology.