Seemingly driven by the remote work trend of the past few months , Seagate revenues rose strongly in its latest quarter, fuelled by demand for high-capacity drives from public cloud and hyperscale customers.

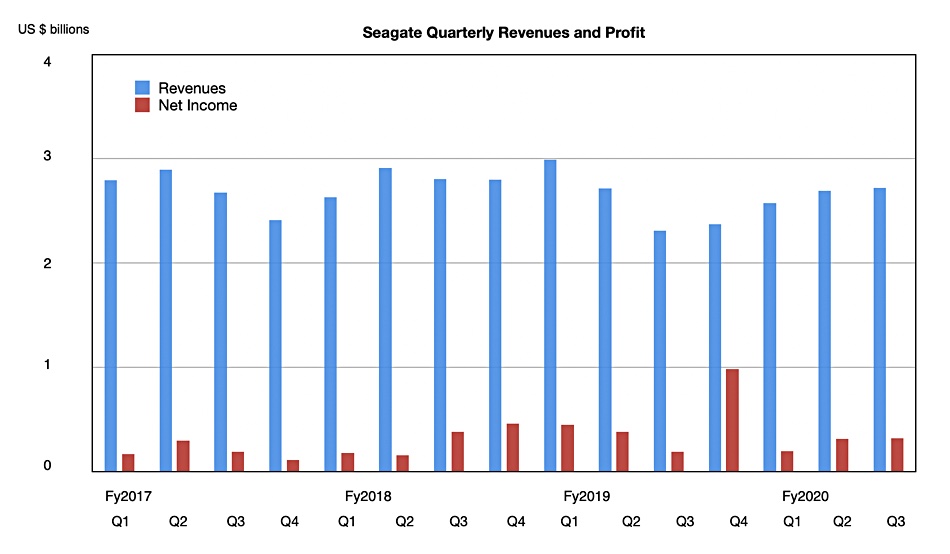

It reported revenues of $2.72bn, 18 per cent up on a year ago, in its third fiscal 2020 quarter ending March 31, 2020. Its net income was $320m, 64.1 per cent higher than a year ago.

While the Seagate topline swan glided smoothly over the waters, its feet paddled furiously to overcome supply chain and logistics problems, and build and ship record exabytes of nearline disk capacity. Consumer and mission-critical drive numbers were more affected by the pandemic.

CEO David Mosley said: “We delivered March quarter revenue and non-GAAP EPS above the midpoint of our guided ranges, supported by record sales of our nearline products and strong cost discipline,” in a prepared quote.

Summary financial numbers:

- Free cash flow – $260m

- Gross margin – 27.4 per cent

- Diluted EPS – $1.22

- Cash and cash equivalents – $1.6bn

Total hard disk drive (HDD) revenues were $2.53bn, up 19 per cent y/y. But non-HDD revenues, which includes Seagate’s SSD business, was more affected by pandemic supply chain issues, showing a mere 1.6 per cent y/y rise to $192m

Earnings call

In the earnings call Mosley said Seagate had worked to overcome pandemic-related supply chain problems, saying: “Today, our supply chains in certain parts of the world are almost fully recovered, including China, Taiwan and South Korea and we see indications for conditions to begin improving in other regions of the world.”

He said: “Demand from cloud and hyperscale customers was strong and accelerated toward the end of the quarter, due in part to the overnight rise in data consumption, driven by the remote economy brought on by the pandemic. …. The strength in nearline demand more than offset below seasonal sales for video and image applications such as smart cities, safety and surveillance, as COVID-19 related disruptions impacted sales early in the quarter.”

But: “With the consumer markets among the first to get impacted by the onset of the coronavirus, we saw greater than expected revenue declines for our consumer and desktop PC drives.”

Capacity rises

Seagate shipped 120.2EB of disk drive capacity, up 56.7 per cent y/y, with an average of 4.1TB per drive. Mass capacity (nearline) drives accounted for 57 per cent of Seagate’s overall revenue in the quarter ($1.56bn ), up from 40 per cent a year ago. This was 62 per cent of Seagate’s HDD revenues, up from 44 per cent a year ago.

CFO Gianluca Romano said: “The mass capacity part of the business is really growing strongly.” Mosley confirmed that Seagate should ship 20TB HAMR drives by the end of the year.

Nearline drives rule, it seems, with continued demand expected in the next quarter from cloud service suppliers and hyperscalers, and possibly the quarter after that too.

Seagate’s guidance for the fourth fy2020 quarter is for revenues of $2.6bn plus or minus 7 per cent.