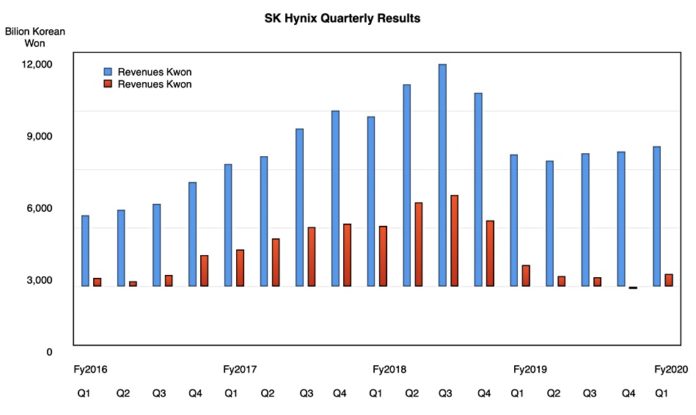

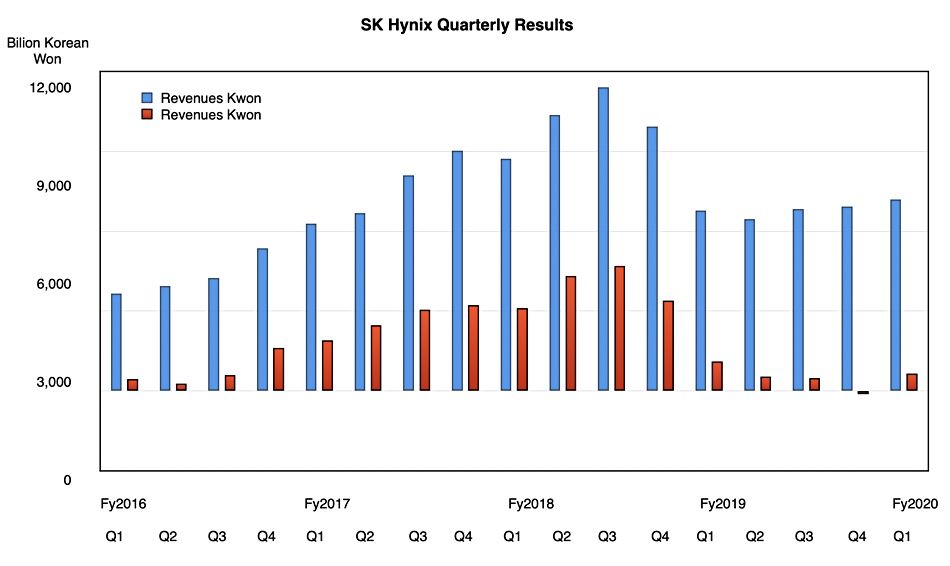

Korean fabber SK Hynix‘s re-positioning toward newer and denser DRAM and NAND products paid off in the first 2020 quarter as it reported 6 per cent y/y revenue growth from its DRAM and NAND operations.

However, the firm’s CFO, Cha Jin-seok, said that the point at which global economies affected by the COVID-19 pandemic bottom recover was crucial to ascertain demand, telling an earnings conference call: “The biggest factor to our demand forecast is the stabilisation of COVID-19 and the recovery timing of global economic activity. If the economic recession is prolonged, we can’t rule out that even memory demand for servers could slow down.”

SK Hynix is the second largest manufacturer of memory semiconductors globally, and competes with Samsung and Micron.

Its first 2020 quarter saw revenues of ₩7.2trn ($6.2bn), up from the year-ago ₩6.7trn ($6.0bn), and net income falling from ₩1.1bn ($947m) a year ago to ₩649bn; ($559m) a 41 per cent drop. It was mainly because of its substantial product cost decreases that it was able to to make a profit, helped by SSD sales.

The company had a dismal 2019 as lower demand created supply gluts leading to price falls. As a result it decided to accelerate transitions to denser DRAM and NAND processes which would lower production costs and enable it to compete better. In DRAM that meant planning a transitioning from 1Ynm to 1Znm products and increasing layer counts in 3D NAND.

How did the novel coronavirus pandemic affect the company in the short term? PC and mobile DRAM demand fell but server demand remained strong. NAND shipments rose because of this server demand strength.

Speaking about the firm’s new fab in Wuxi, Jiangsu Province and its $13.2bn 53,000m2 M16 semiconductor factory in Incheon city, Gyeonggi-do province, SK Hynix said: “With Wuxi, as you know, we have done the buildout last year, and the equipment starts to be moved in.” It added that it was on track for completion and that “for m16 as well work is still underway to complete the clean room by the end of this year.”

It says the rest of the year is full of unprecedented uncertainty because of the pandemic. The company expects that global smartphone sales will decline, but the demand for IT products and services based on the social distancing trend will drive a growth in server memory demand in the mid- to long-term.

SK Hynix plans to move some DRAM capacity to making CMOS sensors. It will boost production of 1Ynm mobile DRAM and start mass-producing 1Znm DRAM in the second half of the year. The company is also boosting production of GDDR6 and HBM2E DRAM.

Wells Fargo managing director analyst Aaron Rakers noted new gaming consoles in the second half could increase GDDR6 demand with HBM2E demand lifted by high-performance computing needs and for high performance computing to boost HMB2E (high bandwidth) sales.

He thinks 5G smartphone sales could potentially increase in the second half of the year which would lift also DRAM demand.

On the NAND front, SK Hynix will focus more on 96-layer 3D NAND, lessening the amount of 72-layer product. It will also start 128-layer product mass production in this, the second quarter of 2020. Rakers told subscribers: “The company expects combined 96 and 128-Layer NAND to exceed 70 per cent of shipments in 2020.”

The company aims to sell more SSDs, now accounting for 40 per cent of NAND flash revenues, and add a data centre PCIe SSD product line to widen its market and increase its profitability.

The business picture for SK Hynix, looking ahead, is not that bleak. Absent a prolonged pandemic, it should be able to continue growing.